Owing to a spate of cuts and suspensions forced by the coronavirus pandemic, the first half of 2020 was a miserable time for dividend stocks.

A year later, things are looking up for global payout equities. That relief is well-timed, because with global bond yields depressed, advisors are scrambling to generate income for clients. Advisors looking to enhance clients’ income streams while adding diversification across market capitalization segments and geographies can consider the WisdomTree Global Dividend Model Portfolio.

“This model portfolio seeks to provide capital appreciation and high current income by investing in a globally diversified set of dividend and yield-oriented equity ETFs. The model strives to deliver current yield in excess of a global benchmark of equities,” according to WisdomTree.

Dividend Growth Is Swinging Back Around

In the first quarter, global dividends were lower on a year-over-year basis because many of the companies, domestic and international, that were payout offenders last year cut those distributions either after the first-quarter dividend was paid or in the second quarter. But by digging a little deeper, advisors will find an improving dividend picture.

“There were clear signs of a forthcoming revival in global dividends during the first quarter. Although payouts were 2.9% lower year-on-year at $275.8bn, the decline was exaggerated by lower one-off special dividends in the US,” according to Janus Henderson research. “On an underlying basis they were just 1.7% lower. In the context of the ongoing pandemic, such a small decline is an extraordinarily good result.”

North American dividends were among the sturdiest in the first quarter, thanks in large part to the United States. The model portfolio capitalizes on that theme via the WisdomTree Total Dividend Fund (NYSEArca: DTD) and the WisdomTree U.S. Quality Dividend Growth Fund (NasdaqGM: DGRW), among other domestic holdings. By geography, the U.S. is the model portfolio’s largest weight at 59%.

Fortunately, the portfolio also features adequate international exposure, including some durable dividend markets like Switzerland. As Janus Henderson puts it, Swiss payouts displayed “resilience” over the course of the coronavirus crisis.

“Switzerland is usually the world’s third largest contributor to Q1 dividends after the US and UK, thanks to the timing of the single annual payouts by pharma giants Roche and Novartis,” according to the research firm.

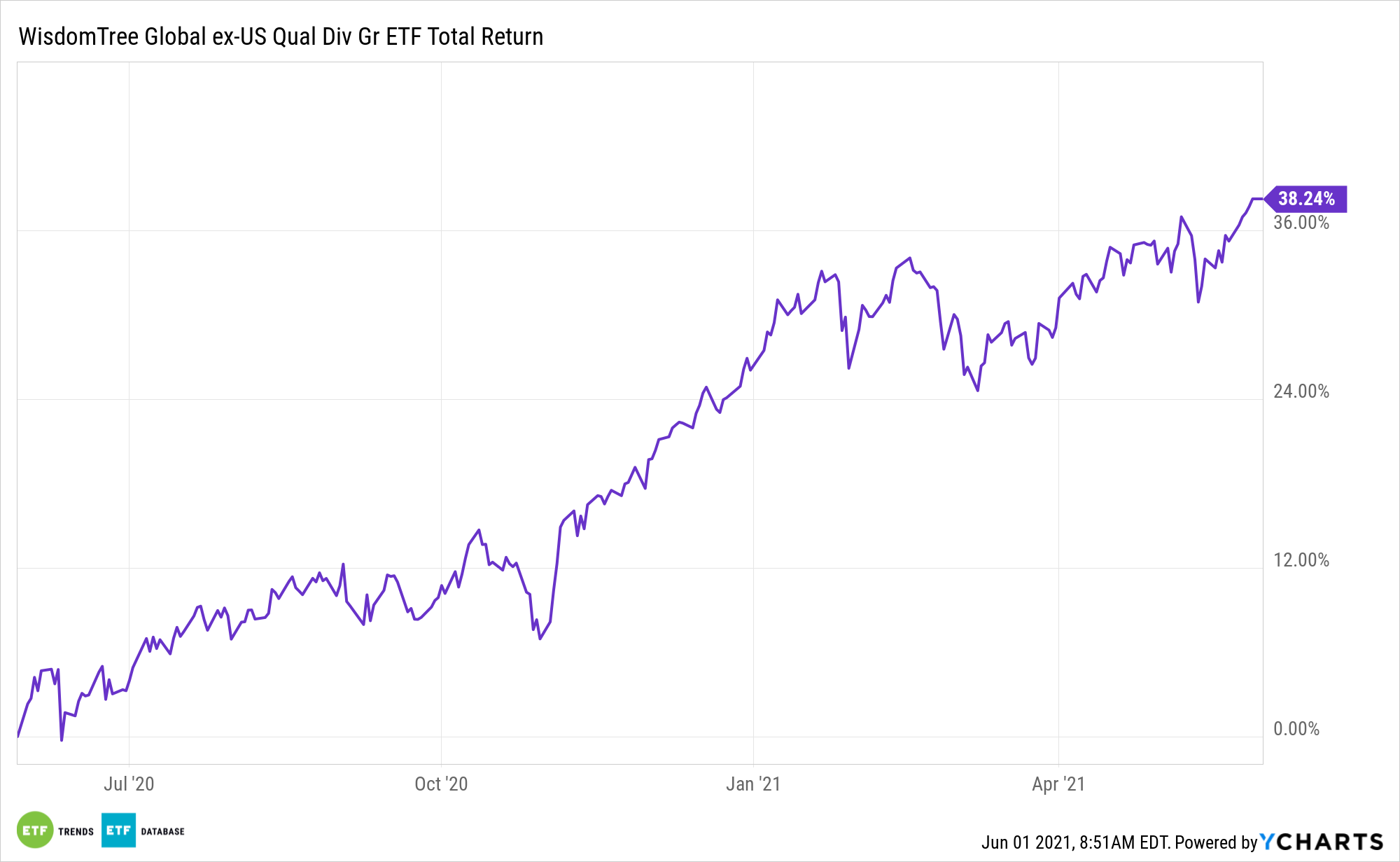

Swiss stocks account for 3% of the WisdomTree model portfolio. One of the ex-U.S. developed markets components in the model portfolio is the WisdomTree Global ex-U.S. Dividend Growth Fund (NYSEArca: DNL), which has recently recorded a series of all-time highs.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.