By Scott Welch, CIMA ® Chief Investment Officer – Model Portfolios

This article is relevant to financial professionals who are considering offering Model Portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

If you are a regular reader of WisdomTree blog posts, you know how seriously we take factor diversification in the construction of our Model Portfolios.

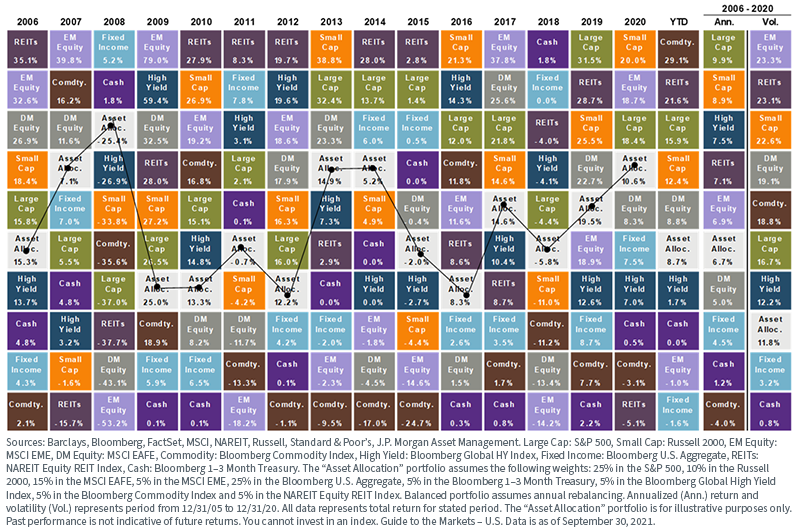

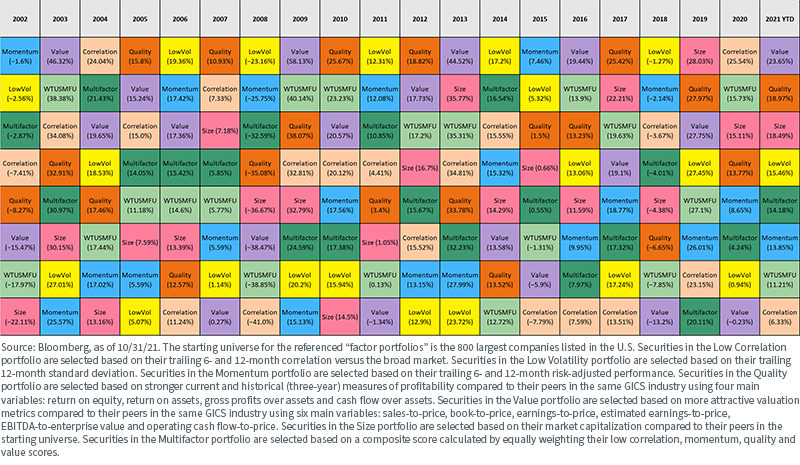

Almost everyone understands and agrees on the importance of asset allocation—that is, diversifying a portfolio across multiple asset classes to improve the consistency and risk-adjusted performance potential of the portfolio. And many are very familiar with the “asset class quilt chart,” which illustrates just how difficult it can be to predict which asset classes will perform best and how diversifying may offer a more consistent performance.

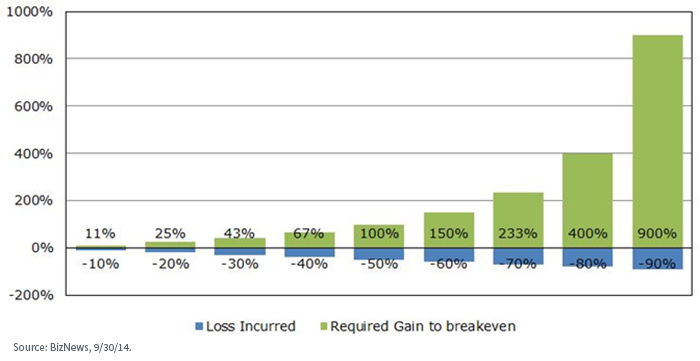

Why does consistency of performance matter? Let’s remind ourselves of the power of compounding—if you don’t lose as much in down markets, you don’t need to gain as much in up markets to still come out ahead.

