Amid forecasts that dividend growth is back, more clients are asking advisors about dividend exchange traded funds.

Advisors can answer that call with WisdomTree’s Global Dividend Model Portfolio. The model portfolio features exposure to nine exchange traded funds from a variety of issuers, and while it’s 60% allocated to domestic equity funds, its 40% international exposure could be compelling against the backdrop of potential tax increases in the U.S.

The Biden Administration needs to fund its infrastructure plan somehow, and while the issue of where revenue will be sourced from could encounter resistance in Congress, corporate and personal tax hikes remain on the table. That could weigh on some sectors of the U.S. equity market. Combine that with the potential of ex-U.S. markets and the model portfolio’s international exposure takes on added allure.

“The U.S. has led the developed world’s economic restart – together with the UK – and its growth looks to be peaking as the restart broadens out,” according to BlackRock. “We see the potential for other DM markets, such as Europe and Japan, to pick up the baton and benefit more from the restart trade. These markets, which already have higher taxes and more regulations than the U.S., face more limited scope for additional taxes and regulation, in our view.”

The three developed markets ETFs in the model portfolio feature substantial allocations to European and Japanese equities.

Another Benefit of the Model Portfolio

Clients engage advisors because they are seeking advice. Advisors can add value on that front by discussing the tax advantages of ETFs against the backdrop of tax increases. In fact, plenty of experts are already speculating if tax increases come to pass, market participants will expand the torrid pace of inflows to ETFs in an effort to trim capital gains exposure.

“Higher taxes on individual capital gains could lead to a greater focus on after-tax portfolio construction, potentially driving up demand for tax-efficient strategies that allow taxable investors to better control the timing of their capital gains, including exchange-traded funds (ETFs) and managed accounts, in our view,” adds BlackRock.

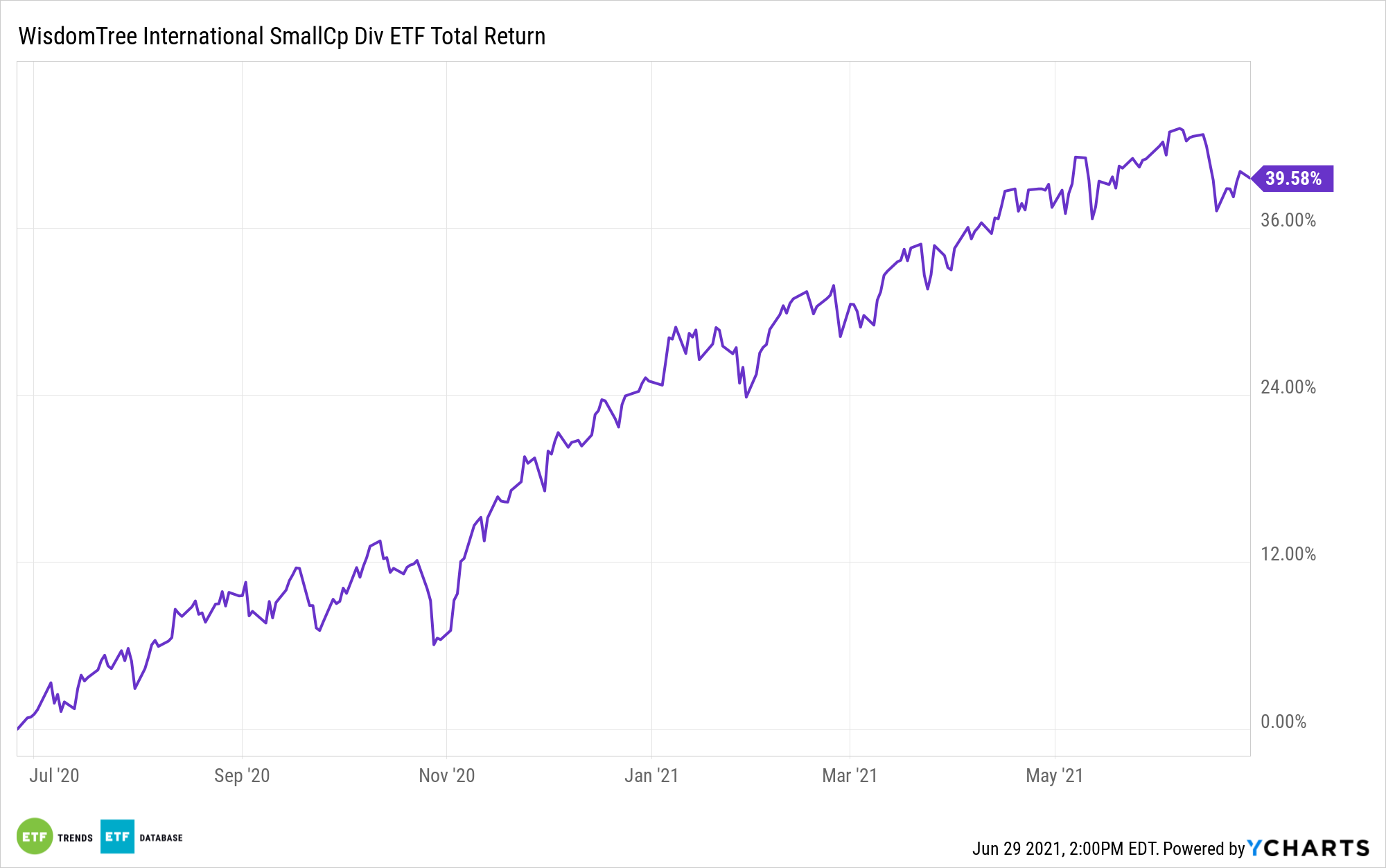

Ex-U.S. developed market exposures in the WisdomTree model portfolio include the WisdomTree Global ex-U.S. Dividend Growth Fund (NYSEArca: DNL) and the WisdomTree International SmallCap Dividend Fund (DLS).

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.