Markets have gone risk-on in a big way as advisors and investors piled into ETFs last Thursday on the news that October’s inflation growth had increased at the slowest rate since January of this year. High yield bond ETFs, otherwise known as junk bonds, raked in $3 billion on Thursday according to Eric Balchunas, senior ETF analyst at Bloomberg, as optimism around potential Fed interest rate easing in December equated to increased engagement with riskier investments.

Hopes are high that the Fed will begin what Kevin Flanagan, head of fixed income strategy at WisdomTree, has coined as a “pivot-lite” in December in which they will begin to ease the rates of each rate hike while continuing to tighten and maintain a restrictive monetary policy.

“Despite the better-than-expected reading for October CPI, the Fed’s rate hike path has not changed. Powell’s ‘pivot lite’, going from 75bp to 50bp rate hikes remains the base case scenario,” explained Flanagan in a communication to VettaFi.

“Against that backdrop, the rise in U.S. interest rates thus far in 2022 has brought about a sense of ‘normalcy’ returning to the fixed income market. In other words, fixed income is poised to return to its more traditional role in investors’ portfolios with US high yield taking on its prior ‘core plus’ position.”

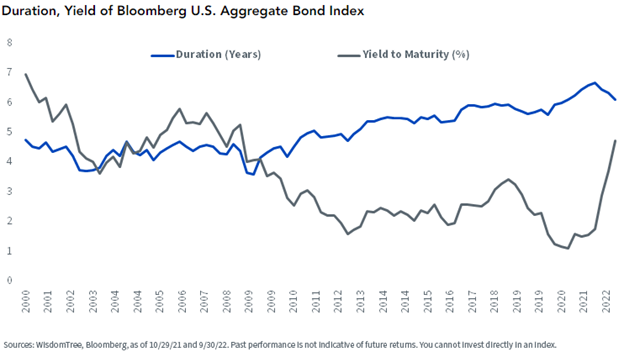

Yields in fixed income have increased over the course of this year, with the Bloomberg U.S. Aggregate Bond Index’s yield growing from 1.75% to approximately 4.6% as of November.

Image source: WisdomTree blog

The increase in yield means there are opportunities within high yield bonds such as the WisdomTree U.S. High Yield Corporate Bond Fund (WFHY) that offers exposure to select U.S. non-investment-grade corporate bonds (also known as “junk bonds”) but utilizes a quality screen and rules-based approach to identify companies that exhibit strong fundamentals and then tilts to more heavily weight those companies that have favorable income characteristics.

“In anticipation of the Federal Reserve taking its foot off the gas albeit slowly, advisors are more willing to embrace some risk-taking and seek out higher yielding investments. Relative to many other high yield ETFs, WFHY incorporates fundamental factors such as liquidity and cash flow generation adding to its appeal.”

In regards to quality, the fund invests in bonds with grades between BBB and CCC but is currently primarily invested in BB (48.28% weight) and B-rated (35.13% weight) bonds.

WFHY invests broadly across sectors, with allocations in media (14.01%), energy (11.89%), healthcare (10.62%), industrials (10.15%), and many other sectors as of November 11, 2022.

For more news, information, and strategy, visit the Modern Alpha Channel.