By Ryan Krystopowicz, Associate, Asset Allocation, and Kara Marciscano, Senior Research Analyst, WisdomTree

COVID-19 has sparked a lot of global innovation and market disruption. A variety of thematic ETFs have been able to capture publicly traded companies leading the charge, and investor demand for these products has skyrocketed.

It raises the question: Are thematic ETFs just a fad for the “Robinhood” trader crowds, or should strategic asset allocators take thematic ETFs seriously?

We believe it’s the latter. Thematic ETFs are here to stay, and investors of all profiles have noticed.

Thematic ETFs seek to capture investment opportunities in companies or sectors created by long-term structural trends. Examples include demographic and social shifts such as diversity, inclusion and equality; disruptive technologies such as cloud computing; geopolitical changes such as globalization; and environmental pressures such as climate change.

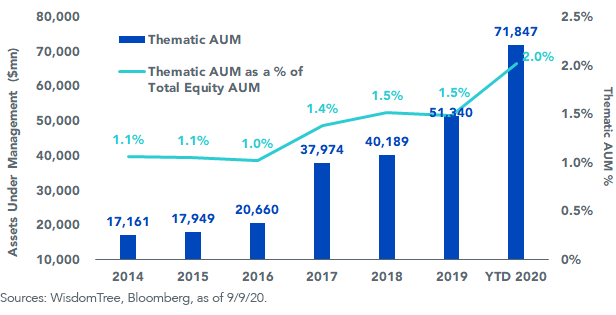

In the last five years, thematic ETF assets under management (AUM) have grown 25% annually, well above the 17% rate for total equity assets1. This year is no different—in fact, the category’s growth has accelerated.

The chart below illustrates how these strategies are carving out a growing niche of the equity ETF market.

Thematic Assets Under Management (AUM)

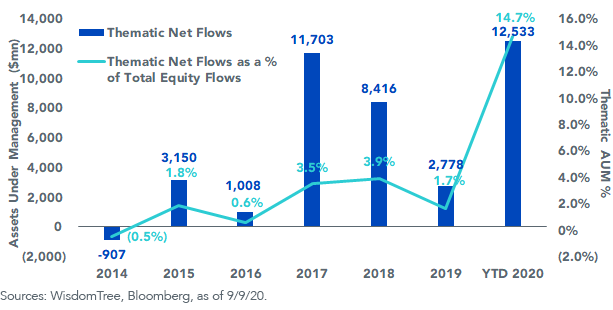

Asset flows have followed. Thematic ETF AUM have increased 40% since the end of 2019, taking in more than $12.5 billion in assets. Year-to-date net inflows have exceeded any recent year2.

Thematic Net Flows (AUM)

With strong net inflows, it may be no surprise that many of these strategies have performed well during the pandemic.

Is the performance sustainable? Are valuations too high?

No one has a crystal ball, but the investment rationale for thematic strategies is anchored in long-term expectations.

We believe the decision to initiate or add to a thematic position should be more dependent on the level of conviction and less dependent on accurately timing a market entry point.

Similarly, we expect positive thematic performance to be driven by emerging structural shifts, and not reliant on shorter-term cyclical changes or technical signals. As a result, these strategies differ from traditional broad-based exposures in three ways:

Targeted Exposure: Thematic strategies offer targeted exposure to a specific secular or economic trend with the potential for higher risk-adjusted returns verses broader-based strategies over the long term.

To High-Conviction Ideas: They enable investors to implement high-conviction ideas in their portfolios, without requiring single-stock decisions or to dilute the desired exposure with non-theme-related holdings.

Driven by Long-Term Structural Changes: They are forward-looking, carry high expectations for future growth and impact, and are expected to develop over the long term.

What are some examples of these innovative and market disruptive strategies?

WisdomTree launched the WisdomTree Cloud Computing Fund (WCLD) and the WisdomTree Growth Leaders Fund (PLAT)—which are some of our top-performing strategies year-to-date3.

WCLD provides targeted exposure to pure-play cloud computing companies. It was launched on the long-term conviction that cloud-based technology will become the underlying connectivity source of our global economy.

We anticipate that the adoption of cloud technology will proliferate across sectors and geographies. Over time, its adoption will extend far beyond the software market with innovations that transform non-tech sectors. WCLD can replace or complement growth-oriented and technology-sector investment strategies.

PLAT provides targeted exposure to companies operating platform-based business models. These businesses create value by connecting interdependent groups (e.g., Uber connects a rider with a driver). This, in contrast to traditional businesses creating value through linear production or supply (e.g., Ford or Hertz produce/buy cars for sale/rent).4

Our expectation is for platforms to disrupt competitive landscapes, and to gain market share at the expense of traditional, linear businesses—while doing so with better economies of scale and potential for long-term profitability. PLAT can replace or complement both active and passive growth-oriented investment strategies.

