Amid speculation that more Chinese companies will face delisting in the U.S. as Beijing continues to regulate domestic companies, Chinese stocks are being crimped. The MSCI China Index is lower by almost 4% over the past month.

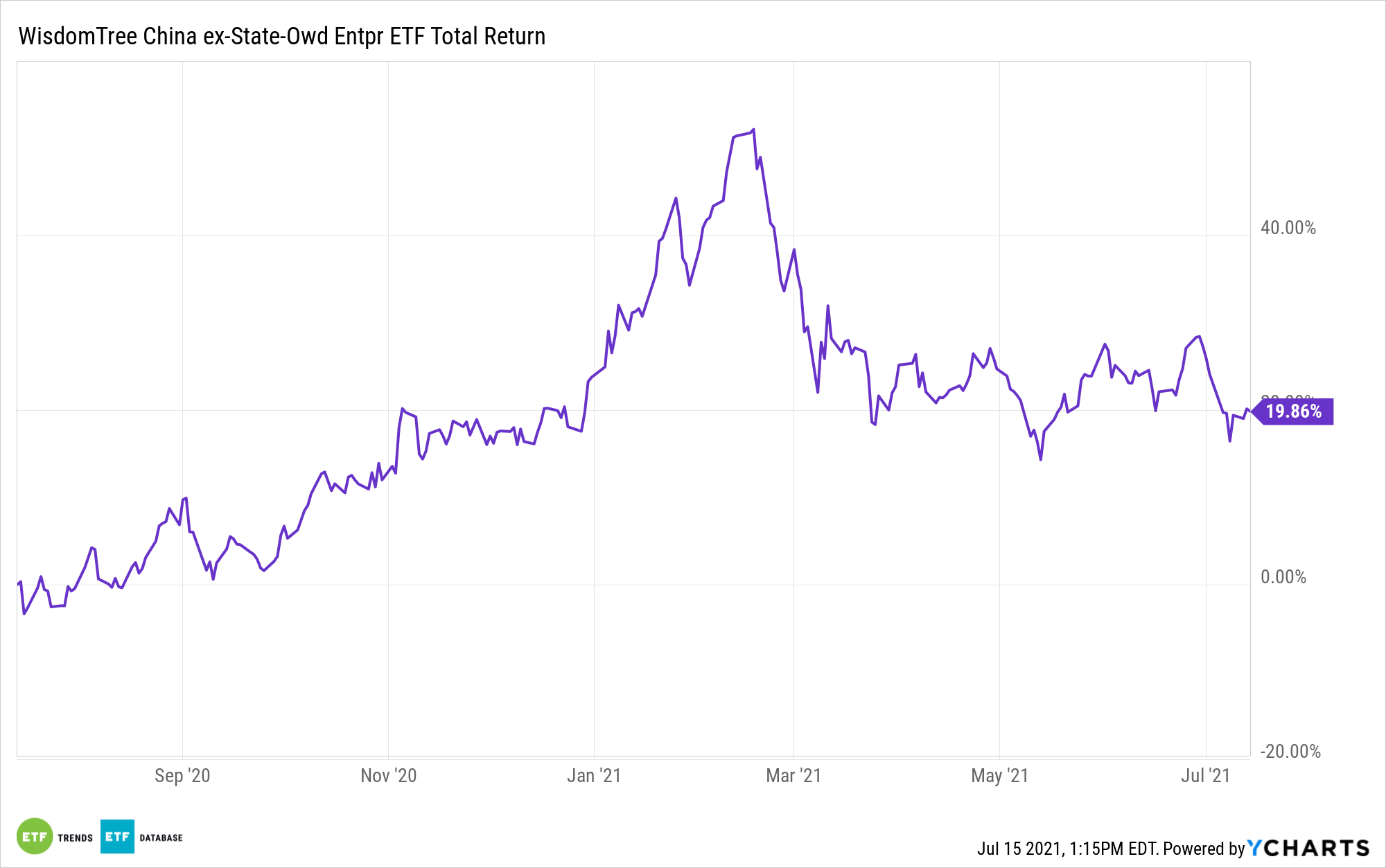

That may not seem like an inviting time at which to consider the WisdomTree China ex-State-Owned Enterprises Fund (CXSE), but the WisdomTree exchange traded fund is slightly outpacing the MSCI China Index over the past month. However, CXSE’s technology- and consumer-oriented emphasis could be a source of allure (and even leadership) when Chinese stocks rebound.

In fact, many of the same catalysts driving domestic tech and internet stocks are relevant to the CXSE roster.

“As with tech-enabled companies in the U.S.—names like Amazon, Netflix and DoorDash—the pandemic accelerated the positive network effects and scalability for many of these businesses when their products/platforms became nearly essential utilities during lockdowns,” says Jeremy Schwartz, WisdomTree global head of research.

CXSE’s Calling Card

The $1.1 billion CXSE, which turns nine years old in September, is one of the premier avenues for accessing the Chinese consumer, as highlighted by the fund’s 53% combined weight to consumer discretionary and communication services stocks.

Past performance isn’t a guarantee of future returns, but CXSE’s track record is confirmation that it’s often the right way of accessing Chinese stocks. Over the past three years, the WisdomTree ETF is higher by 63.8%, as compared to 28.4% for the MSCI China Index. CXSE was only slightly more volatile on an annualized basis than that benchmark. In the present moment, there’s also evidence investors are buying the CXSE dip.

“As we get to mid-year readjustments, some investors are repositioning portfolios away from just the cyclical value rotation toward tech and growth—and we can see CXSE benefiting from that return to growth allocations,” according to Schwartz. “We recently saw a large institutional investor swap $100 million from a broad MSCI China tracking product to CXSE for their China exposure—and we think it is useful to review the arguments for why the non-SOE approach for China is compelling.”

Another reason to consider CXSE today is that the reflation trade, which propped up energy and materials stocks, among other sectors CXSE is light on, appears to be waning. That could be supportive of growth stocks, of which CXSE holds plenty, going forward.

“As the narrative shifts from a ‘reopening trade’ to how to build portfolio allocations toward long-term winners, more investors may want to consider the opportunity set of non-state-owned Chinese companies—a universe that includes many tech and consumer businesses that only seemed to bolster their economic moats over the past year,” concludes Schwartz.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.