Currency hedging hasn’t been a high priority for years for many investors that have international allocations, but as market volatility becomes more the norm and the U.S. undergoes a cycle of Fed tightening to fight inflation, suddenly, the conversion rates and currency fluctuations matter a lot more for international equity investments.

U.S. markets up until last year had been in a long-established bull run, with historically low interest rates, and it’s something that was mirrored in many countries around the world, with low interest rate policies largely the norm. With the onset of the COVID-19 pandemic, global supply chain issues, and now the war in Ukraine heavily impacting the global economy, countries have addressed the economic difficulties in a range of ways that has coalesced into fiscal tightening occurring in some countries and relaxing in others.

This is the kind of environment that currency hedging was designed for, in which fluctuating valuations of currencies can eat into returns for investors allocating internationally if there is no protection in place.

So what exactly is currency hedging? In essence, it’s like insurance for international investments; a fund that utilizes currency hedging will include a portion specifically targeted to neutralize changes in the value of the currency’s exchange rate, thus allowing investors to capture the total return of their equity investment.

“We argue that a strategic case for hedging currency risk is easily described by just wanting local market returns and not wanting to bet on a currency direction. If you are benchmarking to a worldview that starts with international investments from a foreign stock + foreign currency stack, hedging currency risk adds a U.S. dollar return stream to help neutralize that embedded foreign currency exposure,” writes Jeremy Schwartz, CFA, global CIO for WisdomTree, in their blog.

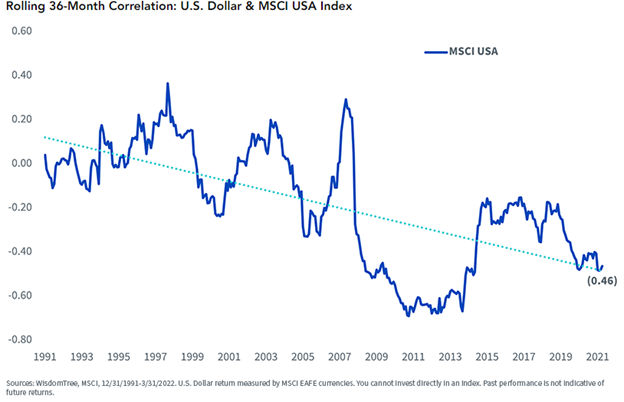

Why the dollar, you might ask? It turns out that the U.S. dollar actually has a negative correlation to the S&P 500, charted over a rolling 36-month time period from 1991-2021; the most recent calculation of that correlation is -0.46. By utilizing the U.S. dollar, it inherently provides better diversification for portfolios than gold (0.20), investment-grade bonds (0.12), and Treasuries (-0.32) in recent years, Schwartz explains.

Image source: WisdomTree Blog

In comparison, foreign currencies have become increasingly correlated to the S&P 500 over that same timeline, providing less diversification opportunities. Schwartz believes that currency hedged strategies will provide strong diversification potential for investors, given both the negative dollar correlation and the current Fed cycle.

The Currency Hedged Suite from WisdomTree

WisdomTree offers a variety of currency hedged options, from broader markets to targeted country exposures, and even drills down into small-cap opportunities within countries, some of the most direct investments possible into the value opportunities within another country’s economy.

For broader, currency hedged investment opportunities, there is the WisdomTree Europe Hedged Equity Fund (HEDJ), which gives exposure to dividend paying companies within the Eurozone, and the WisdomTree International Hedged Quality Dividend Growth Fund (IHDG) invests in dividend paying growth companies in developed countries ex-U.S. and Canada.

A popular choice for investors has been the WisdomTree Dynamic Currency Hedged International Equity Fund (DDWM), which invests in dividend paying companies from industrialized companies globally ex-U.S. and China, all while dynamically hedging for the currency ratio using a rules-based process that takes into account value, momentum, and interest rates.

Targeted country ETFs with currency hedges are the popular WisdomTree Japan Hedged Equity Fund (DXJ) and the WisdomTree Germany Hedged Equity Fund (DXGE), which both invest in dividend paying companies that have an exporter tilt.

For small-cap exposure, options include the WisdomTree Dynamic Currency Hedged International SmallCap Equity Fund (DDLS), the WisdomTree Europe Hedged SmallCap Equity Fund (EUSC), and the WisdomTree Japan Hedged SmallCap Equity Fund (DXJS).

For more news, information, and strategy, visit the Modern Alpha Channel.