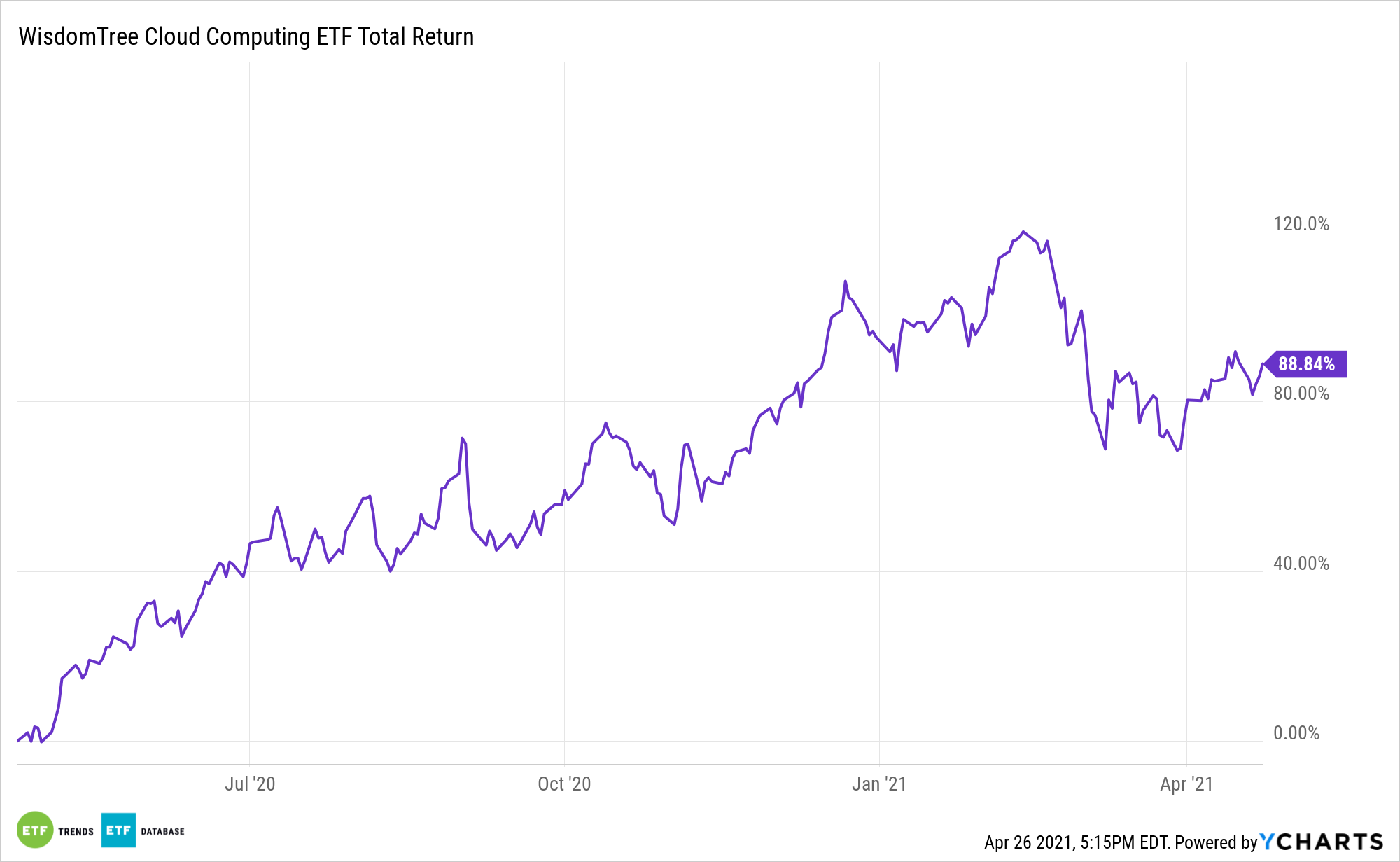

The COVID-19 pandemic transformed cloud computing from a useful tech niche into an essential one, and cloud computing ETFs have reaped the benefits. The WisdomTree Cloud Computing Fund (WCLD) is up 89% over the past 12 months, outperforming all other cloud computing ETFs and easily beating the Dow Jones Industrial Average, which gained just 7.2% over the same period.

“The cloud pre-pandemic was like a Tesla — it was new and hot,” Longbow CEO Jake Dollarhide said in an interview with CNBC. “Coming out of the pandemic, it’s like the Model T. It’s become so ubiquitous.”

Cloud software is installed via online networks and does not require physical infrastructure to function. This made it all the easier for companies to implement as they pivoted to remote work protocols.

As the world begins to reopen and working from home becomes less necessary, there are questions about whether cloud computing will continue to thrive, however. With the end of COVID restrictions in sight, WCLD has dropped 3.2% year-to-date.

Last week was particularly tough for tech stocks, as profit booking and overvaluations hurt the sector.

Long-Term Optimism for the Cloud

Despite the recent bumps, cloud computing has numerous prospects for long-term growth. Once implemented, cloud software becomes embedded in a company’s workflow, giving it higher retention and longer revenue periods. Even if some offices start reopening, remote work will remain a reality for many going forward.

There are also complications and threats to reopening. COVID cases continue to rise, and when the Johnson & Johnson vaccine got pulled due to a rare but severe blood clot issue, investors who had rotated into stocks that benefitting from a return to work began reconsidering the utility of a sector like cloud computing.

Even though there is some apprehension over tech stock valuations, there is ample reason to anticipate that cloud computing will do well in the long run.

Wedbush tech Analyst Dave Ives said in an interview with Yahoo! Finance: “Today we estimate 35% of workloads are on the cloud with a doubling of workloads on the cloud expected by 2023 across the enterprise landscape on an eye-popping trajectory. While valuations will continue to be an emotional bull/bear debate, the fundamental growth on the horizon for these next generation technologies is unprecedented as this 4th Industrial Revolution begins to take hold.”

For more news, information, and strategy, visit the Model Portfolio Channel.