To say 2020 has been an eventful year for fixed income investors is an understatement, but advisors can get ahead of the game for 2021 with the right model portfolio.

Enter WisdomTree’s Fixed Income Model Portfolio, which features exposure to eight fixed income exchange traded funds.

“This model portfolio is focused on a diversified stream of income. It seeks to benefit from secular trends we see evolving in the fixed income markets in a risk-conscious manner. The model portfolio focuses on select opportunities in core sectors, while strategically allocating among sectors and extending the model portfolio’s reach globally,” according to WisdomTree.

The fixed income market was one of the stars in a pandemic-ridden 2020, especially when the Federal Reserve came in to backstop bonds earlier this year when the COVID-19 sell-offs were at their peak. As ETF investors look to position their portfolios for 2021, getting bond exposure is still a must.

AGGY and USFR ETFs Emblematic of 2021’s Fixed Income Lesson

There are some important fixed income themes for investors to focus on in the new year.

“With interest rates at historical lows, investors will be tasked with looking for income without moving too far out in duration or, perhaps more importantly, sacrificing credit quality,” writes WisdomTree head of fixed income Kevin Flanagan.

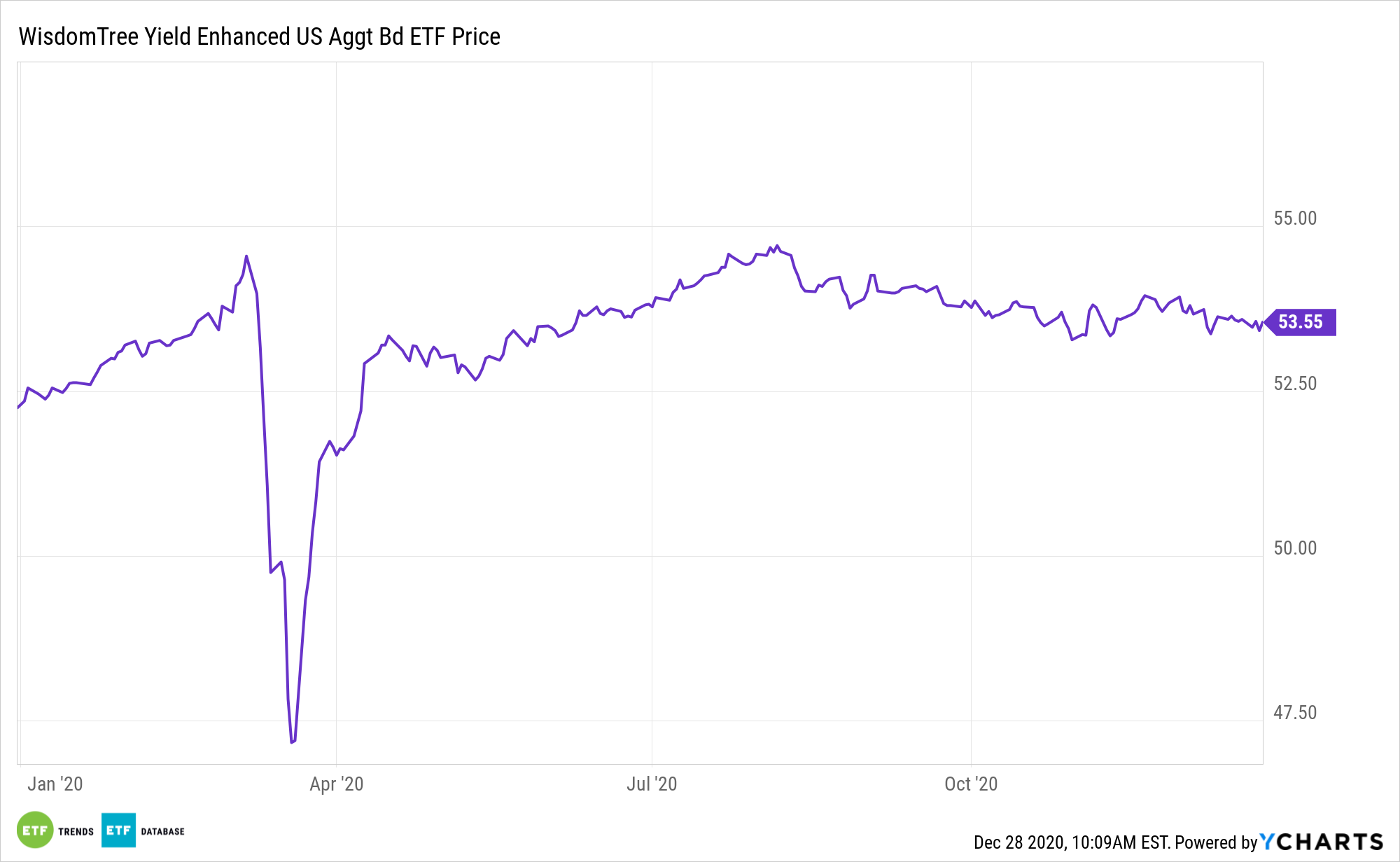

One avenue for capitalizing on Flanagan’s advice is the WisdomTree Barclays U.S. Aggregate Bond Enhanced Yield Fund (NYSEArca: AGGY).

AGGY seeks to track the price and yield performance, before fees and expenses, of the Bloomberg Barclays U.S. Aggregate Enhanced Yield Index (the “index”). The index is designed to broadly capture the U.S. investment grade, fixed income securities market while seeking to enhance yield within desired risk parameters and constraints.

