By Alejandro Saltiel, CFA, Associate Director, Research

Across the globe, the quality factor has outperformed the broad market this year.1 We expect that to continue through the expansion phase of the economic cycle.

This strong performance has been driven by companies with high profitability that have been able to navigate through the Covid-19 slowdown and maintain their long-term earnings growth trajectory.

The WisdomTree Global ex-U.S. Quality Dividend Growth Index (WTGDXG) selects companies from developed international and emerging markets that score well across measures of profitability like return on equity (ROE), return on assets (ROA) and earnings growth prospects.

WisdomTree conducted the annual reconstitution of WTGDXG and in so doing created the roadmap for the rebalance of the WisdomTree Global ex-U.S. Quality Dividend Growth Fund (DNL), which seeks to track the price and yield performance, before fees and expenses, of the Index, at the end of October.

This post provides a review of the reconstitution of the WTGDXG.

Fundamentals

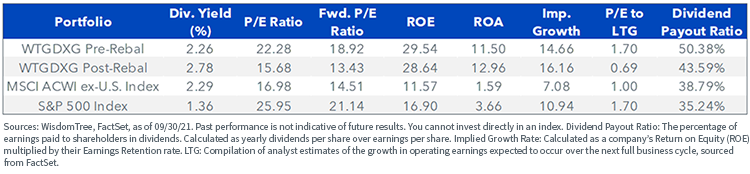

After our rebalance, fundamentals show an increase in quality metrics, as well as higher implied growth, as measured by the earnings retention times ROE. ROA improves from 11.50% to 12.96% and the implied growth rate from 14.66% to 16.16%.

Within its objectives, WTGDXG’s fundamentals show a portfolio with more attractive quality and growth metrics than the MSCI ACWI ex-U.S. Index at a lower forward P/E.

WTGDXG’s lower payout ratio signals its constituents are reinvesting a higher percentage of earnings in growth opportunities and could have a more sustainable dividend. We believe these advantages make WTGDXG’s P/E premium seem like a fair trade-off for investors.

Compared to the U.S. market, represented by the S&P 500 Index—which is often used by investors as a market benchmark—we can see how WTGDXG has provided investors with higher growth at cheaper valuations. We believe this basket of global non-U.S. companies has a more attractive profitability and growth profile, higher dividend yield and lower P/E ratio than the broad S&P 500 Index.

Country and Sector Changes

During this latest reconstitution, Japan, Canada and India had notable reductions in their weights relative to the MSCI ACWI ex-U.S. Index. Exposures to the U.K., France and Germany were significantly increased.

The largest change from a country perspective was France, whose weight increased by 6.18%. This increase was driven by the addition of Consumer Discretionary conglomerates LVMH Moet Hennessy Louis Vuitton SE and Kering SA. Both companies grew dividend payments in 2021 after the Covid-19 slowdown.

The U.K. had the second-largest increase, largely attributed to the addition of companies from the Materials sector.

Country Exposures

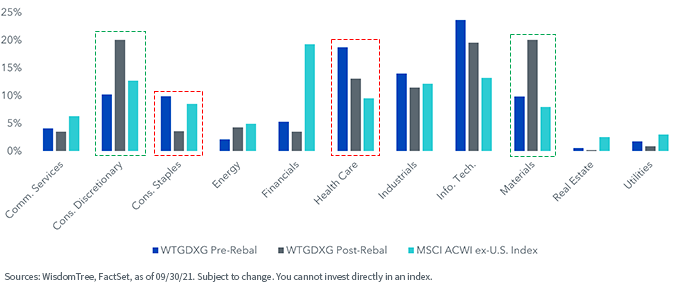

When looking at sector changes, Consumer Discretionary had the biggest percentage-weight increase, driven by the previously mentioned French companies along with Spanish Industria de Diseno Textil, S.A. The Materials sector also saw a significant increase in weight driven by BHP Group Plc, Anglo American Plc and Vale S.A.

Noteworthy weight reductions came from the Consumer Staples and Health Care sectors. Companies with large weight reductions were Unilever Plc and Roche Holding, respectively.

Regional Exposure

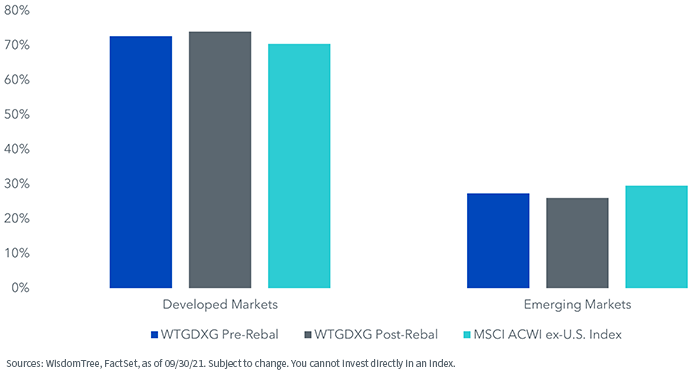

A few years ago, WisdomTree implemented a regional adjustment factor, applied to WTGDXG at rebalance, such that the regional (developed markets and emerging markets) weights are equal to the float-adjusted market capitalization weight of the starting universe.

As we can see below, there was no significant changes to regional exposures at rebalance, and the portfolio remains slightly overweight in developed markets and underweight in emerging markets relative to its cap-weighted performance benchmark, the MSCI ACWI ex-U.S. Index.

Regional Exposures

1 Source: WisdomTree, FactSet, from 12/31/20–10/19/21. Broad global market represented by MSCI ACWI Index.

Originally published by WisdomTree on November 4, 2021.

For more news, information, and strategy, visit the Model Portfolio Channel.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.