Domestic small-cap equities are handily beating large-cap benchmarks this year, but that phenomenon isn’t limited to U.S. borders.

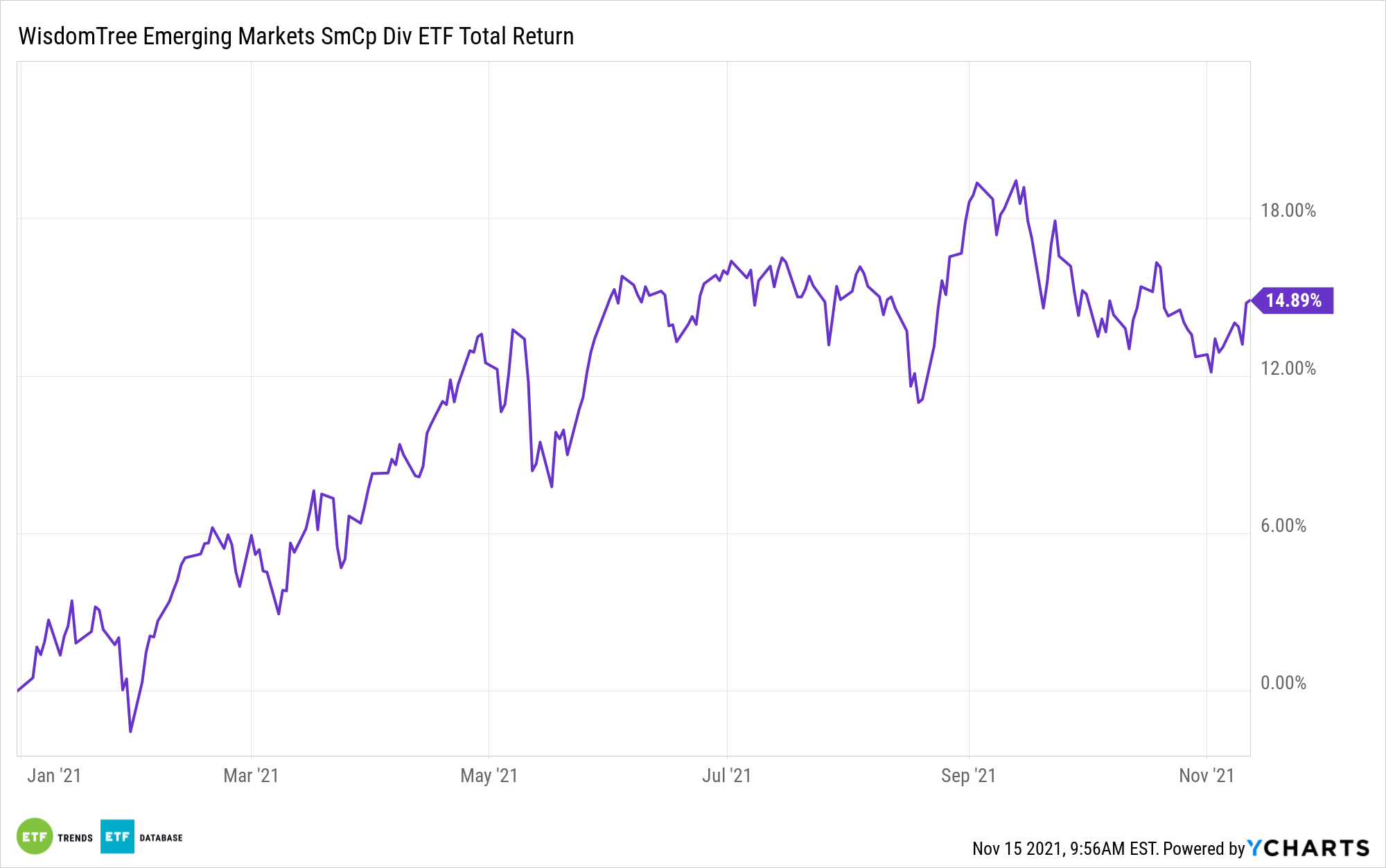

Removing some home country bias can help investors unearth opportunities with international small-caps, including those in emerging markets. That endeavor is paying off this year. For example, the WisdomTree Emerging Markets SmallCap Dividend Fund (NYSEArca: DGS) is up about 15% year-to-date while the large-cap MSCI Emerging Markets Index is up just 1%.

“Cheap valuations and a bias toward economically-sensitive sectors are why investors in developing country markets are choosing to bet on small, according to Manishi Raychaudhuri, BNP Paribas SA’s head of APAC equity research,” reports Nguyen Kieu Giang for Bloomberg.

The $2.31 billion follows the WisdomTree Emerging Markets SmallCap Dividend Index. That’s a fundamentally weighted benchmark that weighs components on the basis of annual cash dividends paid. In other words, DGS isn’t an explicit high dividend strategy, but its distribution yield of 4.92% far exceeds that of the MSCI Emerging Markets Index and domestic small-cap benchmarks.

As Raychaudhuri notes, cyclical sectors, namely commodities groups, are driving upside for emerging markets small-caps this year. DGS allocates 14.42% of its weight to materials and energy stocks, and it has more cyclical exposure by way of a 14.45% allocation to the financial services sector.

That said, DGS also features exposure to some of the more compelling trends in emerging markets equities, including technology and consumer internet. Tech and consumer discretionary stocks combine for almost 28% of the WisdomTree ETF’s weight.

Another reason that DGS is beating large-cap rivals this year is its small allocation to China. DGS devotes just 12% of its weight to Chinese small-caps, whereas a competing large-cap ETF is likely to allocate 30% or more of its lineup to Chinese equities. DGS’s lack of China exposure is relevant on another front. This year, the fund’s annualized volatility is below that of both the MSCI Emerging Markets and the MSCI Emerging Markets Small Cap indexes.

Taiwan, a market known for high-quality tech stocks, is the largest geographic weight in DGS at 27%.

For more news, information, and strategy, visit the Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.