By Andrew Okrongly, CFA

Director, Model Portfolios

This article is relevant to financial professionals who are considering offering Model Portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

In the 10+ years following the great financial crisis, U.S. companies with high growth potential dominated global equity markets.

This was largely due to the prevailing macro environment, as steady economic growth, muted inflation and ultra-low interest rates facilitated the continued multiple expansion of U.S. stocks.

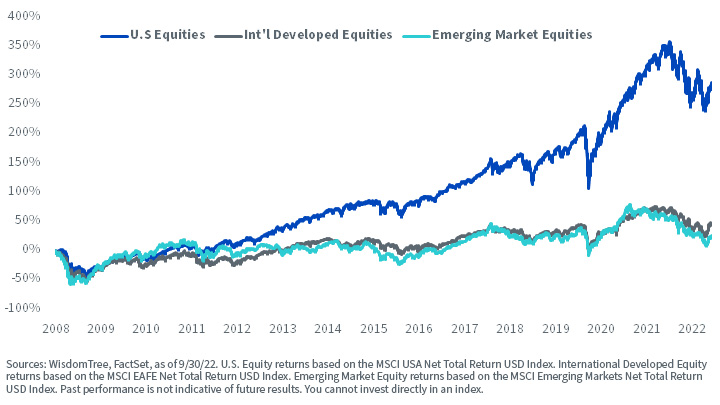

As a result, the more cyclical and value-oriented universe of stocks outside the U.S. lagged. From June 2008 to December 2022, the cumulative underperformance of international versus U.S. equities amounted to more than 200%.

Cumulative Returns in USD (June 2008–December 2022)

Any diversification away from large U.S. growth stocks over this period generally detracted from overall returns. Some U.S. investors have responded by reducing or even eliminating their exposure to international stocks.

At WisdomTree, we believe this era of “deworsification” has come to an end. With an evolving macro backdrop and a renewed focus on balance sheet strength, margin resilience and the ability to return capital via dividends, diversification across both regions and factors may once again prove critical in generating enhanced returns.

This is reflected across our suite of strategic and outcome-oriented Model Portfolios, which incorporates globally diversified equity allocations with:

- Regional weights roughly aligned with the MSCI All-Country World Index (ACWI)

- Strategic tilts toward value, quality and dividend factors

Below, we outline the logic behind our conviction in global diversification and why valuation-focused investors might find international stocks particularly attractive in today’s market environment.

The Benefits of Global Diversification

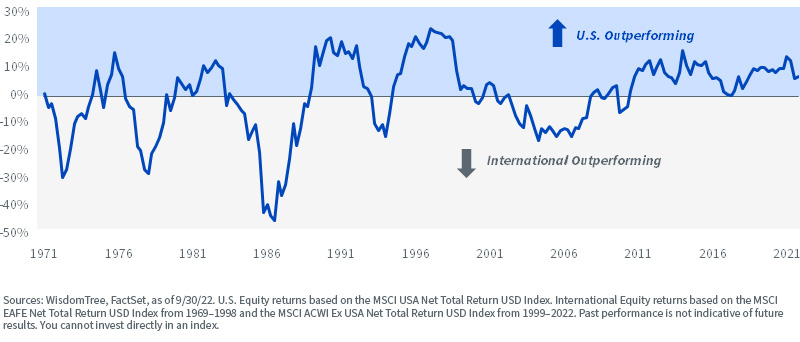

First, it is important to view the most recent example of U.S. outperformance in a historical context, as it only represents one period in what has historically been a cyclical relationship. There are numerous examples of European, Japanese and emerging markets having their own “moments in the sun.”

Rolling 2-Year Annualized Relative Returns of U.S. vs. International Equities (1969–2022)

Even after this recent prolonged cycle of U.S. outperformance, long-term cumulative dollar returns across global regions do not differ significantly. Put simply, we don’t believe global diversification sacrifices long-term return potential.

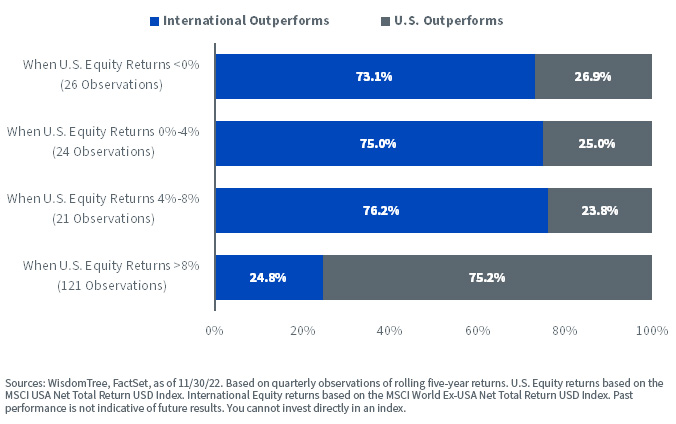

However, imperfect correlations of returns across regions can help protect portfolios on the downside, particularly in periods of poor

U.S. equity returns.

