Investors underweight to active international exposure may potentially be missing out on attractive returns and enhanced diversification.

Uncertainty around interest rates, inflation, and the possibility of recession is expected to continue to challenge markets. This environment may negatively impact portfolios with a home country bias.

We believe the Harbor International Compounders ETF (OSEA) is a compelling solution for advisors looking to adjust or rebalance their clients’ allocations to international equities.

OSEA offers quality exposure to international companies. The actively managed fund focuses on companies with expected sustainable earnings growth to help drive compounded long-term wealth creation.

Security selection has recently played a more significant role in fund performance. This environment has led to quality active management demonstrating its ability to generate strong returns.

Active International Exposure Enhances Returns

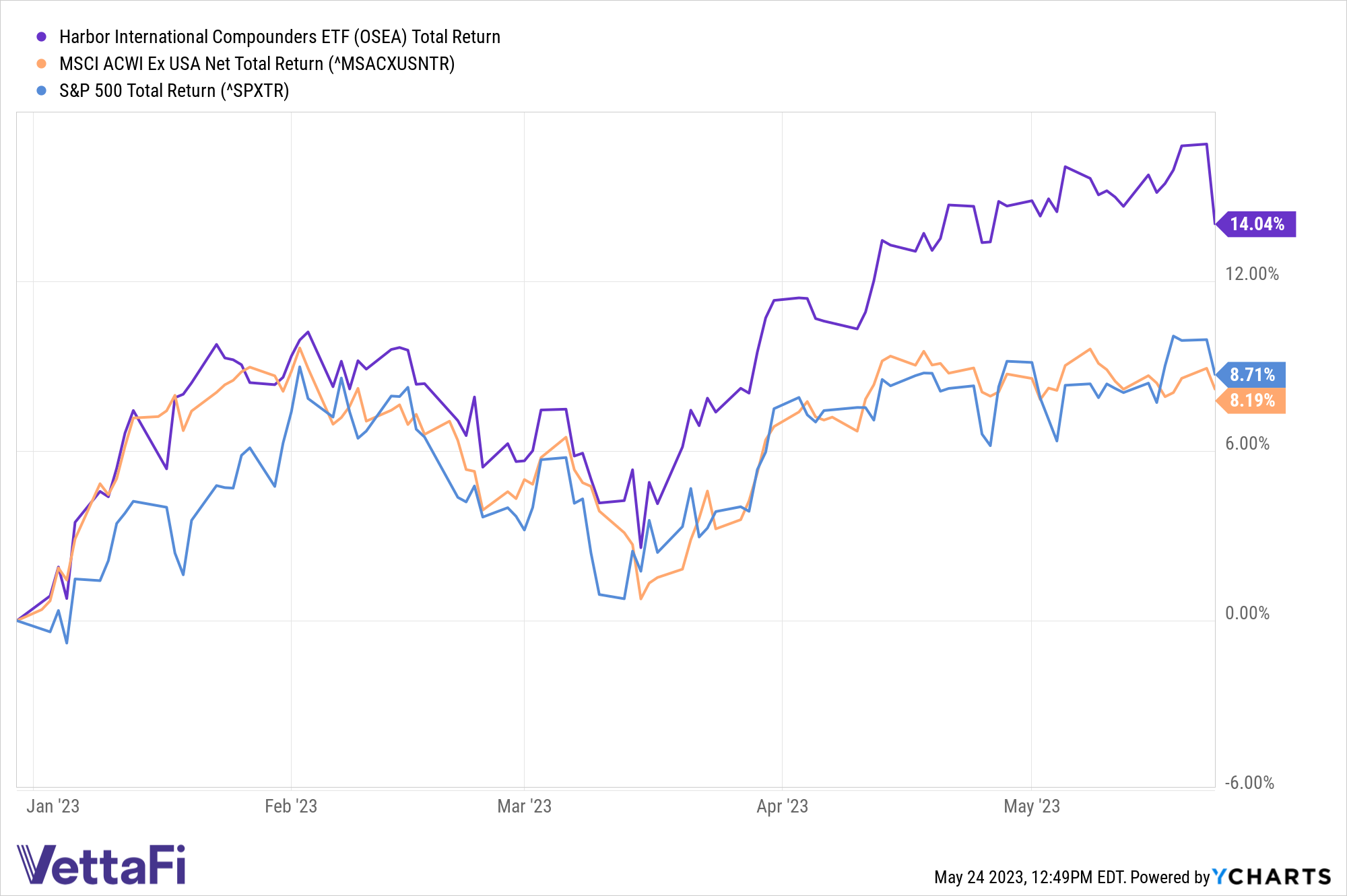

OSEA has returned 14% (NAV) year-to-date, while the benchmark index MSCI All Country World Ex. US Index has increased 8.2% (NAV), each on a total return basis, according to YCharts.1 The figures are looking at the total return level (using the closing price of the security that has been adjusted to include price appreciation, dividend, distribution, and expense ratio).

OSEA is also outpacing U.S. benchmarks, underscoring the importance for investors to challenge home country biases. The fund has outpaced the S&P 500 by 533 basis points year-to-date as of May 24, 2023, looking at the total return level (using the closing price of the security that has been adjusted to include price appreciation, dividend, distribution, and expense ratio).

C WorldWide Asset Management serves as a subadvisor to OSEA. OSEA’s investment team seeks to identify high-quality companies with consistent recurring revenues, stable free cash flows, and sustainable returns on invested capital. Furthermore, the investment team evaluates companies by assessing each company’s business model, management, and financial and valuation metrics.

A benefit of active management, OSEA is free from most benchmark and diversification constraints. The investment team can embrace a long-term mindset when sourcing new ideas and can be patient while their growth thesis plays out, according to Harbor Capital.

For more news, information, and analysis, visit the Market Insights Channel.

1as of May 24, 2023.

Important Information

Investors should carefully consider the investment objectives, risks, charges and expenses of a Harbor fund before investing. To obtain a summary prospectus or prospectus for this and other information, visit harborcapital.com or call 800-422-1050. Read it carefully before investing.

