By Alejandro Saltiel, CFA

Director, Research

Investors often look for ways to enhance income, lower a portfolio’s overall expected volatility or even help manage taxable gains.

This post covers all three goals.

Specifically, how a type of option strategy employed in the WisdomTree CBOE S&P 500 PutWrite Strategy Fund (PUTW) has the potential to enhance portfolios during volatile markets.

PUTW’s Strategy: CBOE S&P 500 PutWrite Index

PUTW seeks to track the price and yield performance, before fees and expenses, of the CBOE S&P 500 PutWrite Index (PUT Index). The PUT Index includes a strategy of writing at-the-money puts on a monthly basis.

You can think of a put option as an insurance contract. The writer plays the part of the insurer, who charges the owner a premium to ensure the price of their underlying asset if it falls below the strike price agreed upon in the contract.

The options sold by the PUT Index use the S&P 500 Index (S&P 500) as the underlying asset.

At-the-money means the strike price agreed to on these contracts is equal to the current price of the S&P 500.

For example, on March 18, 2022, the PUT Index strategy wrote a contract with an April 14, 2022, expiration date and 4,410 strike price. The S&P 500 Index traded around those levels at the time of this transaction.

Options written by the PUT Index settle on the expiration day. There are two potential outcomes, dependent on the price of the S&P 500:

- If the price of the S&P 500 at settlement is at or above the strike price, the PUT Index will keep the full premium it initially collected.

- If the price of the S&P 500 is below the strike price, the PUT Index is required to pay the difference between the strike price and the current level of the S&P 500. This difference can be more or less than the premium initially collected.

Given this payoff structure, the month-to-month upside of the PUT Index is capped by the percent premium it collects (premium collected/strike price), while the downside depends on the movement of the S&P 500, which can be mitigated by the premium initially collected. The PUT Index has a shock absorber equal to the percent premium it collected.

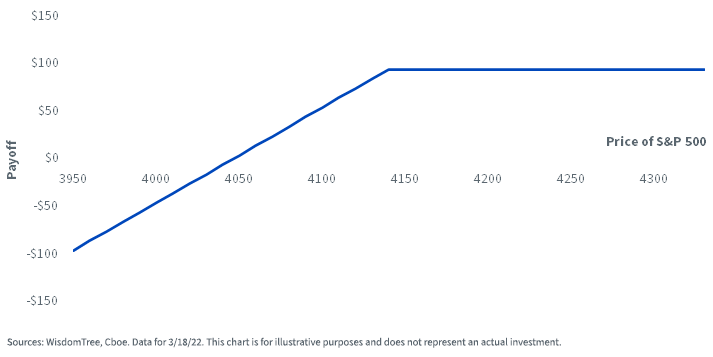

Going back to the March 18 example, this strategy wrote a put expiring one month later (April 14) with a strike price of 4,140 collecting at a premium of $95 per contract, equivalent to 2.16%. The below payoff diagram shows the potential outcomes at expiration. If the price of the S&P 500 finishes above 4,140, the PUT Index will keep the $95 it collected, realizing a return of 2.16% for the Index.

Payoff Diagram

If the price of the S&P 500 is below 4,140, the PUT Index will need to pay the difference between the strike price and the current price of the underlying asset.

If the price of the S&P 500 is below 4,140, the PUT Index will need to pay the difference between the strike price and the current price of the underlying asset.

For example, if the S&P 500 were to fall 2.42% to 4,040, the PUT Index would owe $100. It, therefore, would return the $95 it initially collected plus an additional $5, netting a loss of $5 or 0.28% (2.16%–2.42%) on the transaction. The premium collected would absorb the first −2.16% of the adverse market movement for the Index.

The Role of Market Volatility

The premium charged by the PUT Index is determined, among other things, by the probability of the event occurring (the probability of the S&P 500 dipping below the strike price) and the maturity of the contract.

Think of it like a traditional homeowner’s insurance policy. The premium charged to a homeowner living in a coastal region to ensure their home against flood damage would be higher than to one living in the mountains. And the one-time premium charged by the insurance company would be higher if the coverage is for two hurricane seasons compared to only one.

