Markets continue to be driven by responses to news as performance hinges on the latest released data and volatility persists. Today’s release by the Conference Board of declining consumer optimism for the second month in a row saw markets respond negatively, giving up earlier gains and momentum, reported the Wall Street Journal.

“The question is when we hit a market bottom and when we get that turning point, and it’s not necessarily straight away,” Eloise Goulder, head of global market, data, and positioning intelligence teams within equity trading at JPMorgan Chase, told WSJ.

The S&P 500 entered bear territory earlier this month when it fell more than 20% below its recent highs from January, while the Nasdaq Composite has lingered in bear territory for much of the year.

When looking back historically at times of previous market challenges and downturns, including bear markets, managed futures hedge funds have largely outperformed while equities struggled. In this current environment where inflation and aggressive Fed tightening have both equities and bonds feeling the squeeze, managed futures can be a non-correlated performance opportunity for portfolios.

Image courtesy of Dynamic Beta investments, data as of April 2022

DBMF Offers Hedge Fund Performance With ETF Savings

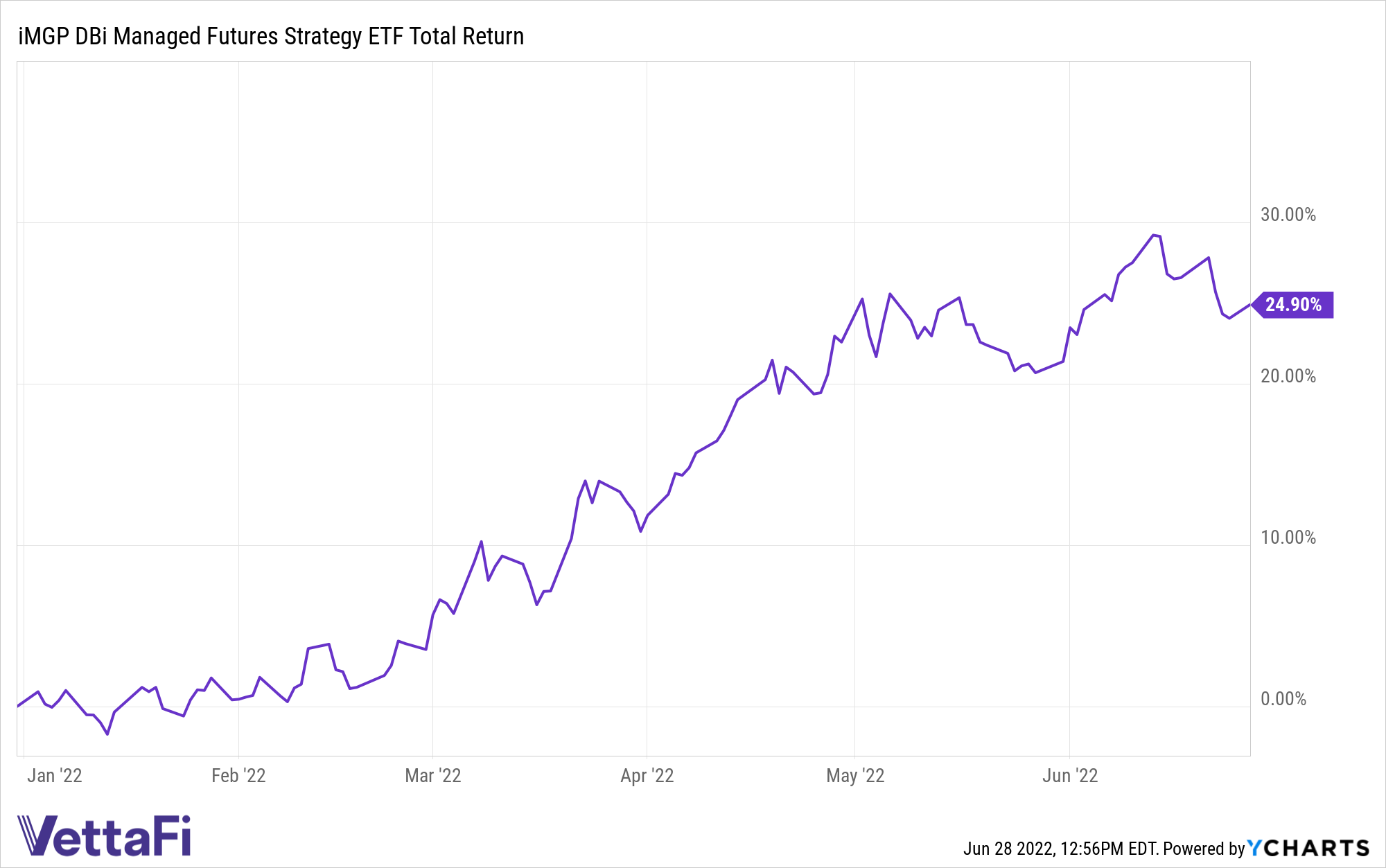

Investors looking for a fund that has performed well during volatility should consider the iMGP DBi Managed Futures Strategy ETF (DBMF); The year-to-date return for the fund is currently 26.60% according to the DBMF website.

DBMF is a managed futures fund designed to capture performance no matter how equity markets are moving. The fund seeks long-term capital appreciation by investing in some of the most liquid U.S.-based futures contracts in a strategy utilized by hedge funds.

DBMF allows for the diversification of portfolios across asset classes that are uncorrelated to traditional equities or bonds. It is an actively managed fund that uses long and short positions within derivatives, mostly futures contracts, and forward contracts. These contracts span across domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary).

The position that the fund takes within domestic managed futures and forward contracts is determined by the Dynamic Beta Engine. This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds have their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds and then determining a portfolio of liquid contracts that would mimic the hedge funds’ performance (not the positions).

DBMF takes long positions in derivatives with exposures to asset classes, sectors, or markets that are anticipated to grow in value and takes short positions in derivatives with exposures expected to fall in value. Under normal market conditions, the fund seeks to maintain volatility between 8%–10% annually.

DBMF has a management fee of 0.85% and an additional 10 bps for other expenses listed in the prospectus.

For more news, information, and strategy, visit the Managed Futures Channel.