By Kevin Flanagan, Head of Fixed Income Strategy; Scott Welch, CIMA, Chief Investment Officer – Model Portfolios

This article is relevant to financial professionals who are considering offering Model Portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

“Well, Jane, it just goes to show you, it’s always something—you never can tell. If it’s not one thing, it’s another.”

(“Roseanne Roseannadanna,” played by Gilda Radner, Saturday Night Live, 1977–1980)

The Evolution of Rates, Spreads and Yields

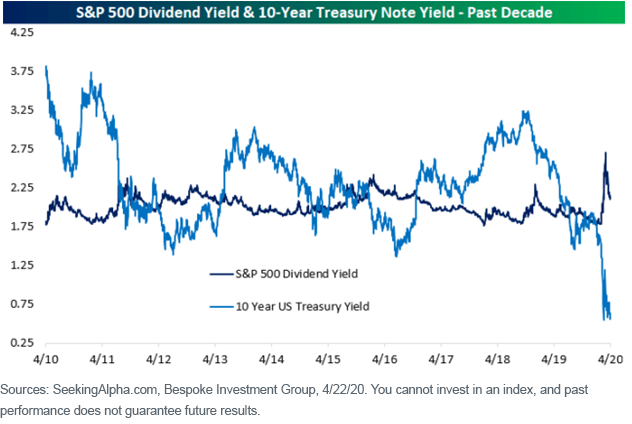

Let’s begin this blog post with a graph we used in a blog post from last June, highlighting the historical disparity between the S&P 500 Index dividend yield and the 10-Year Treasury note yield:

At that time, we made the argument that investors seeking to optimize current income out of their portfolios were better off over-allocating to yield-focused equities than to traditional bond investments.

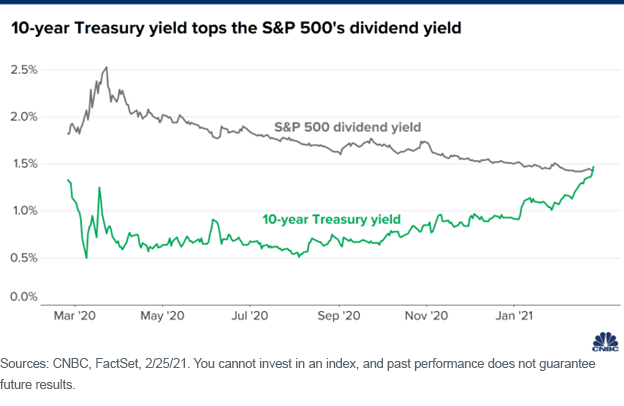

Well, what a difference eight months make:

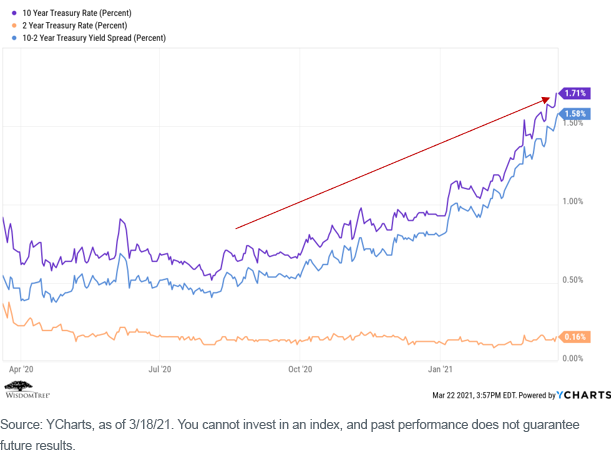

The U.S. yield curve steepened dramatically over the past several months, driven by expectations for an improving economy, massive fiscal stimulus and a continuation of accommodative monetary policy.

To provide some perspective, the rise in the UST 10-Year yield began early last August when the all-time low watermark of 0.51% registered on August 4. Since that date, the rate increase has been an eye-opening 120 basis points (bps) through March 18.1 However, the development getting the lion’s share of attention is what has transpired so far this year, where the rise has been a whopping 78 bps.

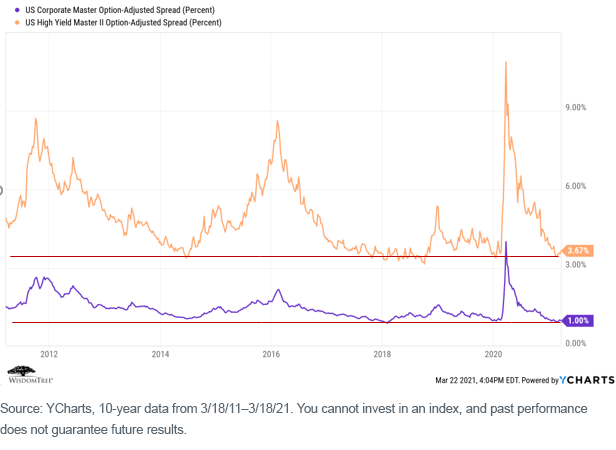

At the same time, U.S. credit spreads have narrowed and come all the way back to reside at pre-pandemic levels. In fact, both investment-grade and high-yield are hovering near lows not seen since 2018.

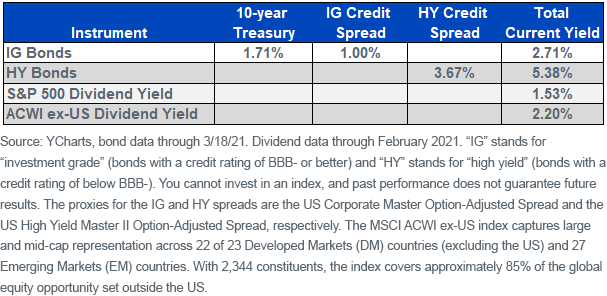

The result is that, for the first time in a long time, investors can now generate current income out of their bond portfolios that is higher than what they can get from their equity portfolios:

Portfolio Implications

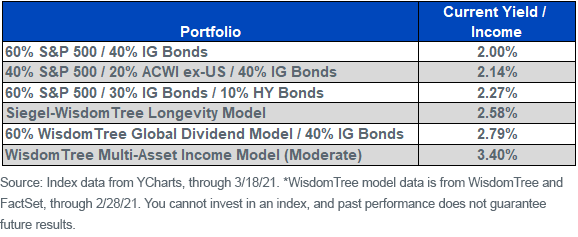

From a portfolio perspective and using the yield information above, let’s begin with a comparison of the current income available from a traditional stock and bond portfolio and the WisdomTree Model Portfolios that are designed explicitly to optimize risk-adjusted current income, specifically the Global Dividend model, the Global Multi-Asset Income model and the Siegel-WisdomTree Longevity model:

Conclusions

Despite the higher current income available from bond allocations, we view the total return risk to be much higher in the bond market. In our base case outlook, we believe rates will continue to grind higher, resulting in a further steepening of the yield curve. Credit spreads could also continue to tighten, but the runway from present levels is a shrinking one.

From a portfolio perspective, we continue to recommend that investors seeking to optimize risk-adjusted current income continue to focus on their equity allocations because, well, “you never can tell.”

Originally published by WisdomTree, 3/24/21

1 Source: Ycharts, as of March 18, 2020.

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.