CEOs and businesses face a number of challenges in the current economic environment, and their sentiments reflect that. With more than half of CEOs now expecting a recession in the coming 12–18 months, positioning portfolios for a challenging economic cycle could be more important than ever, and managed futures can offer an abundance of opportunities for advisors, investors, and portfolios.

A recent survey from the Conference Board of 750 CEOs and C-suite executives globally has found that over 60% are anticipating recession in their region by the end of 2023, while a full 15% believe that their primary region of operations is already experiencing recession.

The survey was conducted between May 10–24, well ahead of the most recent Fed meeting that saw markets plummet leading up to the meeting, recover briefly, and then fall further. The consumer confidence index has remained higher, but consumers are often inherently focused on the shorter term.

“There is this gap between how consumers are viewing this—they’re not as worried as CEOs are,” Dana Peterson, chief economist for the Conference Board, told Wall Street Journal. “But CEOs are trained to look 12 to 18 months down the line. Most consumers? The next few months, or three to six months, is really what they’re thinking about.”

Trend Following Data

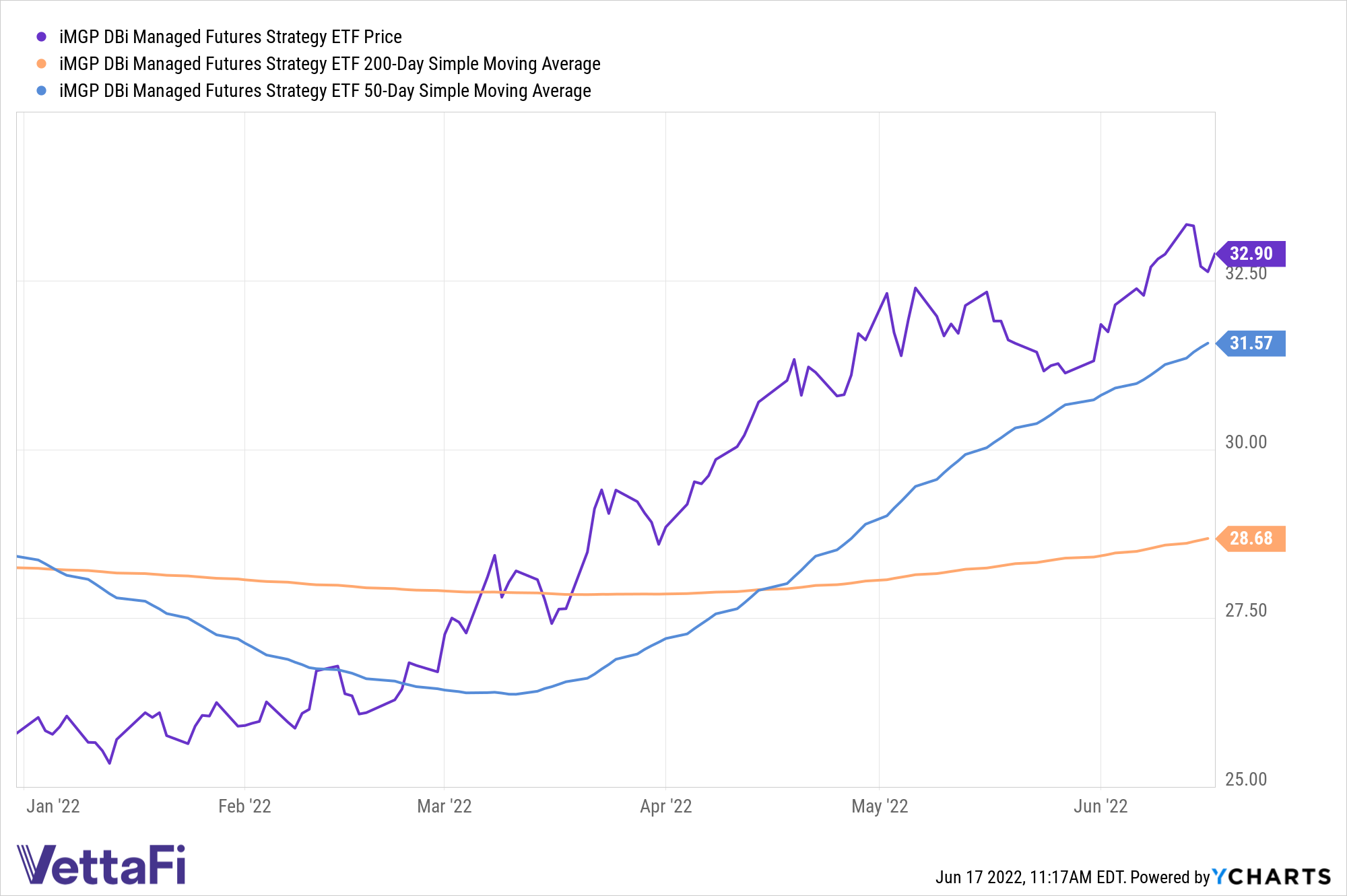

Investors looking for a fund that has performed well during volatility, as well as trend-followers who are considering funds performing above their moving day averages in the current environment, should consider the iMGP DBi Managed Futures Strategy ETF (DBMF).

As of June 16, the fund was trading for $32.90 per share and was above both its 50-day simple moving average of $31.57 and its 200-day simple moving average of $28.68. The simple moving average is one of the easiest ways to calculate moving averages; the SMA adds all of the daily closing prices within the time frame and then divides by the number of days. Trend-followers who utilize technical analysis to invest generally seek to buy funds that are performing over their moving averages and sell when they fall below.

DBMF Provides Portfolio Diversification and Alpha

DBMF is a managed futures fund designed to capture performance no matter how equity markets are moving. The fund seeks long-term capital appreciation by investing in some of the most liquid U.S.-based futures contracts in a strategy utilized by hedge funds. The year-to-date return for DBMF is currently 30.49%.

DBMF allows for the diversification of portfolios across asset classes that are uncorrelated to traditional equities or bonds. It is an actively managed fund that uses long and short positions within derivatives, mostly futures contracts and forward contracts. These contracts span across domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary).

The position that the fund takes within domestic managed futures and forward contracts is determined by the Dynamic Beta Engine. This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds have their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds and then determining a portfolio of liquid contracts that would mimic the hedge funds’ performance (not the positions).

By capturing hedge fund performance within an ETF wrapper, the fund generates alpha inherently in the savings passed on from management fees, allowing investors to capture more of the return stream that mimics the averaged performance of the largest managed futures hedge funds.

DBMF has a management fee of 0.85% and an additional 10 bps for other expenses listed in the prospectus.

For more news, information, and strategy, visit the Managed Futures Channel.