Earlier this year, identifying factor leadership was easy, as value and small cap stocks surged. Then came a decline in Treasury yields, enabling growth stocks to make up some ground.

More recently, there’s been talk that as the business cycle moves forward, quality stocks will come back into style. All of that is to say that factor timing is difficult and usually not worth the hassle. Multi-factor exchange traded funds can help rectify that scenario.

One starting point is the broad swath of ETFs in WisdomTree’s suite of multi-factor model portfolios.

“This model uses factor-tilted equity ETFs designed to provide improved risk factor diversification. Our multi-factor models are available in U.S., Developed International, and Emerging Market versions, and can be used as standalone equity models or as complementary sleeves aimed at improving the overall diversification profile of an existing portfolio,” according to the issuer.

There are seven ETFs in the domestic sleeve of the multi-factor model portfolio, including funds that focus on growth, others with quality and value tendencies, and still others that adhere to multi-factor methodologies. That diversity is relevant to clients because factor leadership can rapidly shift.

“In June, growth was underperforming value by 5% over the prior four weeks (i.e., rolling one-month returns), a two standard deviation event. Fast forward one month, and growth was outperforming value by 10% in the middle of July — a more than three standard deviation event. As of the end of July, growth’s outperformance did decline,” according to State Street research.

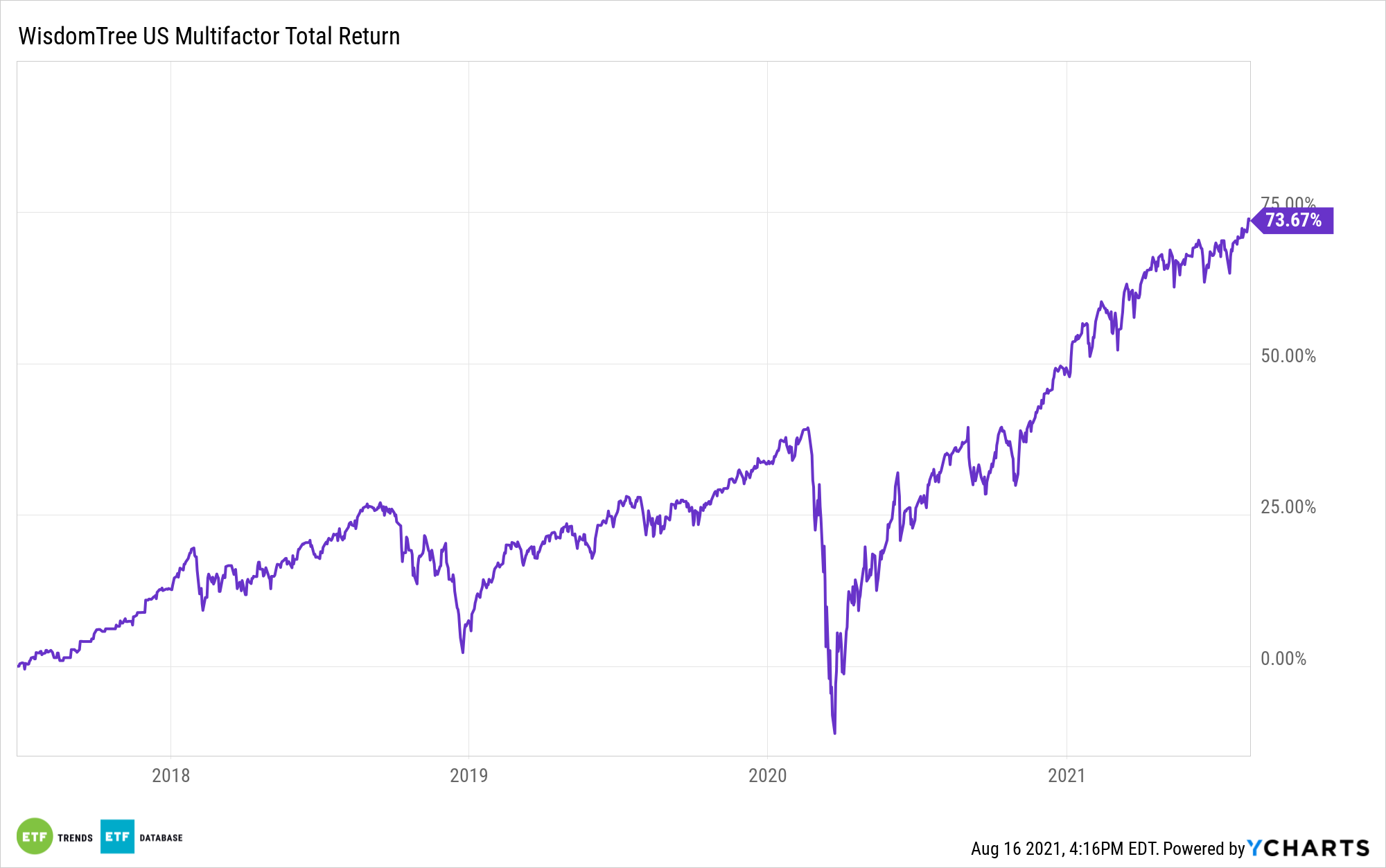

One of the components in this model portfolio is the WisdomTree U.S. Multifactor Fund (CBOE: USMF). USMF holdings are scored on two fundamental factors (value and quality measures) and two technical factors (momentum and correlation). That methodology is particularly relevant at a time when the various investment factors are struggling to establish extended leadership over one another.

“This reinforces the lack of persistency of a particular style as the market lacks clear direction amid concerns over the vibrancy of the recovery, as we witness yet another rise in cases and mobility restrictions alongside uneven economic data,” notes State Street.

On an individual basis, all of the major investment factors perform well over longer holding periods. However, each is affected by macro factors and market swings.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.