WisdomTree has long established itself as an innovator and experienced ETF issuer, having launched one of the only non-market-cap-weighted ETF options on the market in June, 2006. The fund was dividend-weighted, an innovation at the time, and since then, WisdomTree has continued to expand and establish itself as a contender within dividends, emerging market strategies, currency hedging, and value investing, one of the top trends in 2022.

Value investing has suffered in the equity bull run of the last decade when growth-oriented strategies dominated, but the trend has reversed course sharply in 2022 amidst an environment of rising interest rates, soaring inflation, global economic uncertainty, and more.

Looking back all the way to 1975, the pendulum swings largely in one direction or the other — growth to value and back again — for years at a time, explained Christopher Gannatti, CFA, global head of research at WisdomTree, in a recent blog. While past performance is never an indicator of future results, being aware of the historic macrotrends can help advisors make better informed decisions in the present.

Image source: WisdomTree blog

“We have a generation of people who say their high-risk investments tend to trend basically in one direction, as the cost of capital was basically zero or if not zero, then insignificant, from roughly 2009 to 2021,” explained Gannatti.

WisdomTree had approximately $50 billion in AUM within the U.S. as of the end of August, with 44.8% of AUM falling under the umbrella of an equity value strategy according to Morningstar classifications. Of those value-oriented assets, 26.6% are in five-star Morningstar-rated funds and 23.4% are in four-star Morningstar-rated funds.

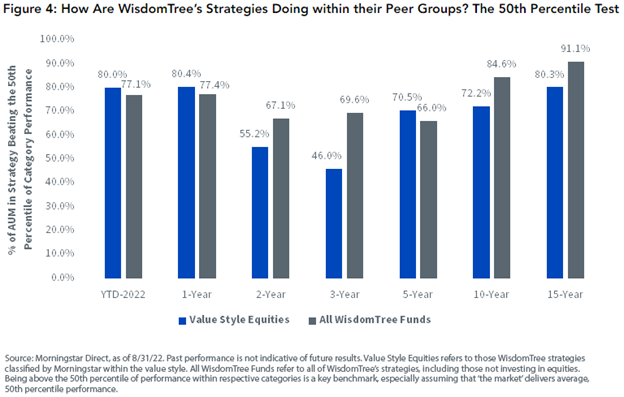

Gannatti broke it down further into how many WisdomTree funds were performing in the top 50th percentile within their categories, with an emphasis on the value funds, over a myriad of timelines.

Image source: WisdomTree blog

“WisdomTree’s track record in managing assets back to 2006 has led to seeing many different types of market environments. The meaning of monetary policy itself and what it entails, for example, has completely changed over this period,” wrote Gannatti. “WisdomTree Funds categorized by Morningstar within the value style have been resilient during the tougher periods, when growth has been in favor, and we have seen a real acceleration in their performance during the current value rotation in 2022.”

Investing in Value-Focused ETFs

WisdomTree has a wide variety of value-oriented ETFs, including the popular WisdomTree U.S. High Dividend Fund (DHS), which invests in high dividend-yielding U.S. equity companies for investors looking for higher-yielding opportunities.

For an international spin on value, the WisdomTree Emerging Markets High Dividend Fund (DEM) invests across all market caps in high dividend-yielding companies within emerging markets, the WisdomTree International High Dividend Fund (DTH) invests in high dividend-yielding companies in the developed world ex-U.S. and Canada, and the WisdomTree Global High Dividend Fund (DEW) invests broadly across developed (including the U.S.) and emerging markets in high dividend-yielding companies.

All four funds are strong value strategies and have offered earnings yields above 9% year-to-date as of 13 September 2022.

For more news, information, and strategy, visit the Modern Alpha Channel.