Second quarter dividend growth for S&P 500 members was off the pace set in the first three months, but even when factoring in the decreases, payouts among domestic companies jumped $12.9 billion in the April through June period.

Advisors looking to capitalize on resurgent payout growth while adding international diversification to the mix can consider the WisdomTree Global Dividend Model Portfolio.

“This model portfolio seeks to provide capital appreciation and high current income by investing in a globally diversified set of dividend and yield-oriented equity ETFs. The model strives to deliver current yield in excess of a global benchmark of equities,” according to WisdomTree.

The model portfolio features nine exchange traded funds – WisdomTree products and third-party funds – spanning domestic and ex-U.S. developed markets as well as developing economies.

A Spotlight on Domestic Dividends

Four of the nine ETFs in the model portfolio provide access to domestic equities. Clients can find comfort with that fact because after a dismal coronavirus-induced showing in early 2020, dividend stocks and payout growth are back.

For the 12 months ending June 2021, net dividend increases in the S&P 500 reached $38 billion, easily beating the net decline of $22.7 billion for the 12 months ending June 2020, according to S&P Dow Jones Indices. While increases jumped $11.2 billion as of June 2021, nearly as important is the fact that dividend decreases dropped by $49.6 billion.

“Dividends are starting to be back in vogue as many companies that suspended their dividends have started to pay again, while others who decreased their dividends or left them unchanged in 2020, have resumed increasing their payments,” said Howard Silverblatt, Senior Index Analyst at S&P Dow Jones Indices.

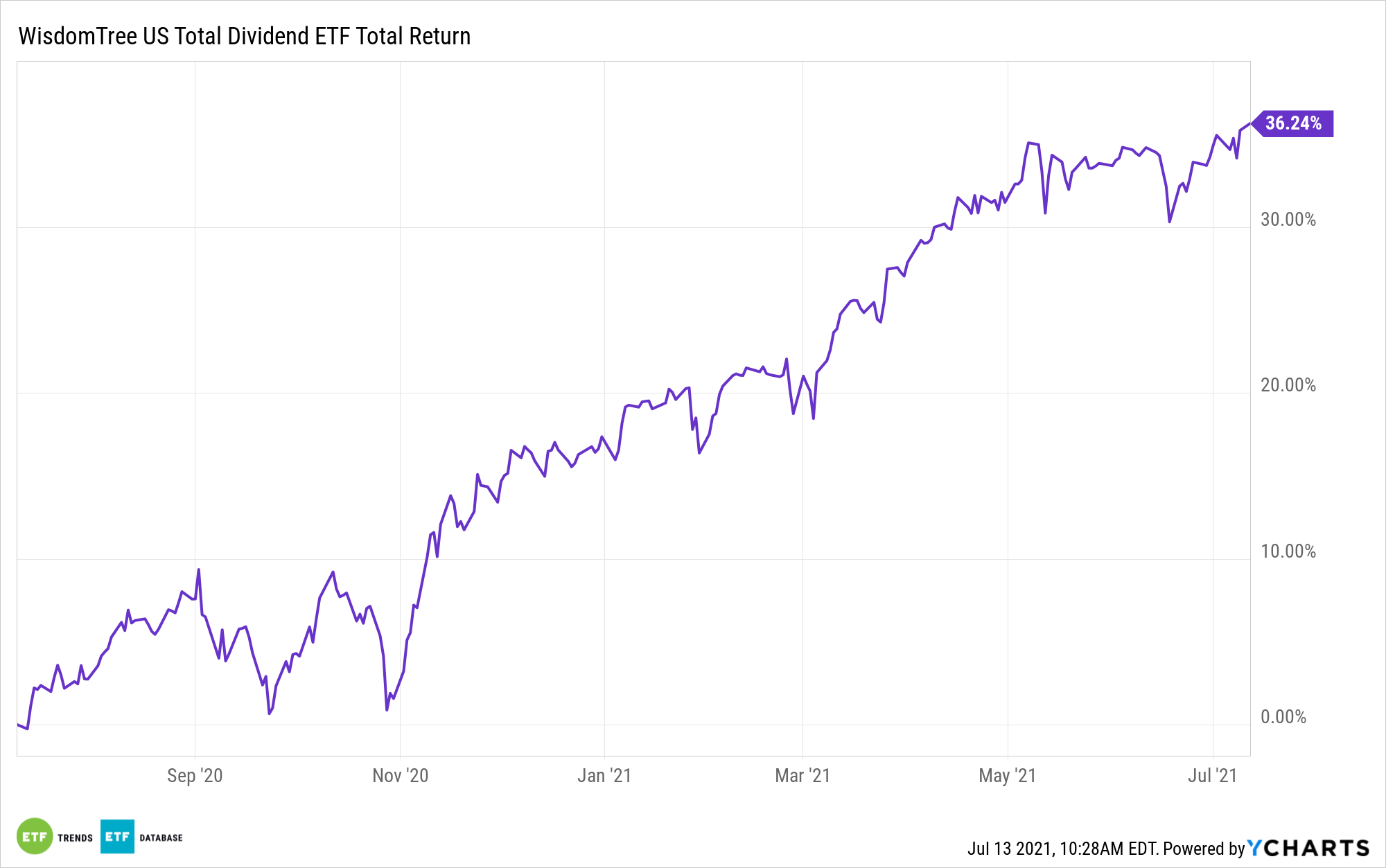

One of the driving forces of the model portfolio is the WisdomTree U.S. Total Dividend Fund (NYSEArca: DTD). The $947.56 million DTD, which turned 15 years old last month, tracks the WisdomTree U.S. Dividend Index. That index is dividend-weighted in an effort to give investors a solid projections of what components’ payouts will look like in the coming year. That’s a meaningful strategy at a time when more companies are feeling comfortable about their payout prospects.

“Given the general acceptance of the reopening and absent a virus upswing, corporate confidence should continue to improve, as more return to resuming dividend payments and increasing them. At this point, for the S&P 500, 2021 is well on its way to a record payout with a 5% increase in the actual cash payments in shareholders pockets,” adds S&P’s Silverblatt.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.