By Matt Wagner, CFA

Associate Director, Research

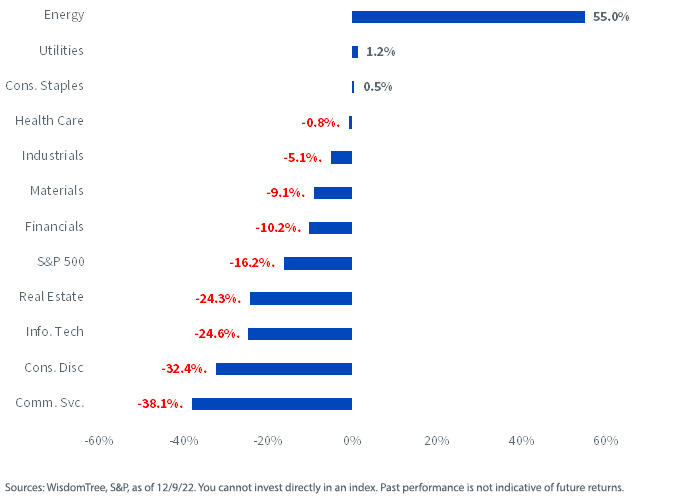

The Energy sector has been just about the only bright spot for U.S. equities in 2022.

The sector has been one of just three with positive returns, and the only one with returns greater than 2%.

Unlike nearly every other sector, Energy companies have had a tailwind from this year’s surge in inflation as outperformance has been directly tied to the jump in oil prices over the last 18 months.

Year-to-Date S&P 500 Sector Returns

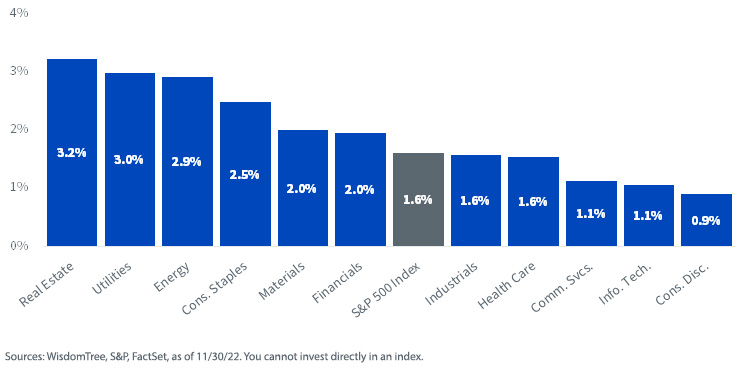

Another major factor in explaining performance across sectors has been dividend yields. Each sector, other than Real Estate, with a dividend yield greater than the S&P 500 has outperformed.

The sectors with the lowest yields—Communication Services, Information Technology and Consumer Discretionary—have had the worst returns.

S&P 500 Sector Dividend Yields

Index Attribution

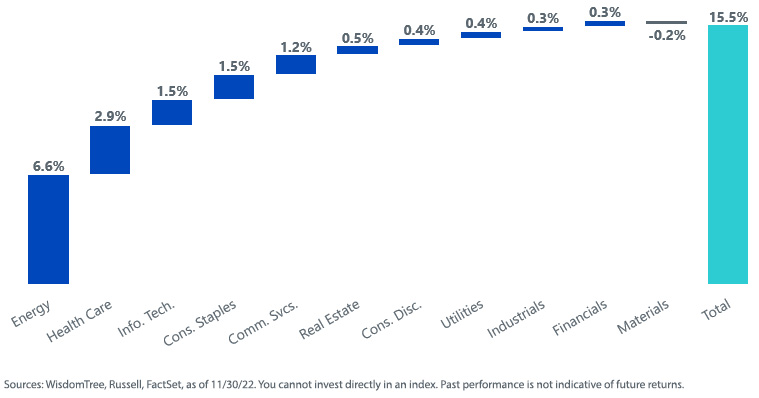

The WisdomTree U.S. High Dividend Index has outperformed the Russell 1000 Value Index by over 15% year to date through November 30, 2022.

Much of the outperformance can be explained by an over-weight allocation to Energy. Of that outperformance, 6.6%—a little less than half the 15.5% total outperformance—is attributed to the Energy sector.

