Advisors and investors are hearing plenty about how momentum small-caps are building to end 2020, a scenario many market observers believe will carry over to the new year.

Asset allocators looking for preparation for more small-cap upside can turn to model portfolios, including the WisdomTree Core Equity Model Portfolio, which features allocations to three small-cap exchange traded funds covering domestic, developed, and emerging markets smaller equities.

“This model portfolio is designed for growth-oriented investors with a long-term horizon looking to maximize long-term potential for capital growth through a globally diversified set of equity ETFs,” according to WisdomTree.

In recent weeks, small-cap equities have been keeping pace with their large-cap brethren, but before advisors start sticking their clients into these small cap funds, they might want to think twice. While it helps to diversify a client’s portfolio and get the additional upside of small-caps, advisors should keep quality in mind. Fortunately the Core Equity Model Portfolio has quality covered.

A January Precedent Could Be at Play

In financial markets, past performance isn’t a guarantee of future success and history doesn’t always repeat. However, history does show that when small-caps perform as they did in November, more upside usually follows.

“While the future is always uncertain, the data makes a strong case that we had an inflection point for small-cap stocks—and that while investors will inevitably feel they ‘missed’ this large turn, this past analysis indicates there’s reason to believe more is to come,” notes WisdomTree Research Director Jeremy Schwartz.

Then there’s the notion of seasonality. When small-cap equities perform well in January, they set the stage for broader market upside over the course of the new year.

“There is also research that suggests January is a particularly strong time for the performance of small-cap stocks. This ‘January Effect‘ does not work every year, and small caps generally have faced a tough stretch for quite an extended period,” according to Schwartz.

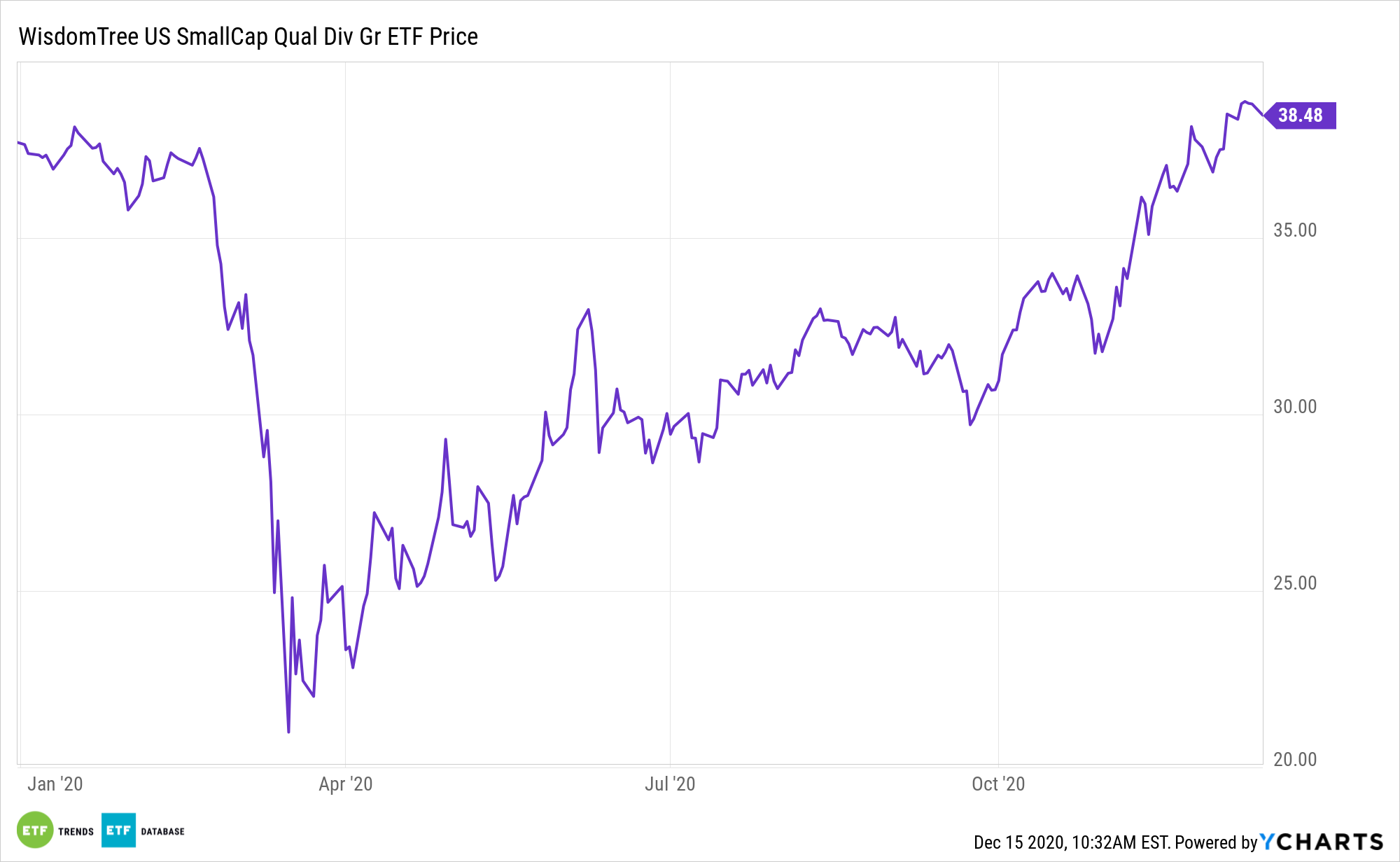

One of the small-cap ETFs featured in the aforementioned model portfolio is the WisdomTree U.S. SmallCap Dividend Growth Fund (NasdaqGM: DGRS).

DGRS tracks the WisdomTree U.S. SmallCap Dividend Growth Index, which is weighted by fundamental factors such as growth expectations, return on equity, and return on assets, according to WisdomTree.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.