Managed futures, the strategy long harangued as underperforming in an environment that punished much beyond vanilla, passive strategies for over a decade, has hit its stride this year, and none more so than with the iMGP DBi Managed Futures Strategy ETF (DBMF) that has just crossed the $1 billion mark in AUM as of 11 October, 2022.

Managed futures are essentially the ultimate trend-following strategy: it’s a quant driven strategy that analyzes how assets are actually moving instead of relying on how advisors and investors believe they will move. They typically perform exceedingly well during times of market regime shifts and dislocations because they invest based on the trends whereas sentiment, habit, or hopefulness can sometimes keep investors in positions longer than what is profitable.

“When the world went from QE infinity to the deflation of Bubble Maximus, managed futures funds turned their portfolios accordingly and never looked back. In a world like today, dispassionate quant models have a huge competitive advantage over us, humans,” explained Andrew Beer to VettaFi. Beer is the co-portfolio manager of DBMF and a managing member of Dynamic Beta investments, the sub-advisor of the fund.

Managed futures got their start as a hedge fund strategy and have offered significant returns this year but gaining access to hedge funds can be a herculean task for the everyday investor, with high entry fees and equally high manager and performance-based fees.

“We are incredibly grateful for the support of the early adopters: independent RIAs who saw the diversification benefits of managed futures, but struggled with how access the strategy without taking on too much single manager risk,” Beer said.

DBMF brings the hedge fund strategy to the ETF wrapper and does so cleverly, offering up the averaged performance of the top 20 managed futures hedge funds within an ETF with management fees of just 0.95%. Collating the average performance eliminates single manager bias risk, and the cost savings of going through an ETF means that advisors and investors can capture and retain more of the alpha that the strategy generates compared to those going through a hedge fund with 2% manager fees and a 20% performance fee.

The fund is the only 5-Star Morningstar rated managed futures ETF and is the fastest growing ETF this year of all ETFs that started the year with $50 million or more (DBMF began with $61 million), with an AUM growth rate of 1,389% as of 05 October 2022 according to a tweet from Athanasios Psarofagis, ETF analyst for Bloomberg Intelligence.

