With interest rates low and credit spreads depressed, corporate bonds present investors with something of a conundrum.

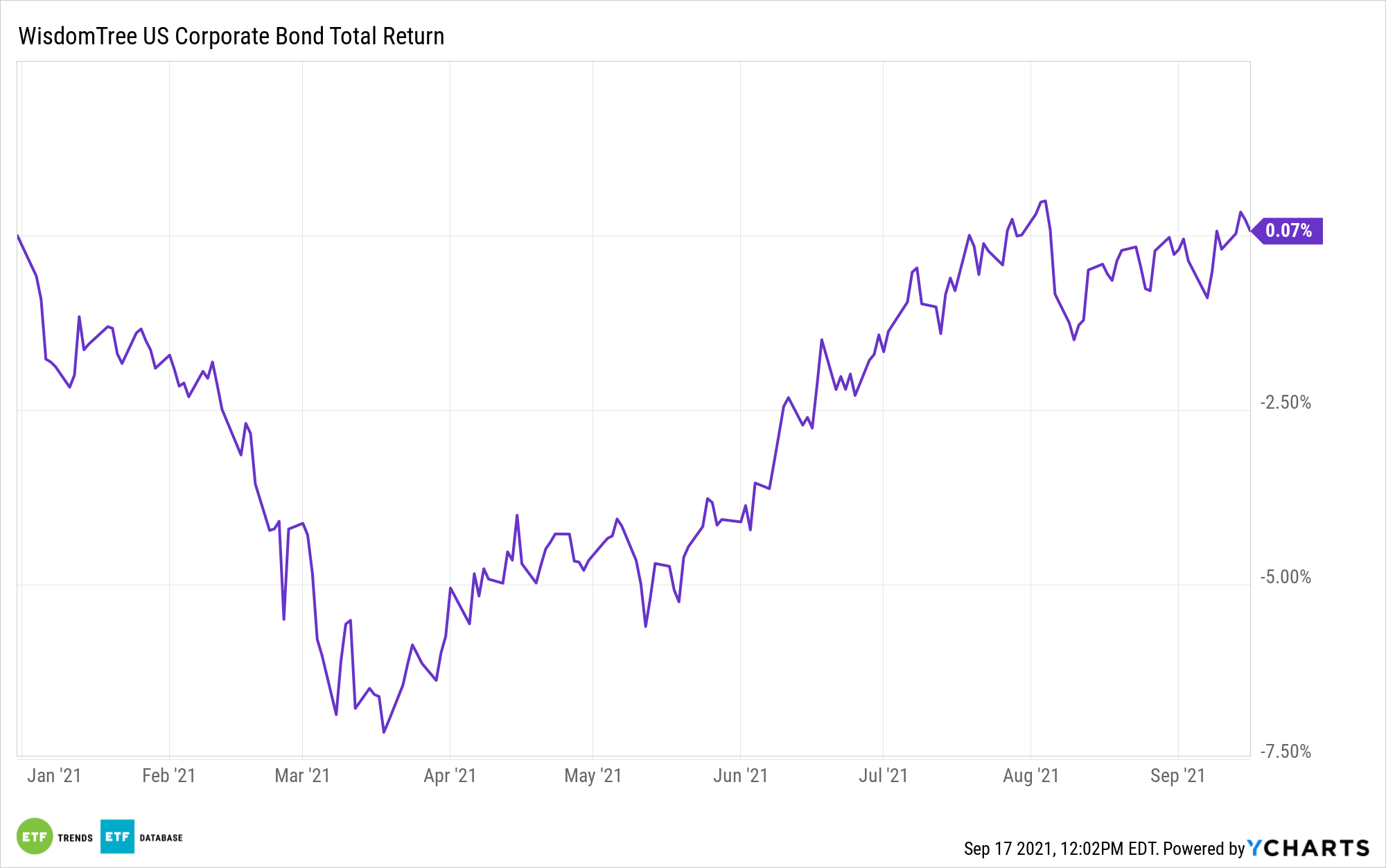

Investors who embrace high-quality issuers may be forced to pay up on valuation. Those who flock to high-yield corporate debt can potentially be exposed to financially flimsy companies. With those factors in mind, the WisdomTree U.S. Corporate Bond Fund (CBOE: WFIG) is a viable idea for income investors in the current environment.

“The bonds of high-quality issuers, for example, rarely trade at bargain valuations, while higher-yielding bonds often come from businesses facing operational challenges. The best strategic-beta corporate-bond ETFs incorporate these factor exposures sensibly,” notes Morningstar analyst Neal Kosciulek.

WFIG is an investment-grade exchange traded fund, so investors aren’t taking on concerning credit risk here. However, lower credit risk alone doesn’t eliminate the chances of being exposed to overvalued bonds. The fundamentally weighted WisdomTree U.S. Corporate Bond Index, WFIG’s underlying index, reduces valuation concerns and elevates quality by employing a multi-step process to unearth the best corporate bonds with favorable income traits.

WFIG Particulars

WFIG offers investors a deep bench, as it’s home to 555 bonds with an embedded income yield of 2.21% and an effective duration of 9.37 years, according to issuer data.

“WFIG excludes the 20% of issuers from each sector least likely to service their debt and weights the remaining bonds by a value-score-adjusted market value,” says Kosciulek. “The value score is equal to the spread multiplied by a probability of default. The bonds with the best value scores in their sector receive double representation in the portfolio, while those with the worst value scores are excluded.”

That methodology has an obvious, positive impact on credit quality. While the bulk of the holdings in traditional corporate bond ETFs reside within one to three notches of junk territory, about half of WFIG’s components are rated AAA, AA, or A. In fact, WFIG has more components rated A and fewer with one of the BBB ratings than some other smart beta corporate bond ETFs.

That quality leaning is also important today because some investors are ignoring warning signs and simply stretching for yield while eschewing quality.

“Bonds representing more than half of the market carry a BBB credit rating, the lowest possible investment-grade rating, and three decades of falling yields have increased demand for yield, providing incentives for risk-taking. Consequently, there is an opportunity for quality-oriented strategies to boost risk-adjusted performance relative to traditional market-value-weighted index funds,” according to Kosciulek.

For more news, information, and strategy, visit the Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.