Rolling 5-Year Returns, U.S. vs. International (1970–2022)

This was the case in 2022, as international equities, as measured by the MSCI All-Country World Ex-USA Index, were down approximately -16.0% compared to the -18.5% return on the S&P 500 Index. Local returns of international equities were even more resilient, with the MSCI EAFE and MSCI Emerging Markets (Local) Indexes down only -7.0% and -15.5%, respectively.1

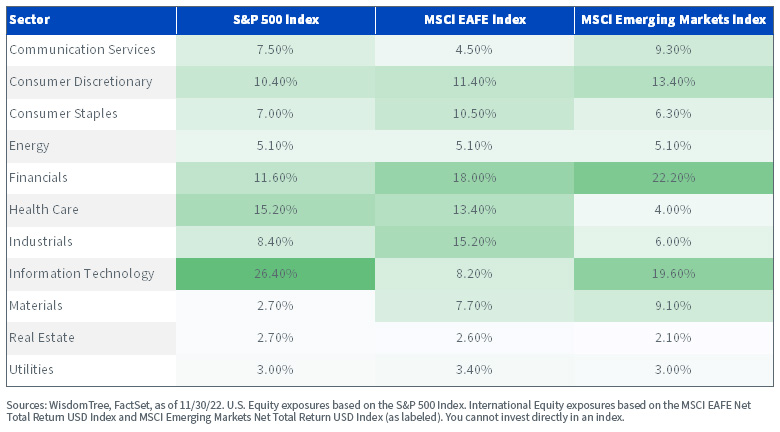

A global approach to equity investing can also help enhance sector diversification.

Even with several large, tech-focused U.S. firms now in the Communication Services (Meta, Alphabet) and Consumer Discretionary (Tesla, Amazon) sectors, U.S. equities are still much more concentrated in the Technology sector than international indexes.

Sector Exposures—U.S. and International Equity Indexes

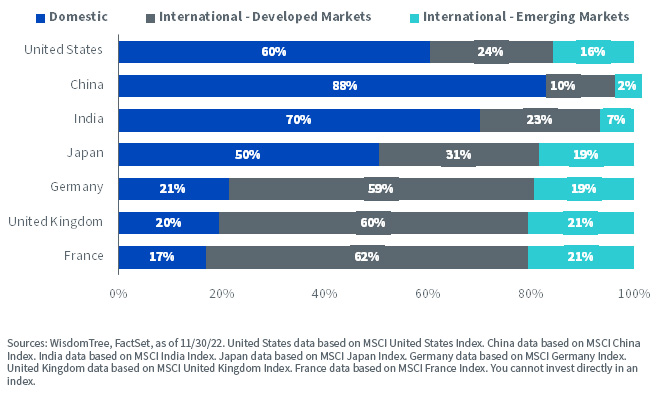

We also believe a regionally diversified equity portfolio is necessary to gain exposure to today’s global economy.

Despite calls for the “end of globalization,” U.S. annual imports have only accelerated in recent years,2 and U.S. companies in the MSCI USA Index now generate approximately 40% of their revenues from overseas.3

Geographic Revenue Exposure for MSCI Country Indexes

Senior Investment Strategy Advisor to WisdomTree, Professor Jeremy Siegel, and Global CIO Jeremy Schwartz argue in the latest edition of Stocks for the Long Run that the current definition of a company’s domicile based on the location of its headquarters may become increasingly arbitrary in today’s globally interconnected world.4

Current Valuations Support an Allocation to International Equities

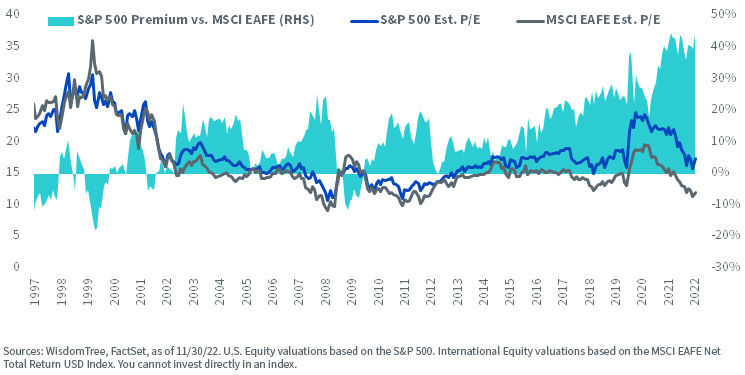

Beyond the strategic arguments for global diversification, current valuations of international equities make a compelling opportunistic case for their inclusion in portfolios.

