After a decade of lackluster interest and performance, managed futures have more than demonstrated their worth and value this year in a macroenvironment of volatility and changing market regimes. Andrew Beer, managing member of Dynamic Beta investments and co-portfolio manager of the iMGP DBi Managed Futures Strategy ETF (DBMF), spoke with Todd Rosenbluth, head of research at VettaFi, about the fund’s performance and the managed futures space in a recent webcast hosted by VettaFi.

Dynamic Beta investments is the subadvisor of the fund, and Beer has extensive background working in the hedge fund industry and has long believed in the potentials of the strategies that hedge funds utilize. Hedge fund investing carries a significant barrier to entry, however (individual investors must be an accredited investor or an institutional one), and comes with expensive fees.

Managed futures have been a strategy locked away behind hedge funds for the last decade and utilize data trends to determine how to invest in various assets (equities, currencies, fixed income) and what kinds of positions to take on them. They perform strongest in times of market volatility, and dislocation and Beer explained the reasoning behind bringing the strategy to the ETF wrapper.

“We’re somewhat unique in the space in that we didn’t come at this as a bunch of guys who built these strategies and tried to make them better over time, rather we were thinking about how do we access the diversification benefits of the strategy… but how do we better than actual hedge funds by cutting out fees, how do we reduce the risk of having a blow-up that makes it difficult for us to hold the investment,” Beer explained.

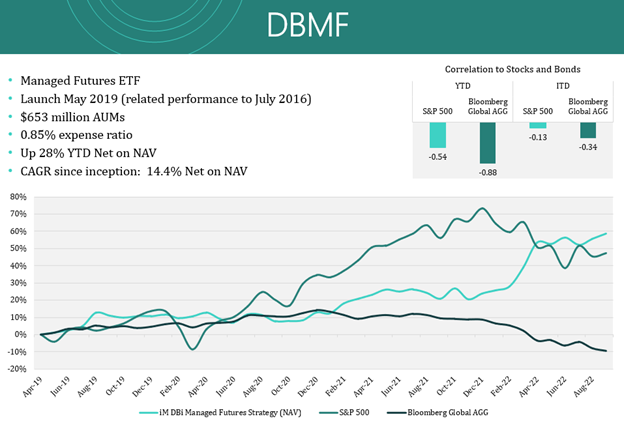

Image source: Dynamic Beta investments Webcast

It’s been a stellar year for DBMF: the fund started with just $65 million in AUM in January and is now closing in on nearly $700 million AUM. The fund had become a strong diversification play for portfolios this year and has offered significant returns (28.99% YTD as of 09/14/22), and was one of the few stocks to actually close higher on September 13, 2022, when markets plummeted.

Beer went on to explain that DBMF was created as a diversifier for model portfolios.

“If you are running an ETF-based model portfolio, I think the question is if you want to diversify out of traditional assets and you’re looking for things that could really help to protect your portfolio in periods like this while also making money during normal times, on our side we were hard pressed to find anything better than the strategy and we’re very pleased to say that we believe DBMF has been able to deliver that so far,” Beer said.

Under the Hood of DBMF

DBMF invests across ten different core futures markets: three different equity futures contracts, three different rates futures contracts, two currency futures contracts, and two different commodity contracts.

“As a philosophical matter, when we decide what we want to invest in, we believe that market depth and liquidity are really, really valuable, precious things because it allows us to go in and out of positions with virtually no trading costs,” Beer explained. “It means that if the cracks underneath the market continue to spread, more liquidity flows into the stuff that we’re trading.”

This year that had meant that the fund capitalized on three big trades that have created much of its returns: DBMF was long crude oil early enough that it captured the strong returns in the early part of 2022, it was short Treasuries when REITs spiked and then has played the strong U.S. dollar in the futures market to reap returns. 2022 has proven to be a perfect storm for extremely strong managed futures performance as both bonds and equities have moved in correlation while managed futures remain uncorrelated to both.

“When managed futures does the best is when the unexpected or the seemingly impossible keeps happening in markets,” Beer said. “We think the diversification argument has really been cemented this year, and there’s no reason to believe that the returns that we’ve realized are going to reverse or even diminish over time just given the market that we’re in.”

It’s a strategy that isn’t limited to extreme volatility, however, and can perform just as efficiently in deflationary environments, recessions, and more as it is a data-driven strategy reliant on identifying and capitalizing on trends, no matter if that’s in a downward or upward moving market.

For more news, information, and strategy, visit the Managed Futures Channel.