The ETF industry continues to grow and innovate at a remarkable rate. 2022 is on track to be the second-highest year for AUMs for the industry. One of the biggest trends of the last few years has been the conversion of strategies from mutual funds and hedge funds into the ETF wrapper, a trend that IM Global Partners and Dynamic Beta investments were ahead of when they launched their two alternatives ETFs in 2019, DBMF and DBEH.

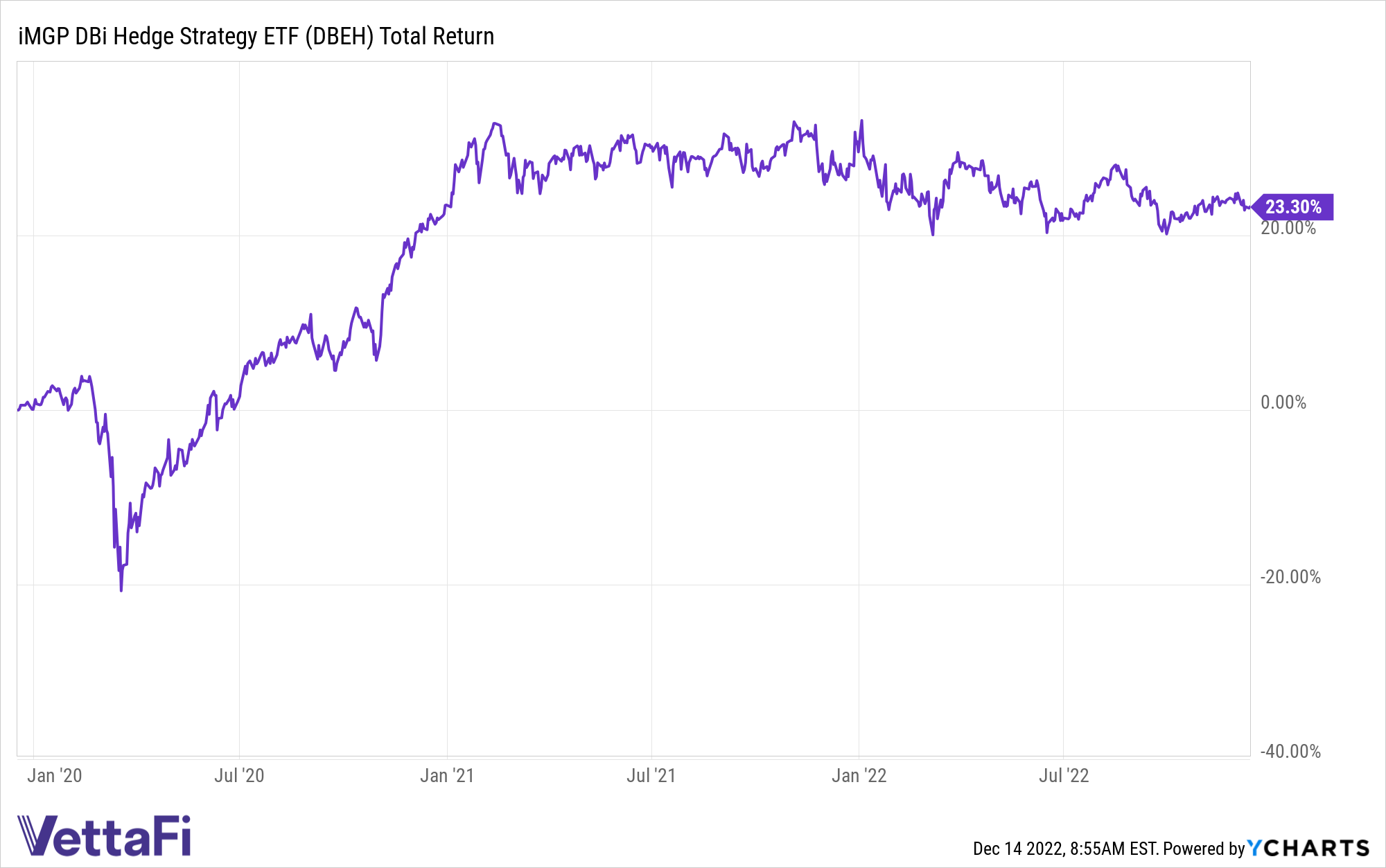

The enormously popular iMGP Dbi Managed Futures Strategy ETF (DBMF) hit its three-year milestone in May of this year, and now the iMGP Dbi Hedge Strategy ETF (DBEH) also crosses the three-year marker today. It’s a big moment for the fund that employs an equity long-short strategy, with outsized opportunities still on the horizon.