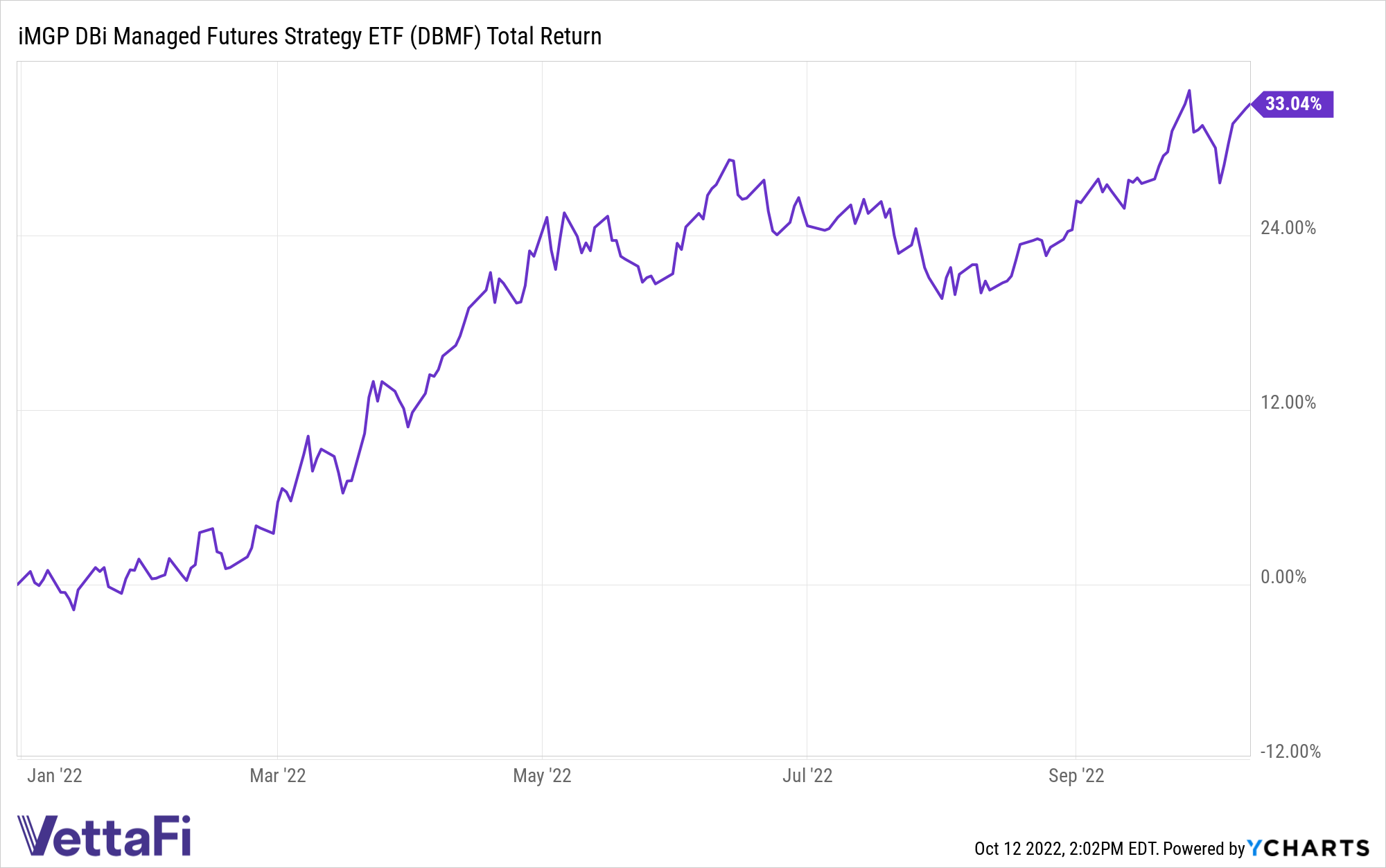

Current year-to-date returns for DBMF are 34.56% as of 10/11/22.

“DBMF hitting the $1 billion mark is a key milestone that proves that advisors and end clients are gaining comfort in managed futures through an ETF. The fund provides an alternative to traditional stocks and bonds for a modest fee,” said Todd Rosenbluth, head of research at VettaFi.

Managed Futures Offer Benefits Long-Term

Managed futures aren’t just for times of volatility but are designed to perform no matter which direction the markets are moving: the strategy takes positions, both long and short, on a range of asset classes through the futures market based on how those assets are trending and invests across currencies, commodities, bonds, and equities. Because managed futures transact within the futures market, they are non-correlated to both stocks and bonds, offering a strong diversification opportunity for portfolios in any market.

DBMF takes long positions in derivatives with exposures to asset classes, sectors, or markets that are anticipated to grow in value and takes short positions in derivatives with exposures expected to fall in value. The fund made big money by taking long positions on crude oil earlier in the year and has been short currencies in a strengthening dollar regime that is wreaking havoc for many countries. It relies on the Dynamic Beta Engine, a proprietary quantitative model that seeks to determine the positions of the largest commodity-trading advisor hedge funds and then mimics their performance (not their positions).

While managed futures struggled in the previous environment of the last decade, higher interest rates and a higher rate environment that is expected over the coming years will provide greater opportunity for long-term performance.

“After this year, managed futures have gone from optional to essential for anyone building a diversified, multi-asset portfolio,” Beer said of the strategy.

“Our job is to find a way to make this strategy more accessible to more allocators. We hope DBMF will invite more and more allocators into the tent,” said Beer. $1 billion in AUM says that Dynamic Beta investments and iM Global Partners are well on their way.

For more news, information, and strategy, visit the Managed Futures Channel.