As growth continues to perform well in 2023, the Harbor Long-Term Growers ETF (WINN) is a distinct fund for investors to consider.

WINN is outpacing large-cap benchmarks year to date and utilizes an interesting investment strategy to generate compelling returns for investors. The fund is actively managed by subadvisor Jennison Associates and employs a proprietary combination of bottom-up, fundamental research, and systematic portfolio construction.

“In the uncertain economic environment, companies with a record of consistent growth are being sought out,” Todd Rosenbluth, head of research at VettaFi, said. “However, this fund provides the benefits of security selection rather than simply tracking an index to choose the ones that are attractively valued.”

The investment team behind WINN seeks to exploit market inefficiencies by investing in companies with under-appreciated multi-year structural growth opportunities, an opportunity exclusively available to active managers, according to Harbor Capital Advisors.

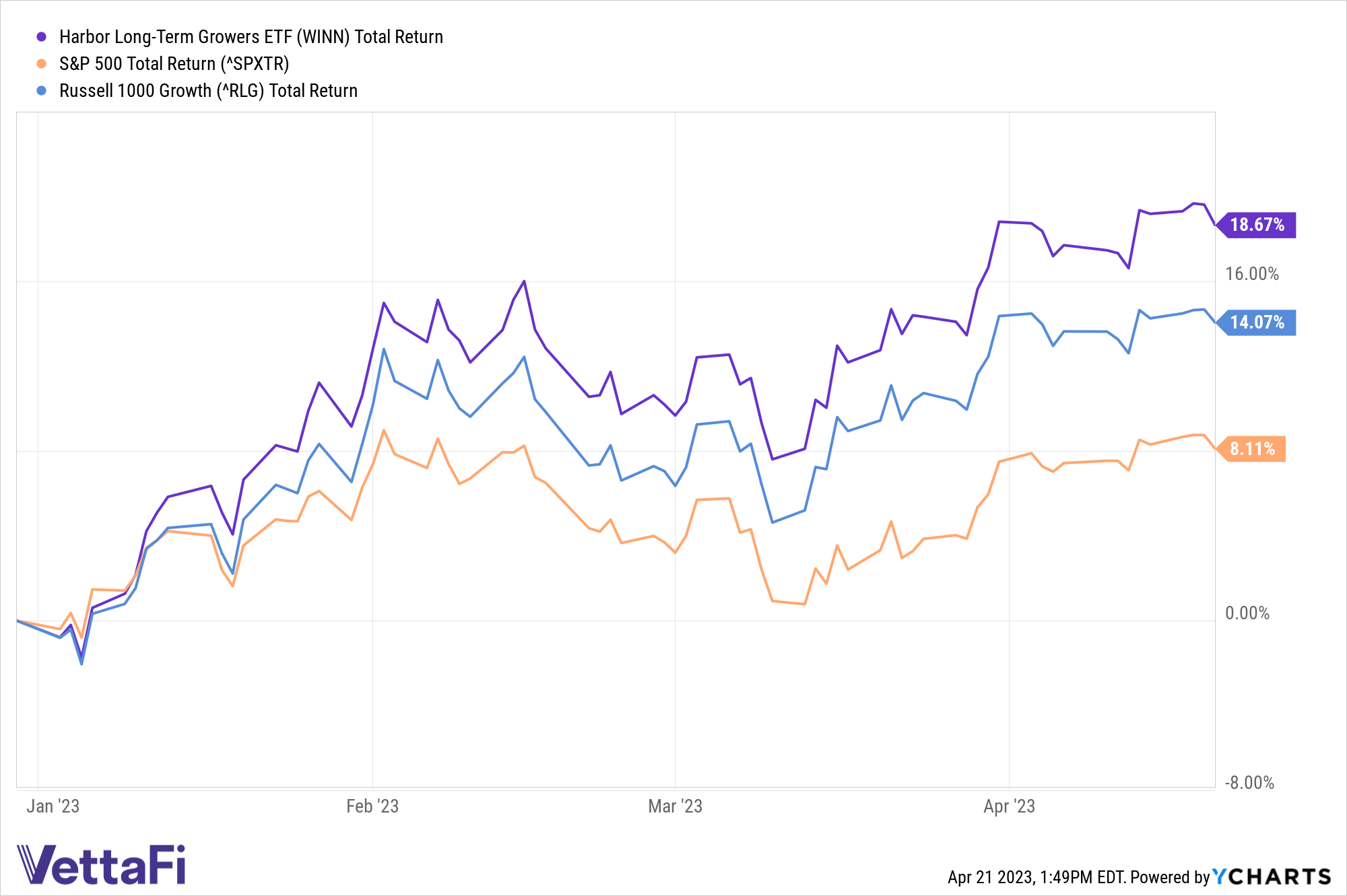

WINN is outpacing the S&P 500 Index by over 1000 basis points (NAV) and its benchmark, the Russell 1000 Growth Index, by over 400 basis points (NAV)year to date. WINN is up by just under 20% (NAV) year to date, while the S&P 500 Index has climbed over 8% (NAV)and the Russell 1000 Growth has gained over 14% (NAV) as of April 20.

Performance data shown represents past performance and is no guarantee of future results. Past performance is net of management fees and expenses and reflects reinvested dividends and distributions. Past performance reflects the beneficial effect of any expense waivers or reimbursements, without which returns would have been lower. Investment returns and principal value will fluctuate and when redeemed may be worth more or less than their original cost. Returns for periods less than one year are not annualized. Current performance may be higher or lower and is available through the most recent month end at harborcapital.com or by calling 800-422-1050.

Over a one-month period trailing April 20, WINN has increased by over 5% (NAV). Meanwhile, the S&P 500 Index and the Russell 1000 Growth Index are up over 4.5% (NAV) and 4% (NAV), respectively.

WINN invests in large-and mid-cap companies, primarily in the U.S., that have strong prospects for long-term growth. To aid in security selection, the investment team focuses on the following characteristics: structural completive advantage; industry leadership and innovation; strong cash flow generation and reinvestment; balance sheet strength; and experienced management.

WINN was one of three Harbor ETFs that migrated to the NYSE from NYSE Arca at the beginning of the year. ETFs trading on the NYSE benefit from the additional element of human oversight by a Designated Market Maker (DMM), which provides trading support that will likely result in increased liquidity, improved price discovery, and reduced transaction costs for investors.

For more news, information, and analysis, visit the Market Insights Channel.