The remainder of the Index’s outperformance has come from over-weight allocations to high dividend sectors/stocks that have outperformed and avoiding the lower-yielding sectors/stocks that have lagged.

The Index’s outperformance has been spread broadly across sectors with positive attribution coming from 10 of 11 sectors (only the Materials sector detracted, by 0.2%).

Year-to-Date Attribution WisdomTree U.S. High Dividend Index versus Russell 1000 Value Index

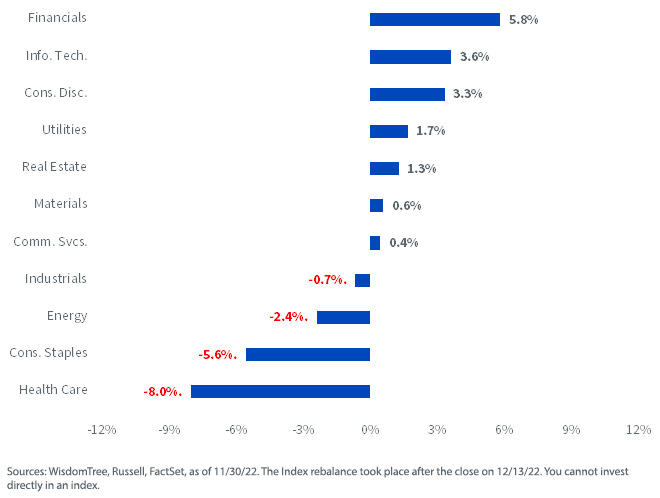

Annual Rebalance

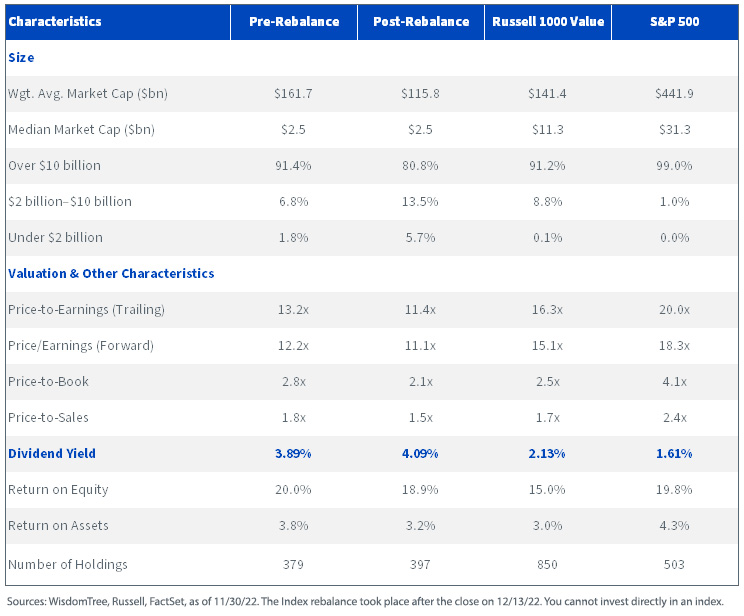

At the market close on December 13, the WisdomTree U.S. High Dividend Index executed its annual rebalance.

Each December, the Index selects companies in the top 30% of the U.S. equity market by yield. Constituents’ weights are set by a modified Dividend Stream® weighting in which companies with greater cash dividends receive larger weights.

After the rebalance, the dividend yield of the Index increased by 20 basis points, pushing the yield above 4%. The Index’s 4.09% yield is well above the 2.13% yield of the Russell 1000 Value Index.

In addition to the high dividend yield, the Index also has significantly lower valuation multiples, while also having higher return on equity and return on assets than the Russell 1000 Value Index.