With so many disruptive industry categories across the globe, we created a holistic offering for investors that invests in several themes selected by our Model Portfolio Investment Committee.

Introducing the WisdomTree Disruptive Growth Model Portfolio, available to financial professionals as part of our Modern Alpha® ETF Model Portfolio offerings.

The Disruptive Growth Model Portfolio targets structural growth themes driving innovation and future impact across different industries and segments of society. The themes and constituent ETFs typically have premium growth projection, as well as seek to avoid holding overlap among one another. The investment objective is to achieve maximum long-term capital appreciation.

In addition to cloud-computing and growth leaders using platform-business models, the WisdomTree Disruptive Growth Model Portfolio provides exposure to four additional themes:

Online Gaming & Esports. Our exposure targets companies that develop or publish video games, facilitate the streaming and distribution of video gaming or esports content, own and operate in competitive esports leagues, or produce hardware used in video games and esports, including augmented and virtual reality.

Cybersecurity. Our exposure targets companies whose principal business is in the development and management of security protocols preventing intrusion and attacks to systems, networks, applications, computers and mobile devices.

Fintech. Our exposure targets companies leading the innovation in mobile payments, digital wallets, peer-to-peer lending, blockchain technology and risk transformation.

Genomics. Our exposure targets companies that are expected to substantially benefit from extending and enhancing the quality of human and other life by incorporating technological and scientific developments and advancements in genomics into their business.

Overall, investors have many thematic strategies at their disposal. WisdomTree can help financial advisors navigate this landscape and access the disruptive themes we believe deliver premium growth potential. These strategies are commonly used as a complement to core equity portfolios, often providing exposures with low overlap to other growth- or technology-focused strategies, or as replacement of individual stock strategies seeking long-term growth.

We believe thematic ETFs serve a purpose outside the confines of traditional asset allocation. They identify disruptive trends that manifest over a medium- to long-term time horizon, and they could potentially help investors, ranging from Robinhood traders to strategic asset allocators, hedge against transformative forces and position for long-term growth.

Originally published by WisdomTree, 10/22/20

1Sources: WisdomTree, Bloomberg, as of 9/9/20

2Sources: WisdomTree, Bloomberg, as of 9/9/20

3Source: WisdomTree, for the period 12/31/2019–9/9/2020. The WisdomTree Cloud Computing Fund and the WisdomTree Growth Leaders Fund returned 61.0% and 33.1%, respectively, at NAV.

4As of 9/9/20, PLAT held 1.3% of its weight in Uber; PLAT did not hold Ford or Hertz.

Important Risks Related to this Article

Past performance is not indicative of future results.

WCLD: There are risks associated with investing, including possible loss of principal. The Fund invests in cloud computing companies, which are heavily dependent on the Internet and utilizing a distributed network of servers over the Internet. Cloud computing companies may have limited product lines, markets, financial resources or personnel and are subject to the risks of changes in business cycles, world economic growth, technological progress, and government regulation. These companies typically face intense competition and potentially rapid product obsolescence. Additionally, many cloud computing companies store sensitive consumer information and could be the target of cybersecurity attacks and other types of theft, which could have a negative impact on these companies and the Fund. Securities of cloud computing companies tend to be more volatile than securities of companies that rely less heavily on technology and, specifically, on the Internet. Cloud computing companies can typically engage in significant amounts of spending on research and development, and rapid changes to the field could have a material adverse effect on a company’s operating results. The composition of the Index is heavily dependent on quantitative and qualitative information and data from one or more third parties and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

PLAT: There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty; these risks may be enhanced in emerging, offshore or frontier markets. Technology platform companies have significant exposure to consumers and businesses and a failure to attract and retain a substantial number of such users to a company’s products, services, content or technology could adversely affect operating results. Technological changes could require substantial expenditures by a technology platform company to modify or adapt its products, services, content or infrastructure. Technology platform companies typically face intense competition and the development of new products is a complex and uncertain process. Concerns regarding a company’s products or services that may compromise the privacy of users, or other cybersecurity concerns, even if unfounded, could damage a company’s reputation and adversely affect operating results. Many technology platform companies currently operate under less regulatory scrutiny but there is significant risk that costs associated with regulatory oversight could increase in the future. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. The composition of the Index is heavily dependent on quantitative and qualitative information and data from one or more third parties and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on, for tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients. Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client, and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio – including allocations, performance and other characteristics – may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures are subject to change and may not be altered by an advisor or other third party in any way.

Genomics and Healthcare sector risks: The health care sector may be adversely affected by government regulations and government health care programs, restrictions on government reimbursements for medical expenses, increases or decreases in the cost of medical products and services and product liability claims, among other factors. Many health care companies are heavily dependent on patent protection and intellectual property rights and the expiration of a patent may adversely affect their profitability.

WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses, or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.

The WisdomTree Model Portfolio Investment Committee is also sometimes referred to as the Asset Allocation Committee.

References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.