By Kevin Flanagan

Head of Fixed Income Strategy

It’s been roughly two months now operating in a post-Silicon Valley Bank (SVB) world, and the markets are still feeling its impact. While the stock and bond markets continue to wrestle with the fallout from both an economic and regional banking concern perspective, there is a very important arena where developments have seemingly flown under the radar of late (which is a good thing): the funding markets.

When banking-related issues “hit the tape,” one of the first locations investors should turn to see if there are any negative effects is the funding markets. Indeed, throughout modern financial history, it is this arena where dislocations can “snowball” and turn a potentially isolated occurrence into a systemic event. Certainly, the 2007–2008 great financial crisis underscored that point, but we’ve also witnessed other episodes where pressures were evident, such as the COVID-19 lockdown.

The Federal Reserve (Fed) is well aware of these scenarios as well. In fact, the Fed acted rather swiftly this time around and implemented the Bank Term Funding Program (BTFP) in response to the first wave of adverse news that came out from Silicon Valley Bank (SVB) and Signature Bank in early March. BTFP was created specifically to offer “funding available to eligible depository institutions.” What can be considered one of the key aspects of this program is that the pledged collateral, such as Treasuries, “will be valued at par,” not only making funding available if needed but also “eliminating an institution’s need to quickly sell those securities in times of stress,” which was one of the major catalysts behind the regional banking turmoil in the U.S.

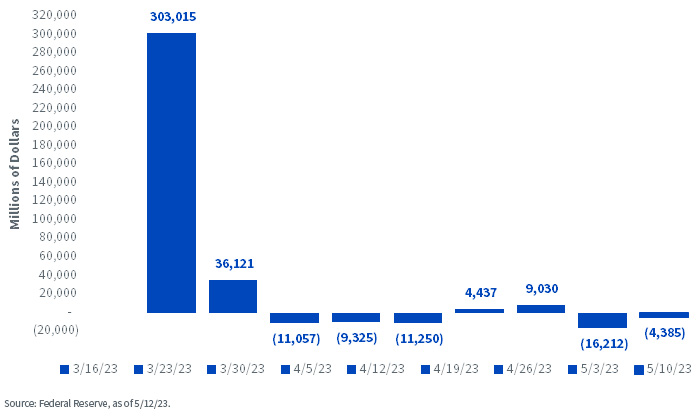

Fed Balance Sheet: The Total Change in Lending Facilities

When looking at the Fed’s key available lending facilities, there are three components to examine: primary credit at the discount window, BTFP and other credit extensions (FDIC-related loans). As you can see, banks utilized these facilities in a visible way in the immediate wake of the turmoil, but since mid-March, total usage has dropped off considerably. To provide some perspective, after hitting a peak increase of $303.0 billion on March 16, the total amount has declined in five out of the last seven weeks, falling by $4.4 billion as of May 10. The bottom-line message is that the Fed’s facilities acted as they were intended and arguably prevented any further calamity up to this point.

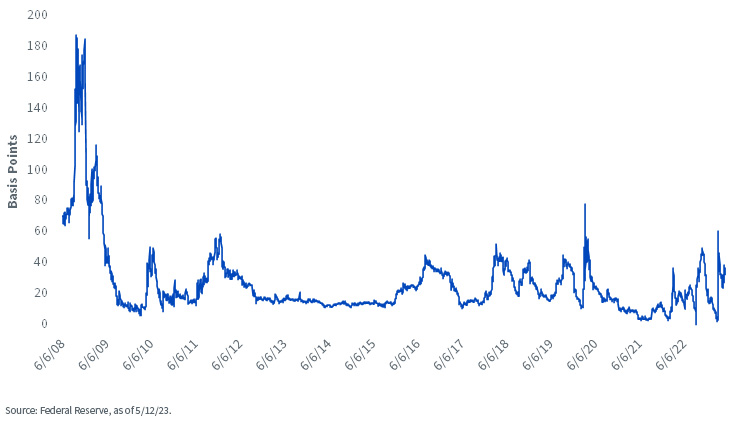

U.S. Interest Rate Swaps

This point has been buttressed by what has also transpired in the aforementioned funding market. The U.S. interest rate swap market (an agreement between counterparties to exchange fixed versus floating cash flows) provides a clear look at developments in this arena. For the record, the wider the spread, as measured in basis points (bps), theoretically, the more pressure, or dislocations, there is for institutions to find funding. As you can see, there was a spike in funding pressures around mid-March, but conditions have steadily improved since then. While the spread has not returned to its pre-SVB reading, it has remained relatively stable (+35 bps) and is well within recent trading ranges and considerably below the high watermarks of the financial crisis (+188 bps) and COVID-19 lockdown (+78 bps).

Conclusion

With regional bank concerns still making headlines, it remains a prudent idea to continue monitoring developments. However, if the funding markets continue to operate as outlined here, the markets, and perhaps more importantly, the Fed, can focus more on the potential economic ramifications that may lie ahead. More on this in a later blog post…

Originally published by WisdomTree on May 17, 2023.

For more news, information, and analysis, visit the Modern Alpha Channel.

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Brian Manby, and Scott Welch are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.