Investors should carefully consider the investment objectives, risks, charges and expenses of a Harbor fund before investing. To obtain a summary prospectus or prospectus for this and other information, visit harborcapital.com or call 800-422-1050. Read it carefully before investing.

All investments involve risk including the possible loss of principal. Please refer to the Fund’s prospectus for additional risks. For current performance, fees, and important information: WINN

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice.

Important Information Investing involves risk, principal loss is possible. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value.

All investments involve risk including the possible loss of principal. There is no guarantee that the investment objective of the Fund will be achieved. Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions. At times, a growth investing style may be out of favor with investors which could cause growth securities to underperform value or other equity securities. Since the Fund may hold foreign securities, it may be subject to greater risks than funds invested only in the U.S. These risks are more severe for securities of issuers in emerging market regions. A non-diversified Fund may invest a greater percentage of its assets in securities of a single issuer, and/or invest in a relatively small number of issuers, it is more susceptible to risks associated with a single economic, political or regulatory occurrence than a more diversified portfolio.

ETFs are subject to capital gains tax and taxation of dividend income. However, ETFs are structured in such a manner that taxes are generally minimized for the holder of the ETF. An ETF manager accommodates investment inflows and outflows by creating or redeeming “creation units,” which are baskets of assets. As a result, the investor usually is not exposed to capital gains on any individual security in the underlying portfolio. However, capital gains tax may be incurred by the investor after the ETF is sold. Shares are bought and sold at market price not net asset value (NAV). Market price returns are based upon the closing composite market price and do not represent the returns you would receive if you traded shares at other times.

The S&P 500 Index is an unmanaged index generally representative of the U.S. market for large capitalization equities. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

The Russell 1000® Growth Index is an unmanaged index generally representative of the U.S. market for larger capitalization growth stocks. This unmanaged index does not reflect fees and expenses and is not available for direct investment. The Russell 1000® Growth Index and Russell® are trademarks of Frank Russell Company.

Investors should carefully consider the investment objectives, risks, charges and expenses of a Harbor fund before investing. To obtain a summary prospectus or prospectus for this and other information, visit harborcapital.com or call 800-422-1050. Read it carefully before investing.

Jennison Associates LLC is an independent subadvisor to the Harbor Long-Term Growers ETF.

This article was prepared as Harbor Funds paid sponsorship with VettaFI.

Foreside Fund Services, LLC is the Distributor of the Harbor ETFs.

2862498