All investments involve risk including the possible loss of principal. Please refer to the Fund’s prospectus for additional risks associated with the Fund. For the Fund’s prospectus, holdings, and most current standardized performance, please click: OSEA

Performance data shown represents past performance and is no guarantee of future results. Past performance is net of management fees and expenses and reflects reinvested dividends and distributions. Past performance reflects the beneficial effect of any expense waivers or reimbursements, without which returns would have been lower. Investment returns and principal value will fluctuate and when redeemed may be worth more or less than their original cost. Returns for periods less than one year are not annualized. Current performance may be higher or lower and is available through the most recent month end at harborcapital.com or by calling 800-422-1050.

There is no guarantee that the investment objective of the Fund will be achieved. Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions. Investing in international and emerging markets poses special risks, including potentially greater price volatility due to social, political and economic factors, as well as currency exchange rate fluctuations. These risks are more severe for securities of issuers in emerging market regions. A non-diversified Fund may invest a greater percentage of its assets in securities of a single issuer, and/or invest in a relatively small number of issuers, it is more susceptible to risks associated with a single economic, political or regulatory occurrence than a more diversified portfolio.

Additional Information

The S&P 500 Index is an unmanaged index generally representative of the U.S. market for large capitalization equities. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

The MSCI All Country World Ex. US (ND) Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market performance in the global developed and emerging markets, excluding the U.S. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

Diversification in an individual portfolio does not assure a profit.

Home country bias refers to investors favoring companies from their own country over those from other countries or regions.

A basis point is one hundredth of 1 percentage point.

Free cash flow represents the cash a company can generate after accounting for capital expenditures needed to maintain or maximize its asset base.

C Worldwide is a third-party subadvisor to the Harbor International Compounders ETF

This article was prepared as Harbor Funds paid sponsorship with VettaFI.

Foreside Fund Services, LLC is the Distributor of the Harbor ETFs.

2922935