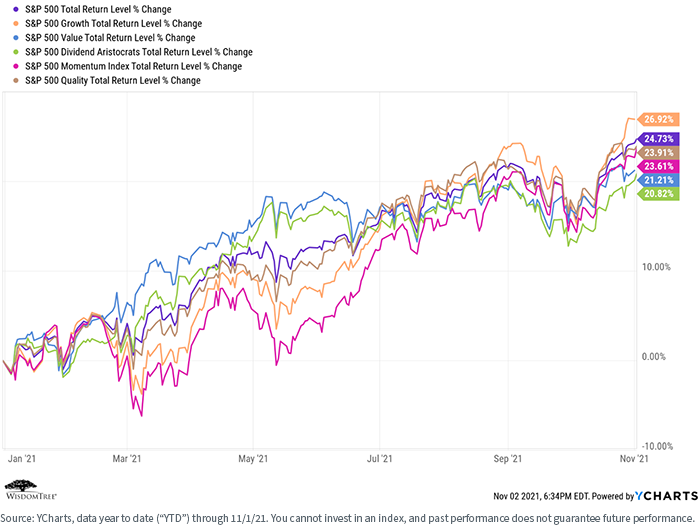

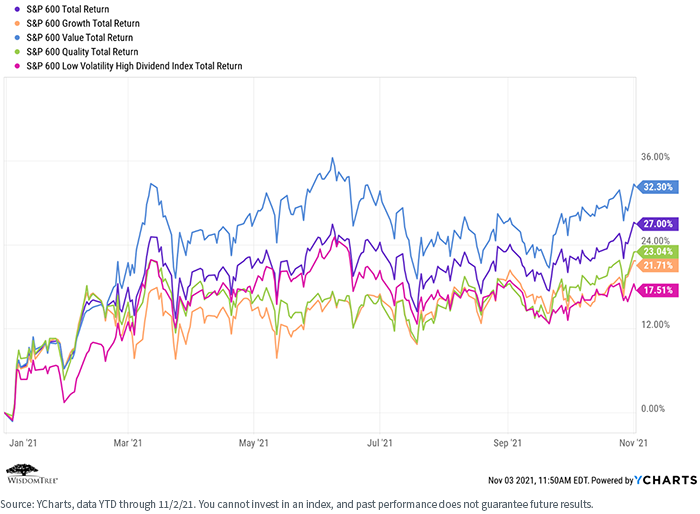

At WisdomTree, we take diversification one level further and diversify across risk factors as well as across asset classes. Take a look at the performances of multiple risk factors over the course of this year within the S&P 500 Index—note that there is an almost 7% return dispersion between them.

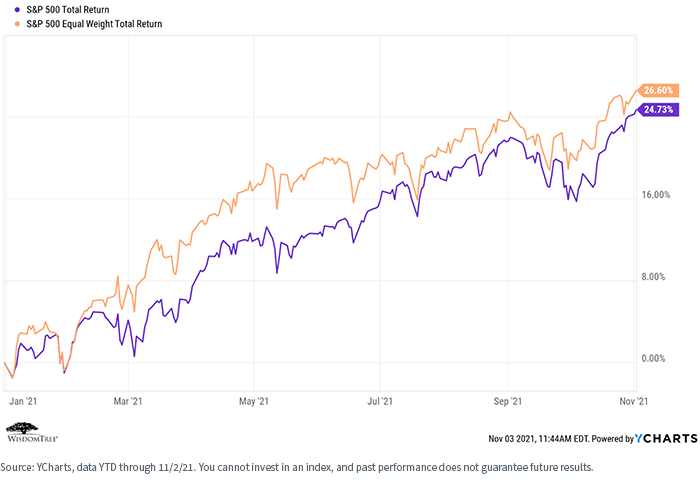

Another factor that doesn’t show up in the above chart is the “size” factor; that is, the performance of smaller-cap stocks versus larger-cap stocks. Using the S&P 500 Equal Weight Index as a proxy, we can see the outperformance of smaller-cap stocks over the course of this year.

It is also worth noting that factor performance is not necessarily consistent across asset classes. While value and quality are middle-of-the-pack performers YTD in large-cap stocks, where growth has dominated, they are performing much better in mid- and small-cap stocks, while growth has lagged (using the S&P 600 Index as the proxy for SMID-cap stocks).

As one final example, take a look at the YTD performance differential between broad market and small-cap emerging markets (“EM”) stocks.

For definitions of terms in the chart, please visit the glossary.

We particularly love this last chart because we believe we are somewhat unique in that we make explicit allocations to non-U.S. small-cap stocks within many of our Model Portfolios, at both the EAFE and EM levels. [EAFE small caps have also outperformed this year, but the differential is not nearly as extreme as with EM.]

The point of the story is that, just like with asset classes, it is almost impossible to outguess the market with respect to which risk factors will outperform or for how long when they do. We prepare a “risk factor performance quilt” every month to highlight this point.

For definitions of terms mentioned above, please visit the glossary.

Conclusions and Model Portfolio Implications

While all WisdomTree Model Portfolios have different mandates, they all have certain common characteristics at the asset allocation and portfolio construction levels:

- Global in nature. We are a global shop, and we believe in global diversification.

- ETF-centric, to improve the potential for optimizing fees and taxes.

- “Open architecture”—they include both WisdomTree and third-party products. This is not only the right thing to do from the end client perspective, but it also ensures that we can access any and all risk factor exposures we want to include in a given model.

- The ETF structure and embedded risk factor tilts inherent in the WisdomTree product set allow us to build “core/satellite” portfolios—increasing the potential to deliver both cost and tax efficiency and also outperformance versus cap-weighted beta portfolios over full market cycles.

- We charge no strategist fee—our revenue is derived solely from the expense ratios associated with the WisdomTree products we choose to include.

We believe in diversification and the power of compounding—we seek to deliver consistent performance regardless of market regime. We believe that diversifying at both the asset class and risk factor levels optimizes our potential for meeting that objective.

You can learn more about our Model Portfolios at our Model Adoption Center.

Originally published by WisdomTree on November 12, 2021.

For more news, information, and strategy, visit the Model Portfolio Channel.

Important Risks Related to this Article

Neither diversification nor an asset allocation strategy assures a profit or eliminates the risk of experiencing investment losses.

For Retail Investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: Your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.

For Financial Professionals: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients.

Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures, is subject to change and may not be altered by an advisor or other third party in any way.

WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.