Given the market performance of equities and bonds during in the coronavirus environment, investors might want to rethink the 60-40 strategy.

A common approach to reducing this downside risk is to replace part of the stock and bond exposure with an uncorrelated, or negatively correlated, alternative asset, resulting in something like a 50-30-20 or 40-40-20 portfolio. The issue here is the opportunity cost of replacing a familiar asset class like stocks and bonds with a non-traditional asset class – especially when it underperforms relative stocks and/or bonds.

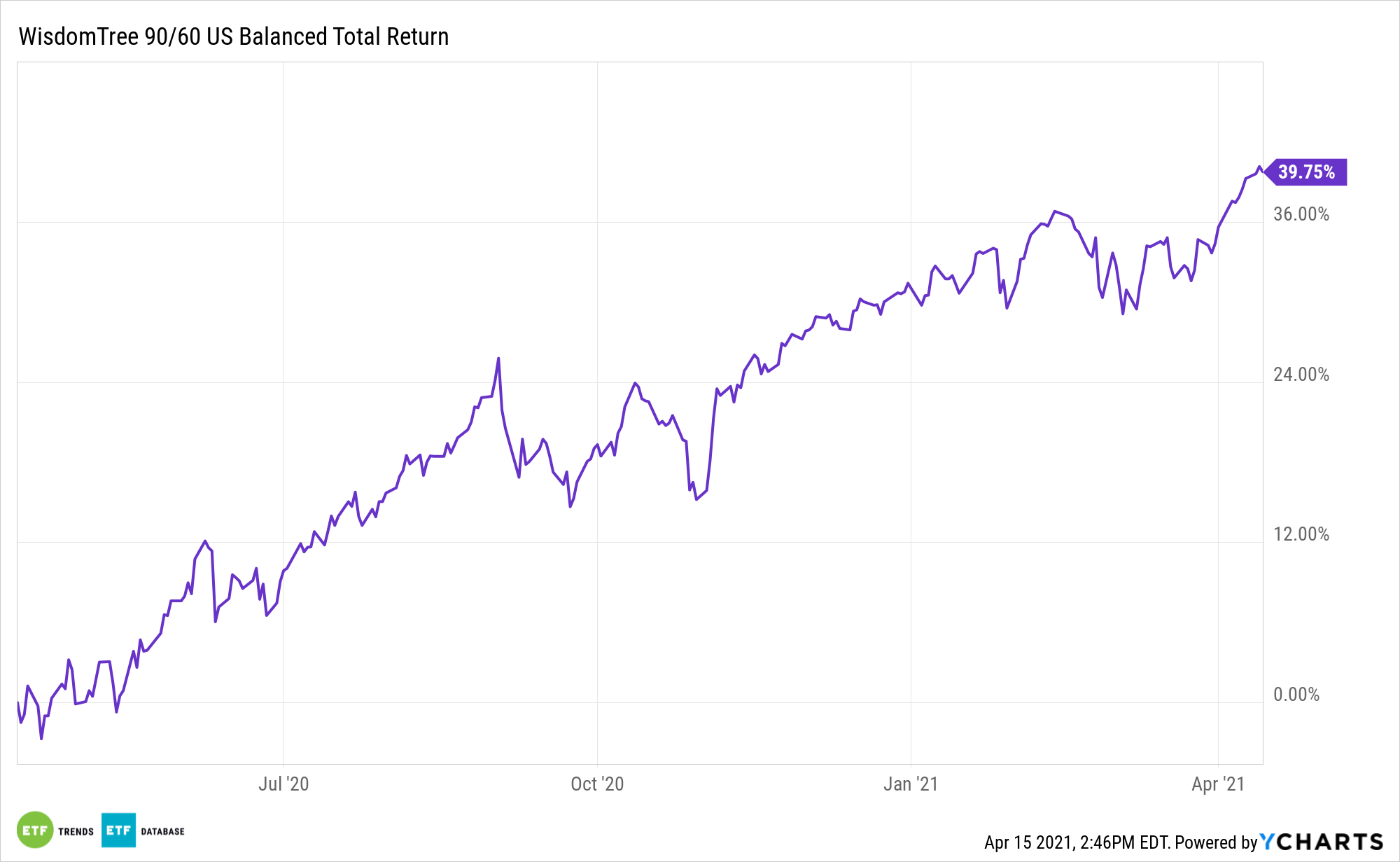

Advisors can deploy an evolved approach to 60/40 and multi-asset investing with the WisdomTree 90/60 U.S. Balanced Fund (NTSX).

“WisdomTree’s approach applies 1.5x accounting leverage to a traditional 60/40 portfolio to create exposure equal to 90% equities, 60% bonds,” a WisdomTree investment case noted. “This exposure is created by investing 90% of Fund assets in equities and 10% in short-term fixed income. The 60% bond exposure is achieved by overlaying Treasury futures contracts to achieve the net 90/60 target. Through this higher-efficiency portfolio, investors can devote a smaller percentage of their assets (66.6%) to core holdings while still achieving their desired exposure.”

NTSX: Rethinking Multi-Asset Standards

Multi-asset strategies are currently in the spotlight due to depressed bond and cash yields. Yet these ideas aren’t carbon copies of each other, making allocating in this space a tricky endeavor.

NTSX is relevant at a time when safer investments aren’t expected to generate much in the way of yield or capital appreciation.

Low yields are certainly making a formidable roadblock when it comes to fixed income investing, but there are still some multi-asset, income-generating strategies out there.

There are also tax benefits to be derived from the NTSX strategy.

“In thinking of other ways to improve on 60/40, we believe 90/60 could also boost returns via greater tax efficiency,” according to WisdomTree. “This is primarily driven by gaining exposure to fixed income via futures contracts as opposed to cash bonds. In instances where fixed income total returns are primarily driven by interest income and held in taxable accounts, any income distributions are subject to withholding tax rates of up to 39.6%. By comparison, capital gains on Treasury futures contracts are taxed at 60% long-term, 40% short-term capital gains rates. We believe this tax advantage could be particularly important during periods of rising rates.”

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.