By Rick Harper

CIO, Fixed Income,

Kevin Flanagan

Head of Fixed Income Strategy, and

Scott Welch, CIMA ®

Chief Investment Officer – Model Portfolios

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

A little over a year ago, WisdomTree launched its Short Duration Fixed Income Model Portfolio. Given the Fed’s current rate hike regime and the corresponding rise in short-term rates, it is time to revisit it.

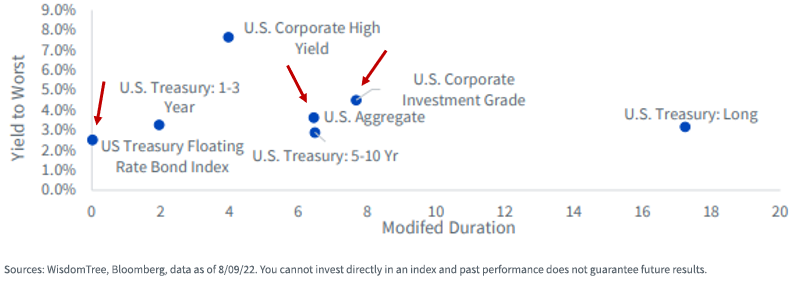

First, let’s look at the current duration profile of the U.S. bond market. As a reminder, duration is a measure of the sensitivity of bond prices to changes in interest rates—the longer the duration, the more sensitive. The current duration of the Bloomberg U.S. Aggregate Index is roughly 6.5 years, and that of U.S. Investment Grade Corporates is even longer—almost 8 years. Note as well the duration of the Bloomberg U.S. Treasury Floating Rate Bond index is essentially zero—that is, little to no interest rate risk.

Index Yield to Worst/Modified Duration

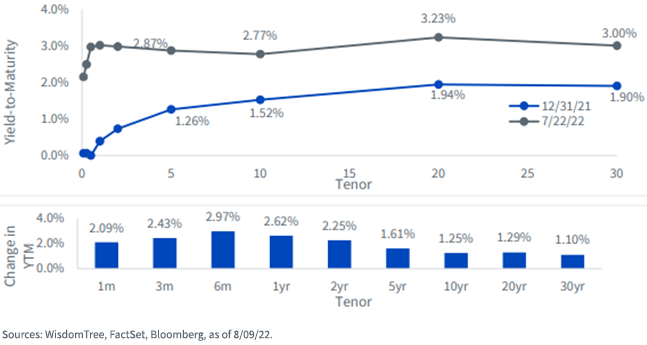

Now let’s look at the current shape of the yield curve. Given current Fed policy, combined with the perception of a slowing economy, we’ve seen a distinct “flattening” of the yield curve—not much difference between short-term and long-term rates. In fact, there has been inversion at certain points of the curve.

Treasury Yield Curve

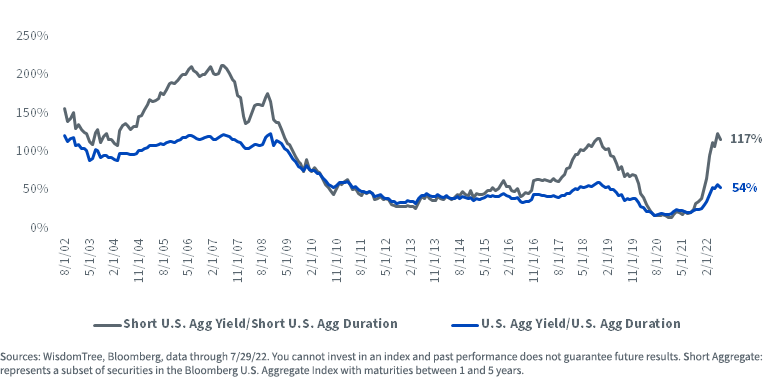

Finally, look at the trade-off between potential returns and duration, that is, how much an investor is being paid to take on duration risk. We see a very interesting situation right now—shorter maturity securities are currently providing yields greater than their duration. Put differently, investors are being paid more return per unit of duration risk at the short end of the curve than at the long end.

Yield & Duration Trade-Offs for Short Aggregate vs. U.S. Aggregate

Looked at from a different perspective, in the current environment an investor can generate, at the short end of the curve, more than 90% of the yield of the broad Bloomberg U.S. Aggregate Index, while taking only 42% of the duration risk.

