“Market cap-weighting by nature of the way it works is subject to concentrations of risk,” added Dahya. “So if you think about the S&P 500, 150 stocks make up three-quarters of your exposure so you actually have a lot of exposure to a small part of the market. There is an opportunity to diversify that risk, which helps to lower volatility.”

Adaptable Fixed-Income Option

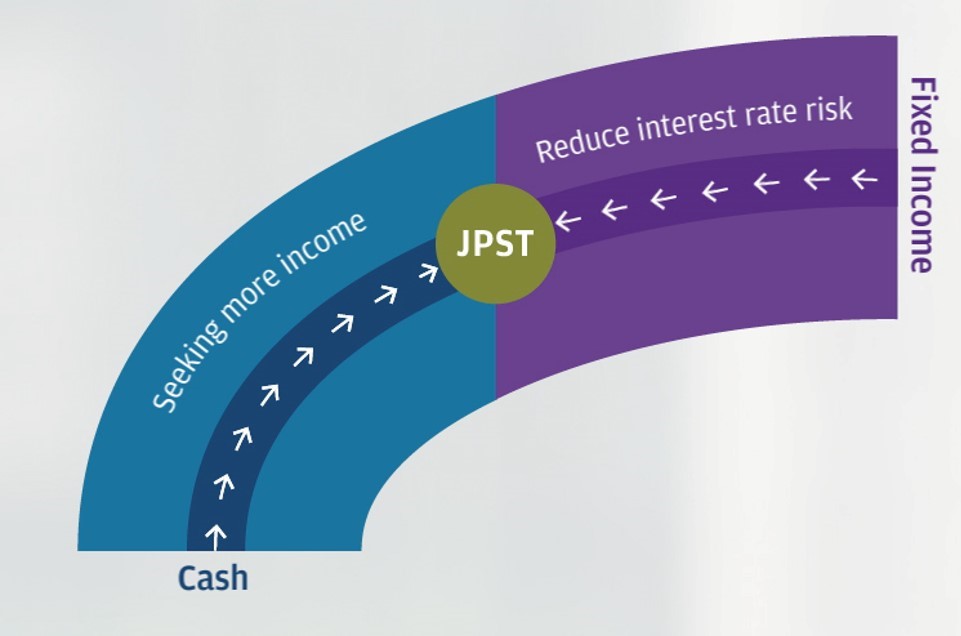

For the fixed-income investor, Dahya suggests looking at the JPMorgan Ultra-Short Income ETF (JPST), which can serve as a flexible tool during times when rates are decreasing or rising. The floating rate component of bonds in JPST’s debt portfolio would effectively hedge against interest rate risk and capitalize on any short-term rate adjustments the Fed decides to make through the rest of 2018 and beyond.

![]()

Related: In the Know – Stay up to date on ETF This Quarter

Furthermore, the fund seeks to maintain a duration of one year or less, thereby limiting prolonged exposure to the fluxes of the capital markets and reducing volatility. This is effective for investors who want to avert the risk associated with holding on to debt securities with long durations.

“We are seeing a lot of interest in our short-term fixed-income product and it’s coming from two dimensions,” said Dahya. “From on dimension, it’s clients who, because of low interest rate, are looking to come up the yield curve to add additional yield to their portfolio, but there’s also clients who are thinking about rising rates and their implications on their portfolio, are looking to come down the yield curve and lower their duration.”

Alternative Strategies

An area that Dahya sees as one that is rife for innovation is within alternatives strategies funds. By utilizing the same methodologies employed by hedge funds, alternative strategies funds can benefit, particularly in a down market.

“In that market context, I think there’s a lot of value for an alternative,” said Dahya. “The challenge has been for clients that historically, alternatives have been very expensive and in many cases, have not been accessible to a lot of clients.”