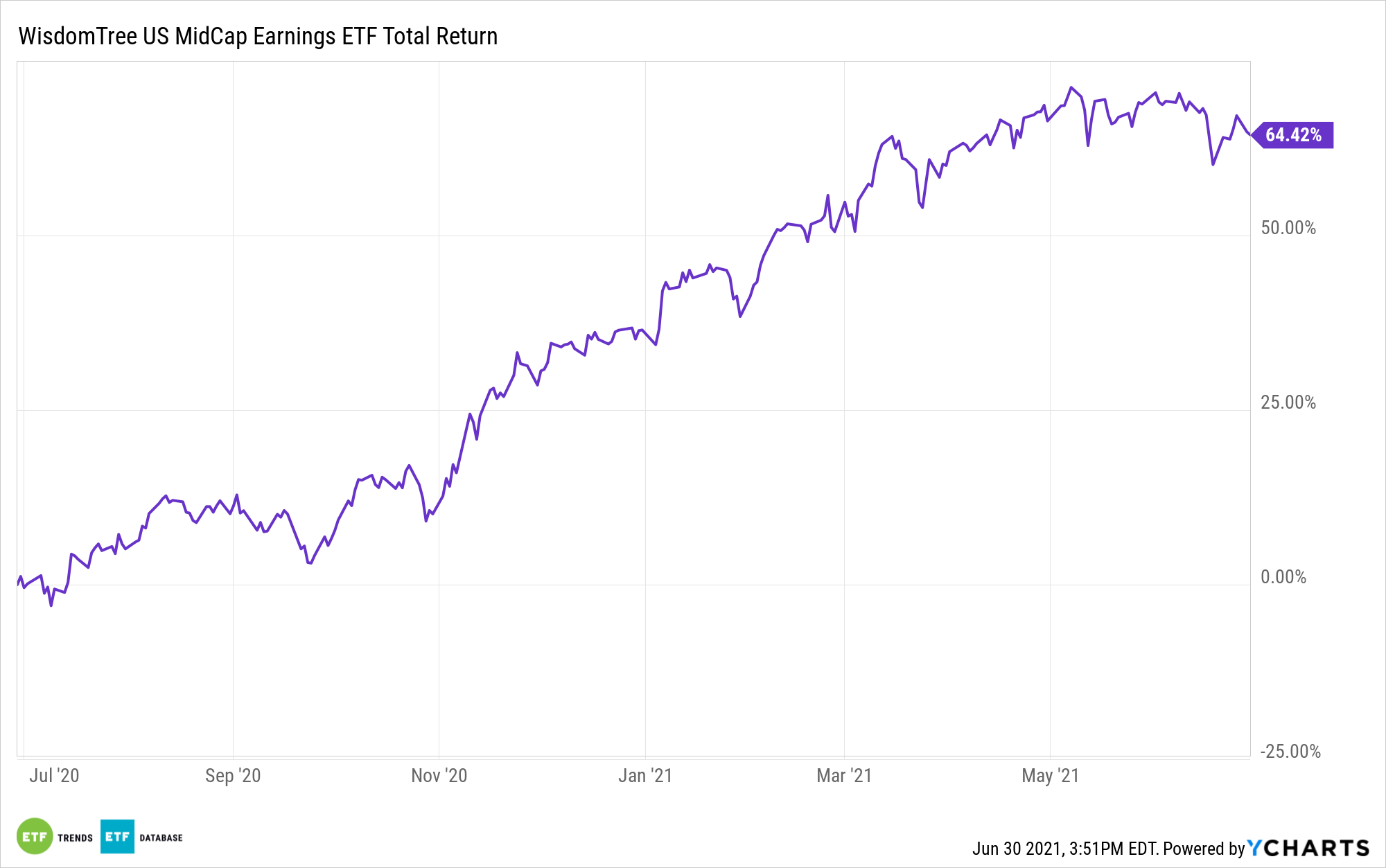

With the S&P MidCap 400 Index up almost 17% year-to-date, it’s hard to argue with the returns offered by mid cap equities. However, after that run for middle-class equities, investors may want to consider elevating quality in the asset class.

Enter the WisdomTree U.S. MidCap Fund (NYSEArca: EZM). One point solidifying EZM’s status as a quality ETF is its earnings weighted methodology. That means the most profitable components in EZM’s underlying index take on the largest weights in the benchmark and the fund. EZM doesn’t force investors to endure lofty valuation in the name of quality. In fact, a case can be made EZM is quality on the cheap.

“More importantly, it is trading at almost its highest discount in history compared to the Russell Midcap Index on a forward P/E basis. Since inception, EZM has always traded at a forward P/E discount due to its earnings weighting, but the current gap is almost as steep as it has ever been,” notes WisdomTree analyst Brian Manby.

The EZM Methodology

EZM is beating the the aforementioned S&P MidCap 400 Index by more than 300 basis points this year. Alone, that’s impressive, but there are reasons to believe EZM can continue trending higher, beating that benchmark and perhaps large caps, too, as the economy continues improving.

Cyclical stock choices have made EZM especially attrative.

“Likewise, mid caps tend to perform better in cyclical economic sectors compared to larger market benchmarks such as the S&P 500,” adds Manby. “Cyclicals have already started to enjoy the benefits of the reopening trade. If they have more room to rally, then there’s reason to believe EZM’s cyclical overweight may be additive.”

There’s no denying EZM has the goods when it comes to mid cap cyclical exposure. The financial services, industrial, and consumer discretionary sectors combine for 57% of the fund’s roster, according to issuer data. EZM’s 23% weight to financials may even provide a buffer if 10-year Treasury yields rise again.

That’s one benefit. Another is EZM’s quality purview – something that investors often overlook when it comes to smaller stocks, opting to embrace lower quality fare in the name of growth.

“The quality pickup in the portfolio implies that EZM can potentially seek to mitigate risk from a swift market reversal as the underlying companies are fundamentally healthier. Both return on equity (ROE) and return on assets (ROA) improve significantly compared to the Russell and S&P mid-cap indexes,” concludes Manby.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.