By Jack Forehand

Bubble has become one of the most overused words in finance. If you read the financial media, you would likely conclude that we are currently surrounded by bubbles. Not only are stocks currently in bubble territory, but bonds are also a classic bubble. And don’t even get them started about cryptocurrencies. Even with their decline, they are still commonly referred to as the greatest bubble of all time.![]()

Either all of us should just take our money and put it in shoeboxes under the bed or the term bubble is being used a little liberally.

But what is a bubble? And how do you know when you are in one?

Those are questions that don’t have exact answers, but I think there are some general rules you can use to identify bubbles. And those rules lead to very different conclusions about whether there are currently bubbles all around us.

First, some caveats.

Bubbles are much easier to identify after the fact. That is because the euphoria surrounding them clouds people’s judgment. That is one of the common characteristics of a bubble. There were very few people who thought the late 90s tech bubble was a bubble until it popped. Then it seemed obvious to everyone that it was a bubble. Hindsight bias like that is something you see in every historical bubble.

Bubbles also tend to persist much longer than people think. That is why even if you could predict a bubble in advance, there isn’t too much you can do about it. For example, if I told you in 1997 that the stock market was in the midst of a bubble and you sold everything, it would have been a mistake. It would have been well into the ensuing bear market before you got back to break even.

Keeping those caveats in mind, there are some general rules that I think can help to identify whether a bubble is present.

Cliff Asness of AQR often talks about two criteria he looks for when determining whether a bubble exists for a particular asset class.

There is no defensible case to invest in the asset class going forward

What you are seeing is 50% greater than what has ever occurred before

And I would add a third

There is a euphoria surrounding the asset class that leads to a common belief that this time is different and historical rules don’t apply.

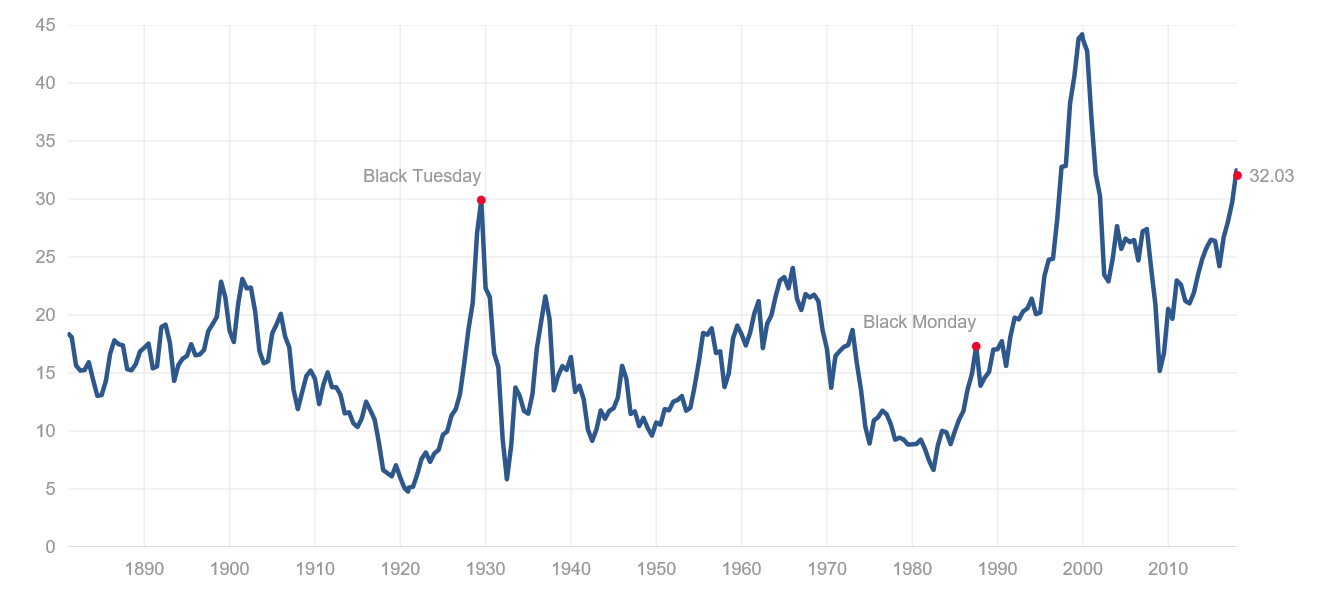

The late 90s technology bubble met all these criteria. Take a look at this historical chart of the Shiller PE.

The Shiller PE peaked at 45 in that bubble, which was 50% greater than what had ever occurred before. If you plug that type of valuation into any system that predicts returns over the next decade, you end up with negative projected future returns. And there was certainly no shortage of euphoria at the time, and a belief that the rules of the past no longer applied was prevalent.