The price premium on U.S. equities, based on the estimated price-to-earnings (P/E) ratio, is now near an all-time high.

Historical Estimated Price-to-Earnings (P/E) Ratios

The relative valuation discounts on international stocks can also be seen in current dividend yields. As of December 31, 2022, the MSCI EAFE and Emerging Markets Indexes offer dividend yields of 3.23% and 3.36%, respectively, versus the 1.69% dividend yield of the S&P 500 Index.5

Relative Strength of the U.S. Dollar

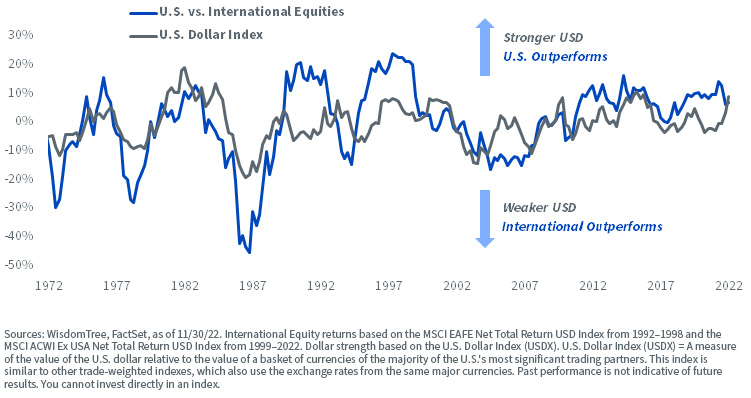

As most U.S. investors do not hedge foreign currency exposure within international equity allocations, another important factor in relative performance versus domestic equities is the strength of the U.S. dollar.

Historically, a stronger USD has generally been associated with U.S. equity outperformance, while a weaker USD has generally been associated with international stocks outperforming U.S. equities.

Rolling 2-Year Annualized Relative Returns

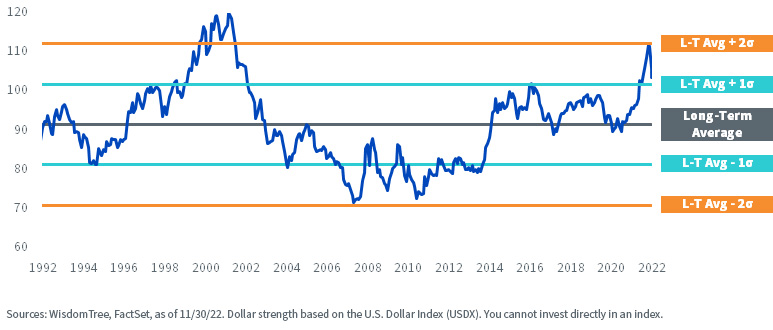

While the dollar recently took a breather from the relentless strengthening seen throughout 2021–2022, it is still more than one standard deviation above long-term averages.

U.S. Dollar Index

Should this trend of USD weakness continue, it may present an additional tailwind for international stocks.

Conclusion

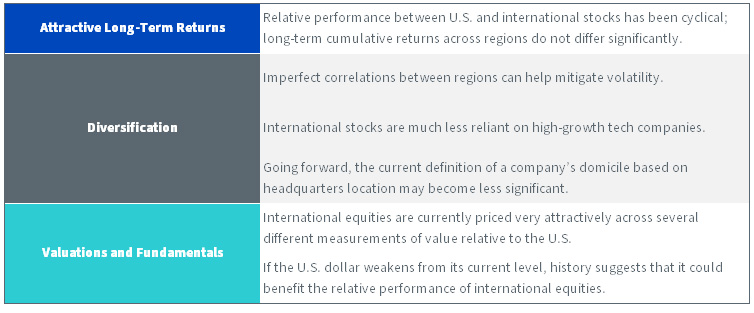

While recent U.S. equity outperformance has led some investors to question the role of international stocks, we are strong believers in the potential long-term advantages of global equity investing:

Originally published 2 February 2023.

For more news, information, and analysis, visit the Modern Alpha Channel.

1 Sources: WisdomTree, FactSet, as of 12/31/22.

2 Source: Bloomberg, as of 10/31/22.

3 Sources: WisdomTree, FactSet, as of 11/30/22. United States data based on MSCI United States Index.

4 Source: Jeremy J. Siegel with Jeremy Schwartz, Stocks for the Long Run: The Definitive Guide to Financial Market Returns and Long-Term Investment Strategies (6th ed.), New York: McGraw-Hill.

5 Sources: WisdomTree, FactSet, as of 12/31/22.

Important Risks Related to this Article

Diversification does not eliminate the risk of experiencing investment losses.

For Financial Advisors: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy.

For Retail Investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.