On Fed rate hike expectations, regional bank shares have plummeted, with more companies flashing warning signals of contagion. Previously buoyed by a better-than-expected earnings season, markets have sagged again, as volatility and uncertainty spike. But this is an environment that managed futures strategies historically have done well in longer-term.

PacWest (PACW) is the latest regional bank to spark fear of contagion. News broke Wednesday that the bank was looking into strategic options, including possibly selling. PacWest shares fell 54% on Thursday and were stopped multiple times for volatility.

The bank is the latest in a string of regional bank failures in the U.S., as well as the collapse of Credit Suisse abroad. Fears of bank contagion have frequently weighed on markets in the last month.

“Watching Credit Suisse (CS) and First Republic go down was like watching a controlled demolition of an office building. One minute there, the next, nope,” said Andrew Beer, co-founder of Dynamic Beta Investments and co-PM of the iMGP DBi Managed Futures Strategy ETF (DBMF), said in a communication to VettaFi.

Contagion Fear Spreads Through Regional Bank Space

Fear and overall banking sector stress continue to weigh heavily on investors’ minds, particularly as more regional banks are showing tension from the past year’s rapid rate hikes.

First Horizon (FHN) dropped 36% in trading after news that its merger with TD Bank had fallen through. The termination was due to uncertainty regarding the timing of regulatory approval, reported CNBC.

Western Alliance (WAL), a regional bank out of Phoenix, was also down 38% in trading midday Thursday. All the media attention on banks will likely weigh heavily on investors, despite Federal Chair Powell’s statement post-FOMC meeting yesterday regarding the regulatory body’s belief that banking failures had likely concluded for now.

Media attention has also had another unintended consequence, according to Beer. “The publicity around SVB had an unexpected effect: The media told depositors across the country that they could get triple the yield by handing the money to Uncle Sam. So much for bank profitability.”

Invest for Bank Contagion Fear Volatility With DBMF

Lending tightening is inevitable for banks going forward. How much that impacts economic drawdown, however, remains to be seen.

Adding in the uncertainty regarding banking sector stress and contagion, the likelihood of volatility remains high, particularly as recession looms large.

“The big question today is: Do regional banks stop lending?,” mused Beer. “This could cause the measured slowdown of the economy through rate hikes to morph into an economic faceplant.”

Prolonged volatility is an environment that managed futures strategies have historically thrived in. This year, the abrupt reversal of the inflation trade in March has exacerbated some of the underperformance of some managed futures strategies. But as new trends emerge in light of bank tightening, these strategies are positioned to capture the changing tides.

The iMGP DBi Managed Futures Strategy ETF (DBMF) allows for the diversification of portfolios across asset classes uncorrelated to traditional equities or bonds. It is an actively managed fund that uses long and short positions within the futures market on several asset classes. These include domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary).

DBMF is currently down 8.3% YTD as of May 3, 2023, presenting a buying opportunity for those seeking long-term diversification.

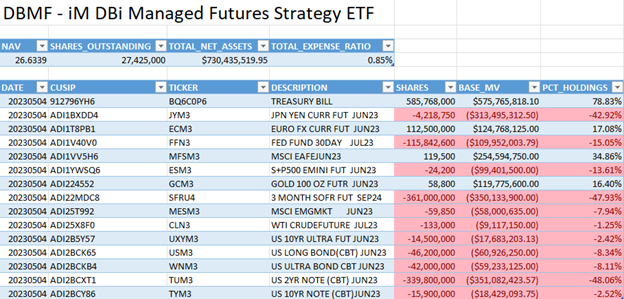

The long and short positions for DBMF, as of May 4, 2023

Source: Dynamic Beta investments

The fund’s position within domestically managed futures and forward contracts is determined by the Dynamic Beta Engine. This analyzes the trailing 60-day performance of CTA hedge funds, then determines a portfolio of liquid contracts to mimic the hedge funds’ averaged performance (not the positions).

DBMF takes long positions in derivatives with exposures to asset classes, sectors, or markets anticipated to grow in value. It takes short positions in derivatives with exposures expected to fall in value.

DBMF has management fees of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.