“In 2019, iMGP and DBi partnered to bring two innovative alternative ETFs to market in an easily accessible, affordable and efficient framework that provides access to DBi’s long standing investment research on replication. We are thrilled to see the iMGP DBi Managed Futures Strategy ETF (ticker DBMF) and the iMGP DBi Hedge Strategy ETF (ticker DBEH) achieve such successful three-year track records and industry recognition,” Jeff Seeley, CEO of iM Global Partner US. Advisors, told VettaFi.

DBEH is actively managed and seeks long-term capital appreciation through its use of long and short positions in futures and forward contracts across equities, currencies, and fixed income. It’s modeled after the long-short equity strategy that hedge funds employ and utilizes the Dynamic Beta Engine, a proprietary, quantitative model, to determine the positions of the largest long-short equity hedge funds.

By looking across a range of equity hedge funds, the Dynamic Beta Engine is able to identify changing trends in how the hedge funds are allocated and adjust its models accordingly, creating an optimized portfolio of long and short positions that resets monthly. It also holds investment-grade debt securities such as bonds and Treasuries as collateral for the futures investments, for liquidity or to increase yield.

The Proof Is in the Performance

“Since inception, DBEH has materially outperformed developed market equities with less than half the drawdown and 300 bps per annum of alpha – for traditional portfolios, that’s a great way to raise the efficient frontier,” said Mathias Mamou-Mani, co-portfolio manager of DBEH and DBMF and managing member of Dynamic Beta investments.

Dynamic Beta investments and IM Global Partners have proven the value of this new generation of hedge fund strategy ETF products in 2022 with DBMF, which brought in over $1 billion in inflows. These types of strategies that are generally locked away to all but institutional investors can offer great diversification benefits for portfolios, and the untapped market share potential of DBEH is enormous.

The hedge fund industry had $2.2 trillion in AUM as of the end of the third quarter, according to data from EurekaHedge; in comparison, the ETF industry had over $5.9 trillion in AUM. ETFs continue to gain market share, but that growth is much smaller so far within alternatives, particularly in equity long-short strategies. The AUM for equity long-short hedge funds in the third quarter was $647 billion, compared to just $1.4 billion in AUM for long-short equity ETFs.

“Hedge fund ETFs — that work well — are a greenfield area. There’s $7 trillion in ETF assets now and a handful of basis points allocated to true hedge fund strategies,” said Andrew Beer, co-portfolio manager of DBEH and DBMF and managing member of Dynamic Beta investments.

Hedge fund strategies captured within ETFs offer a number of specific benefits that are appealing to advisors. Replication strategies often capture a multitude of hedge funds in their models and calculations, offering diversification potential and eliminating single-manager risk.

“No model allocator should fill the ‘equity long/short bucket’ with a single fund. The idiosyncratic risk of single funds – manager, sub-strategy, etc. – simply overwhelms the long-term benefits of equity long/short,” said Mamou-Mani.

Transparency and Lower Fees Put Hedge Fund ETFs Ahead

With transparent ETFs, the ease of seeing exactly how a complex strategy is positioned at any given time has great appeal for advisors and investors as well. “It’s true that most hedge fund strategies will never work in an ETF: the transparency alone is a deal killer. By investing in deep, liquid futures markets, we are more than happy for allocators to see our positions every day,” Beer explained.

One of the largest benefits to hedge fund ETFs, however, remains the savings incurred from management fees. DBEH has a management fee of 0.85%, whereas most hedge funds have a 2% management fee with an additional performance fee of 20% on profits that the hedge fund makes beyond an established threshold. By saving a significant amount through the ETF wrapper, advisors and investors are able to capture more of the alpha generated.

“Imagine investing in forty leading Equity Long/Short hedge funds at a fraction of the fees with no minimums, intraday liquidity, and a daily risk report that summarizes core factor weights? That’s what we’re trying to simulate with DBEH,” said Beer.

For more news, information, and analysis, visit the Managed Futures Channel.