AGGY uses a “rules-based approach and re-weights the subcomponents of the Bloomberg Barclays U.S. Aggregate Bond Index to enhance yield, while broadly maintaining familiar risk characteristics. AGGY tries to boost return by reweighting the components of the Aggregate Index. But this additional yield is not free as it comes with greater credit risk and rate risk,” according to WisdomTree.

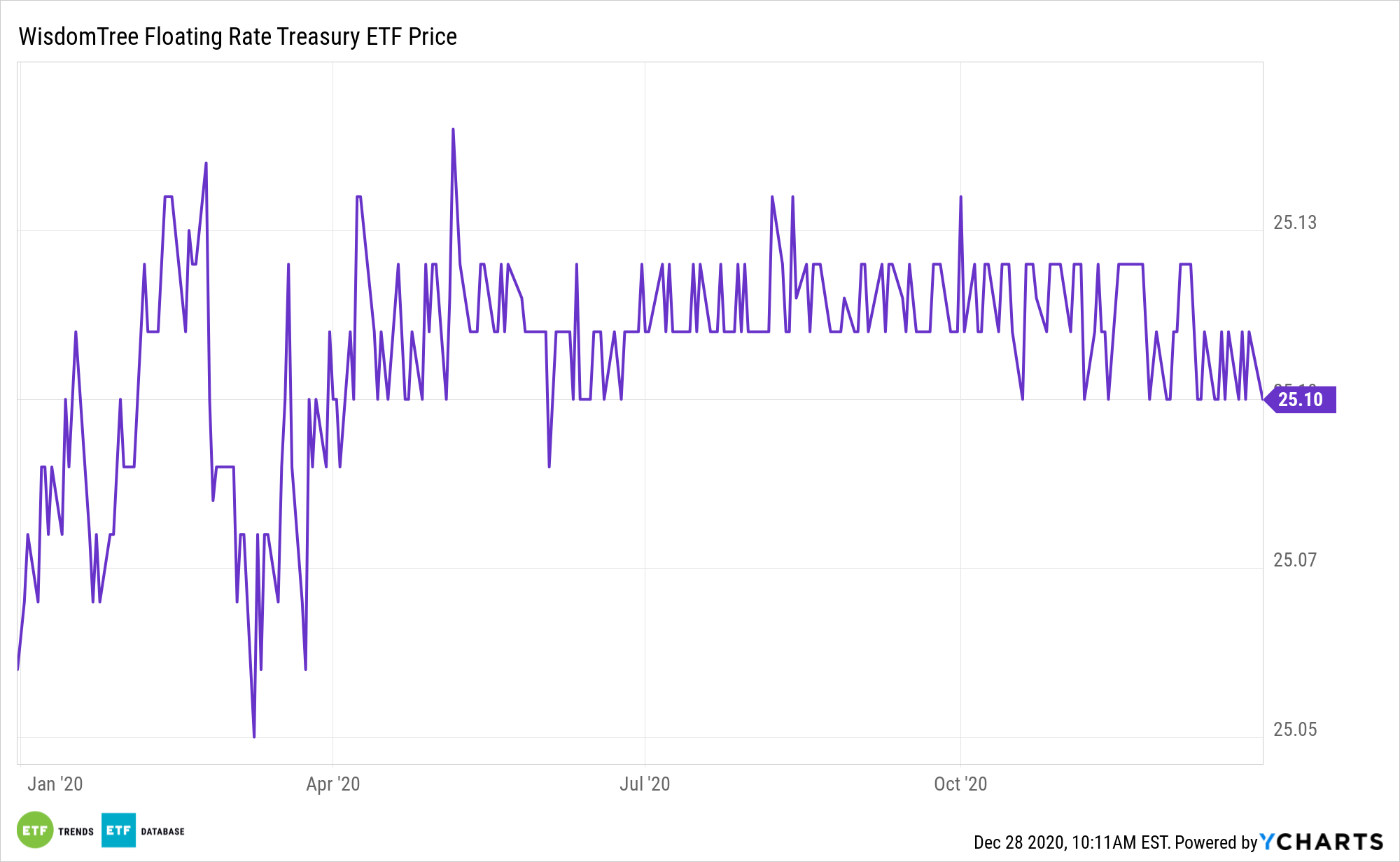

Flanagan also points out that the reflation trade could be on the agenda in 2021. Advisors can prepare for that theme with the WisdomTree Bloomberg Floating Rate Treasury Fund (NYSEArca: USFR).

USFR, which debuted in February 2014, follows the Bloomberg U.S. Treasury Floating Rate Bond Index. The fund’s holdings are priced at a spread over 3-month Treasury bills.

Floating rate notes, like the name suggests, have a floating interest rate. Specifically, the notes have a so-called reset period with interest rates tied to a benchmark, such as the Fed funds, LIBOR, prime rate, or U.S. Treasury bill rate. Due to their short reset periods, these floating rate funds have relatively low rate risk.

USFR uses a “rules-based approach and re-weights the subcomponents of the Bloomberg Barclays U.S. Aggregate Bond Index to enhance yield, while broadly maintaining familiar risk characteristics. AGGY tries to boost return by reweighting the components of the Aggregate Index. But this additional yield is not free as it comes with greater credit risk and rate risk,” per WisdomTree.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.