The PUT Index is a rules-based strategy, so most of the variables that determine the price of these put contracts—like time to maturity and strike price (as a % of the underlying asset)—remain constant month to month. The biggest driver in determining the contracts’ premium is the probability that the S&P 500 Index dips below the strike price. This probability is greater as volatility in markets increases. The most used market gauge to measure volatility is the Volatility Index (VIX).

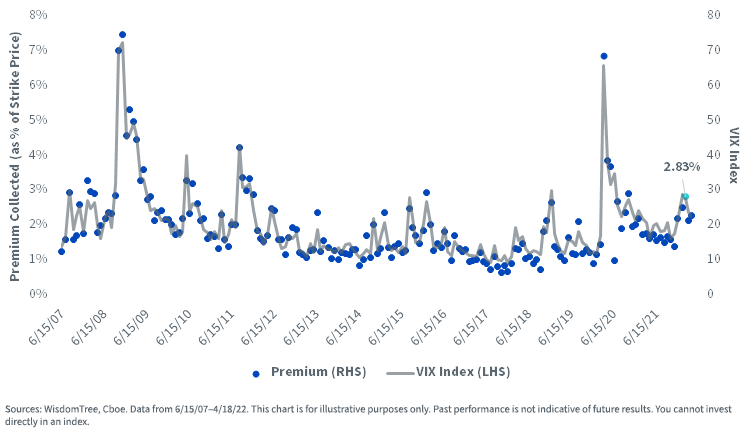

As we see below, the premium collected by the PUT Index (as a percent of the strike price) increases when market volatility increases.

Looking at the past 14-plus years of data, we can approximate the percentage monthly premium collected by the at-the-money put as close to the level of the VIX, divided by 10.

A put-writing strategy relies on the premium collected, which is typically measured as a percentage of the strike price.

A put-writing strategy relies on the premium collected, which is typically measured as a percentage of the strike price.

For example, the strategy wrote a put on the S&P 500 with a strike price of 4,460 on February 18, 2022, and collected a $123.50 premium—equivalent to 2.83%—as the VIX increased with recent volatility.

Put writing in periods of volatility

Both the upside capture (which is limited to the premium collected) and downside mitigation (a higher premium gives the writer a larger shock absorber in case the price of the underlying falls below the strike price) of a put-writing strategy depends on the percentage of premium collected when writing the options. The strategy underlying the PUT Index works best in periods of higher market volatility and range-bound markets.

As seen in the chart below, the relative performances of the S&P 500 and PUT Index are driven primarily by the total premium collected in each period, which in turns depends on the average level of the VIX.

Quarterly Returns

For the most recent PUTW performance click here.

For example, during the first quarter of 2022, the strategy behind the PUT Index collected premiums totaling 7.58% as volatility spiked. During this quarter those premiums mitigated market drawdowns and the PUT Index returned 1.72%, while the S&P 500 Index had a return of −4.60%. On the other hand, during the first quarter of 2019, the strategy behind the PUT Index collected premiums totaling 5.27% as markets rallied and volatility subsided. In this period, the PUT Index had a return of 5.48% while the S&P 500 returned 13.65%.

Given the rocky start of the year, and the different drivers behind equity markets, we expect volatility to continue being an important driver in 2022. So far, the PUT Index is outperforming the S&P 500 Index by more than 10% year-to-date.

Investing in a strategy like PUTW, that harnesses this volatility in its favor, could complement your portfolio.

Originally published by WisdomTree on May 6, 2022.

For more news, information, and strategy, visit the Modern Alpha Channel.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. The Fund will invest in derivatives, including S&P 500 Index put options (“SPX Puts”). Derivative investments can be volatile, and these investments may be less liquid than securities, and more sensitive to the effects of varied economic conditions. The value of the SPX Puts in which the Fund invests is partly based on the volatility used by market participants to price such options (i.e., implied volatility). The options values are partly based on the volatility used by dealers to price such options, so increases in the implied volatility of such options will cause the value of such options to increase, which will result in a corresponding increase in the liabilities of the Fund and a decrease in the Fund’s net asset value (NAV). Options may be subject to volatile swings in price influenced by changes in the value of the underlying instrument. The potential return to the Fund is limited to the amount of option premiums it receives; however, the Fund can potentially lose up to the entire strike price of each option it sells. Due to the investment strategy of the Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.