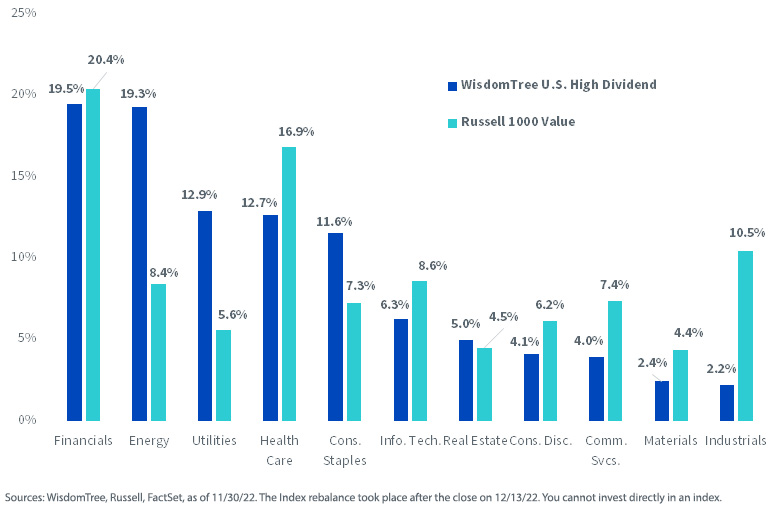

From a sector perspective, the Index had notable additions to Financials (+6%), Information Technology (+4%) and Consumer Discretionary (+3%), while trimming from Health Care (-8%) and Consumer Staples (-6%).

Rebalance Sector Weight Changes

Relative to the Russell 1000 Value, the WisdomTree U.S. High Dividend Index has notable over-weight allocations to Energy (+10%), Utilities (+7%) and Consumer Staples (+4%). Its most notable under-weight allocation is to Industrials (-8%).

The Real Estate sector is capped at 5%, which puts that sector’s weight roughly in line with the Russell 1000 Value Index.

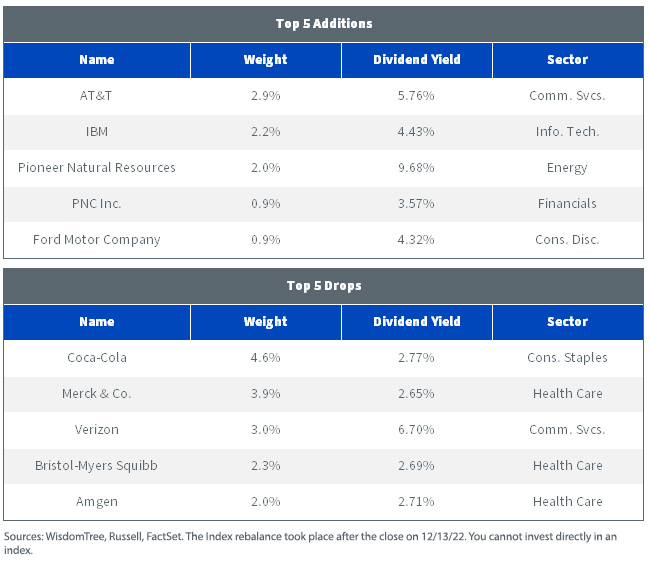

The strong performance of dividend paying Consumer Staples and Health Care companies reduced the dividend yield of some large companies below 3%, removing them from the highest dividend yield segment of U.S. equities.

Verizon, which had a high dividend yield of 6.7%, was dropped from the Index based on its composite risk screen (CRS).

AT&T and IBM—each consistently high-yield companies—were screened out on the CRS in 2021 and became eligible at this year’s rebalance.

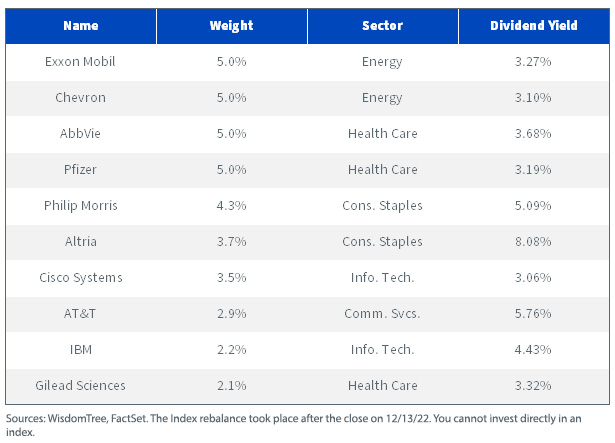

The single holding cap for this Index is 5%, which is why four holdings have 5.0% weights.

Each Top 10 holding has a dividend yield above 3%, with Altria having the highest yield at 8.08%.

Originally published by WisdomTree on 22 December 2022.

For more news, information, and analysis, visit the Modern Alpha Channel.