Yield/Duration for Short Aggregate & U.S. Aggregate

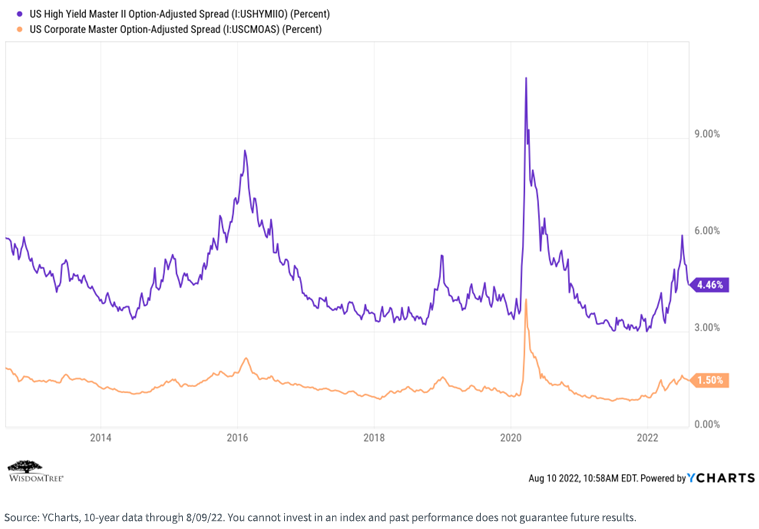

Meanwhile, credit spreads have widened, meaning investors are once again being paid to take on credit risk. There has been a notable retracement over the past few weeks, especially in high yield spreads, but they remain higher than at any time since June 2020.

Why the WisdomTree Short Duration Fixed Income Model Makes Sense Right Now

All of this is to provide context for why our Short Duration Fixed Income Model Portfolio may make sense for many investors seeking to generate quality income without taking unwanted interest rate risk.

We intentionally made the Model Portfolio simple and inexpensive—we currently allocate to five strategies that provide diversification across sectors while maintaining a low duration profile.

WisdomTree Short Duration Fixed Income Model Portfolio

1. SHAG is our Yield Enhanced U.S. Short-Term Aggregate Bond Fund, which seeks to provide enhanced quality income while tracking the performance of the Bloomberg U.S. Short-Term Aggregate Bond index.

2. HYZD is our Interest Rate Hedged High Yield Bond Fund, which seeks to capture higher quality, high yield income while minimizing interest rate risk.

3. SFIG is our U.S. Short-Term Corporate Bond Fund, which seeks to generate higher quality income while tracking the Bloomberg U.S. Short-Term Aggregate Bond index.

4. MTGP is our Mortgage Plus Bond Fund, which attempts to generate high quality income in a risk-controlled manner via the mortgage-backed and other securitized debt sectors.

5. USFR is our Floating Rate Treasury fund, which pegs its coupon to the weekly auction of 2-Year U.S. Treasury Bills. It essentially has minimal duration or credit risk, and benefits from a rising short-term rate environment, such as we are currently experiencing.

Unlike all other WisdomTree Model Portfolios, this one is “closed architecture” and contains only WisdomTree strategies. We did this intentionally to (a) keep the number of line-item allocations to a minimum, (b) provide a diversified exposure across a variety of fixed income strategies and sectors and (c) keep the cost low.

The Portfolio has not been immune to the market environment this year. Its year-to-date total return performance through July 31st is −4.27% at NAV (far better than the Bloomberg Aggregate index performance of −9.12%).

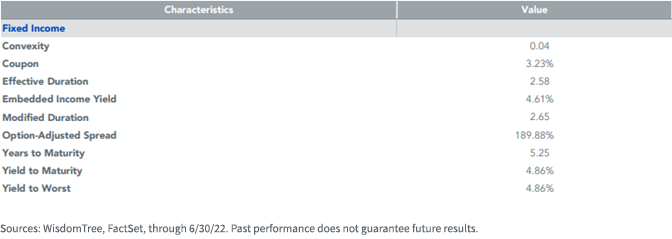

But the primary mandate of the Portfolio is to generate enhanced quality income within a low duration profile, and it is succeeding in doing so. While maintaining a duration of less than half of the Bloomberg Aggregate index (2.58 years versus roughly 6.5 years), the Portfolio is generating a comparable level of yield. A different way of saying this is that an investor is being paid more yield per unit of duration risk in this Portfolio than the broader Bloomberg bond index.

Conclusions

We believe the current and expected future rate environment will be marked by rising rates, increased volatility and a much flatter yield curve regime. With this backdrop, investors should be cautious about taking on duration risk in search of higher yields.

Our short-duration fixed income Model may potentially be part of the solution. It can help reduce interest rate risk while generating levels of yield that are close to broad market index levels. If the Fed continues its rate hike regime and the economy continues to slow (a strange mix of events, we acknowledge, but that seems to be where we are), this Portfolio should only increase in attractiveness for investors seeking risk-controlled yield while maintaining the overall portfolio diversification benefits of a fixed income allocation.

You can learn more at our Model Adoption Center. We hope you will take a look.

Originally published by WisdomTree on August 11, 2022.

For more news, information, and strategy, visit the Modern Alpha Channel.

Important Risks Related to this Article

For financial advisors: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy.

For retail investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded funds and management fees for our collective investment trusts.