The Federal Reserve has made it clear it will hold interest rates at historic lows for some time, turning attention to fiscal policy and its affect on the bond market.

Expectations are in place for rampant government spending with the Democrats controlling the White House and both chambers of Congress.

Advisors can prepare for that scenario with the WisdomTree Fixed Income Model Portfolio.

“This model portfolio is focused on a diversified stream of income. It seeks to benefit from secular trends we see evolving in the fixed income markets in a risk-conscious manner. The model portfolio focuses on select opportunities in core sectors, while strategically allocating among sectors and extending the model portfolio’s reach globally,” according to WisdomTree.

The WisdomTree Fixed Income Model Portfolio features eight ETFs with varying credit qualities and durations.

A Model Idea for this Fixed Income Environment

“As I mentioned before, monetary policy is seemingly on autopilot. What exactly do I mean by that? Well, given the Fed’s new policy framework of average inflation targeting, a.k.a. ‘letting things run hot,’ any potential rate hikes are apparently off the table this year (let’s worry about 2022 a little later on, right?),” writes Kevin Flanagan, WisdomTree head of fixed income strategy. “As a result, the only game in town right now for policymakers is continuing to add to the balance sheet through purchases of Treasuries and mortgage-backed securities (MBS), better known as quantitative easing, or QE.”

The model portfolio’s bond exposure isn’t overly reliant on long-term Treasuries. It features short duration exposure, as well as allocations to investment-grade and junk corporates.

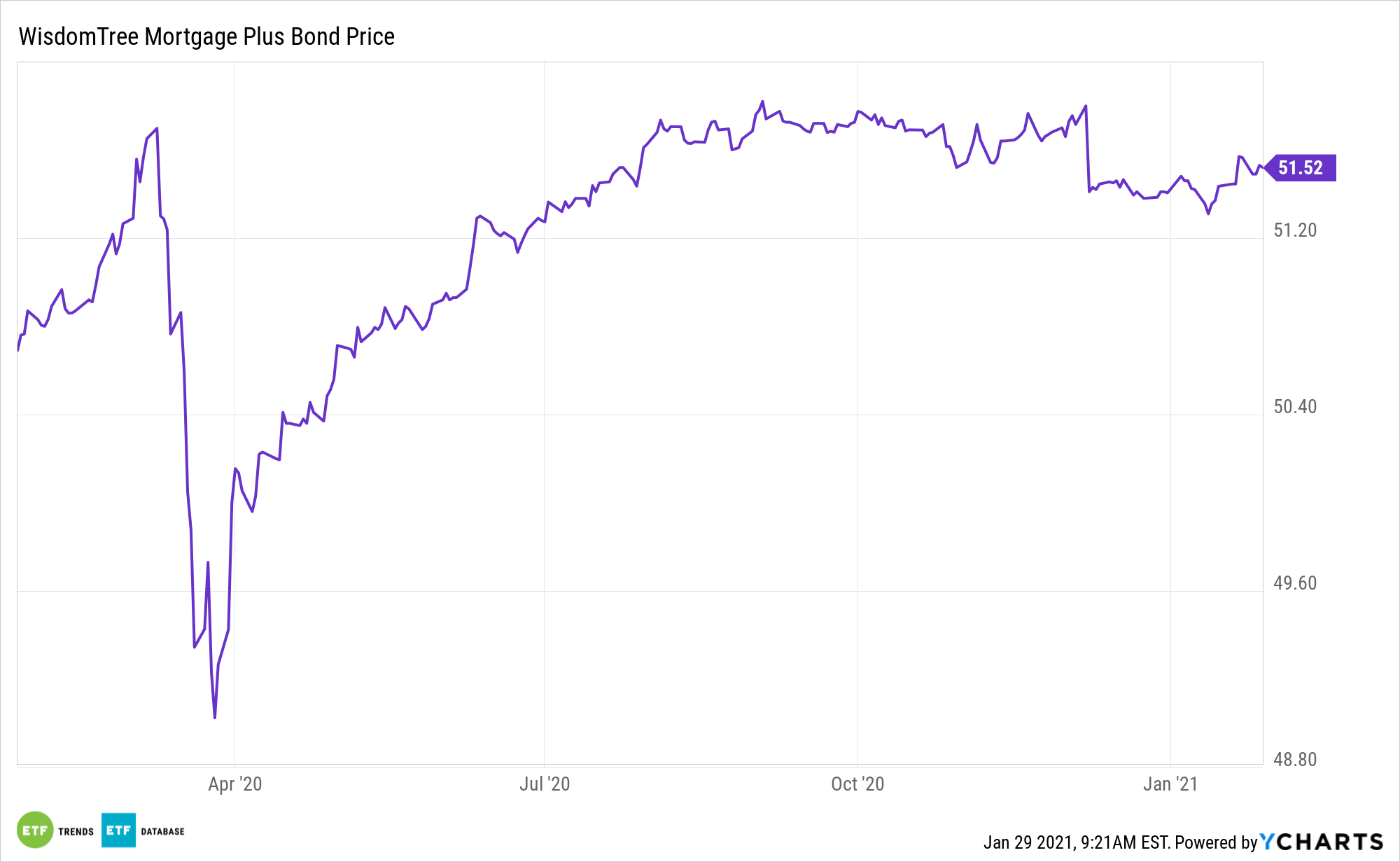

One of the fixed income holdings is the WisdomTree Mortgage Plus Bond Fund (NYSEArca: MTGP), which offers strong credit quality and higher yields than Treasuries.

MTGP is an actively managed ETF primarily investing in agency residential and commercial mortgage-backed securities. It has the flexibility to diversify into other sectors of the securitized debt market however. The fund is sub-advised by Voya Investment Management Co., LLC (Voya IM), a well-respected investment manager in securitized debt that manages over $31 billion.

“It is fiscal policy that has taken, and will more likely keep, center stage. President Biden has already laid the groundwork with an additional $1.9 trillion proposal that comes on top of December’s $900 million stimulus package,” notes Flanagan.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.