Investors looking to bet on the ongoing U.S. economic recovery should focus on companies that generate significant percentages of their sales within the confines of U.S. borders.

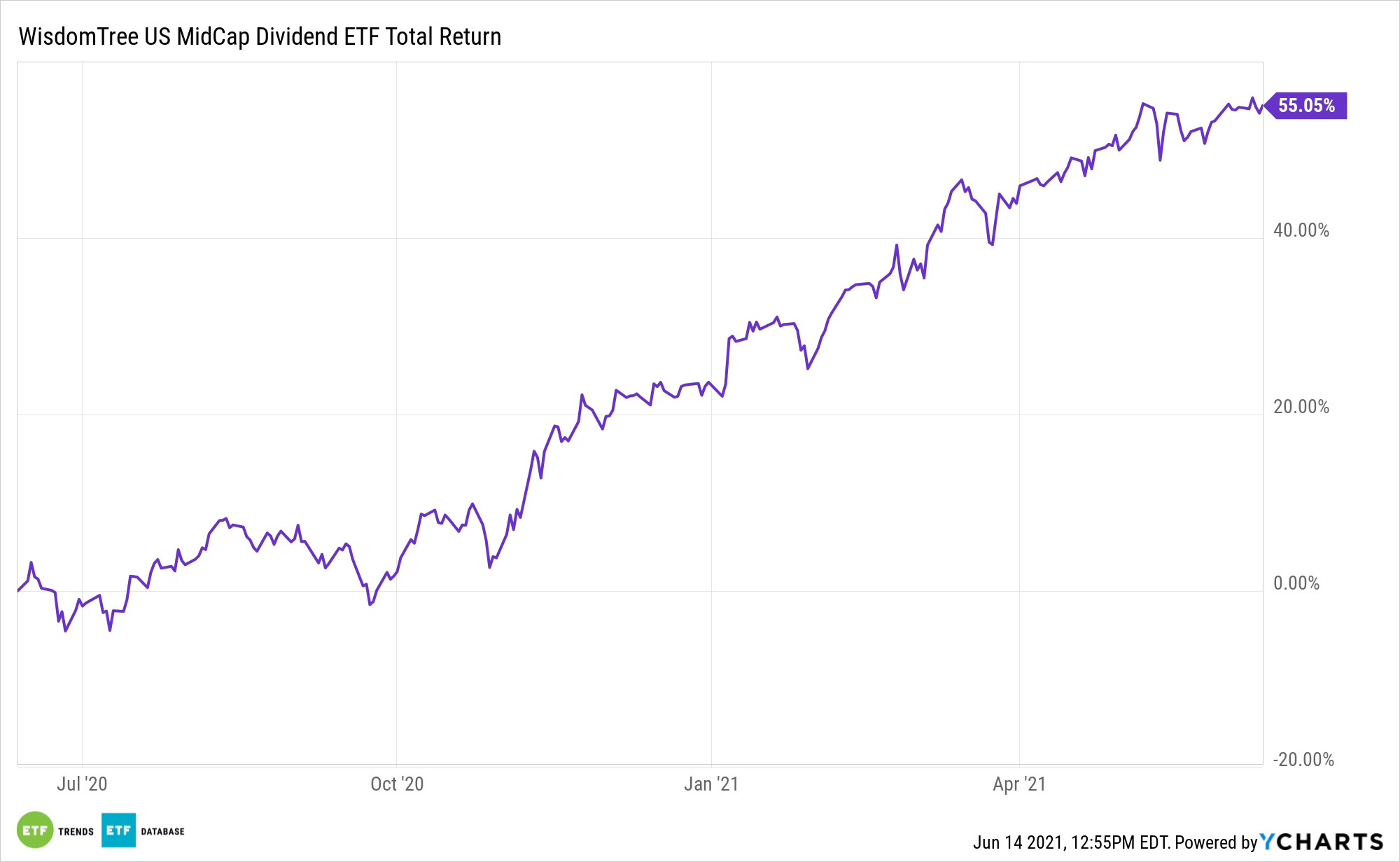

Thing is, many S&P 500 companies don’t do that. In fact, several sectors in the large-cap equity benchmark depend on international markets for more than half their revenue. That diminishes their leverage to a domestic rebound. However, mid cap stocks often deliver exposure to a rebound in U.S. economic activity and that’s one reason the WisdomTree U.S. MidCap Dividend Fund (NYSEARCA: DON) is higher by 24.79% year-to-date, an advantage more than 1,100 basis points over the S&P 500.

“Among the 331 members of the S&P MidCap 400 that break out foreign and domestic sales, 60% of revenue is from the U.S., compared with a little more than half for the much bigger companies that make up the S&P 500,” reports Bailey Lipschultz for Bloomberg.

Other Benefits to the ETF

Another tailwind for DON is its exposure to cyclical sectors, which jives with the domestic recovery theme. The WisdomTree fund allocates 26% of its weight to financial stocks – its largest sector exposure.

Overall, 71% of DON’s holdings have market values ranging from $2 billion to $10 billion, and when it comes to its bank stock exposure, it’s in a potential sweet spot for rising mergers and acquisitions activity.

DON also sports a 10.53% consumer discretionary allocation. Many of the fund’s holdings in that sector are exposed to the themes of the re-opening trade and rejuvenated consumer spending. For now, those highly domestic themes that investors should access with, well, equities with heavy domestic positioning. Data confirm mid caps are a practical avenue for accomplishing that objective.

Mid caps are “more exposed to disruptions in international supply chains and increased antitrust activities in some jurisdictions. Mid-cap companies, with their U.S. focus, have raised their full-year revenue guidance more than at any time since at least 2017,” according to Bloomberg.

Up 4% over the past month, DON yields, 2.35%, which is more than double the dividend yield on the S&P MidCap 400 Index. DON’s underlying index is dividend weighted in an effort to project what member firms’ payouts will look like in the year ahead.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.