Markets came into the beginning of the year priced for perfection that the U.S. would avoid a major recession, Fed rate hikes would conclude soon, and inflation would fall rapidly back near its 2% target rate. It’s a narrative that has changed in the last month and Andrew Beer, co-portfolio manager of iMGP DBi Managed Futures Strategy ETF (DBMF) and managing member of Dynamic Beta investments, discussed these changes, managed futures strategies, and the fund’s performance in a DBMF monthly recap.

Markets have been caught in a paradoxical cycle of good economic data leading to market drops on concerns of aggressive Fed response while economic slowing has been cheered by markets in the last year. It’s created a market of prolonged volatility but that volatility could extend for years to come, according to advisors and analysts who experienced investing in the 1970s, Beer said. Analysts believe that the excessive equity environment and stimulus of the 2010s will take years to unravel and will mean a challenging market environment looking ahead.

Managed futures hedge funds had a range of performance in February, with the overall space up but individual funds running the gamut of performance: in February DBMF was up 0.8% in price but down -2.5% compared to the SG CTA Hedge Fund Index.

“These kinds of variations are natural for our strategy: replication works incredibly well but not perfectly,” Beer said, explaining that DBMF outperforms the index the vast majority of the time but does have quarters where it trails before catching up.

In February, the winner for the fund was a short position in Treasuries, while a move into long positions in non-U.S. developed markets pulled gains downwards. This positioning is in alignment with the outlook that in a structurally higher rate global economy, value stocks are potentially positioned for better performance, with non-U.S. stocks offering cheaper exposure to value. It’s all culminated in a more balanced portfolio for DBMF’s holdings compared to its inflation positioning for much of last year.

“This is… what I would expect to see: we have these two widely divergent views of the markets and the funds are trying to find ways to express both sides, hopefully in a way that generates stable, incremental returns through market gyrations,” Beer explained.

DBMF remains uncorrelated to both equities and bonds, with a stronger negative correlation to bonds due to last year’s capitalization on bond underperformance, a correlation that Beer expects to level out closer to zero in the next five years.

What to Expect From Managed Futures Strategies Looking Ahead

Much remains unknown about the Fed interest rate path, particularly given the recent collapse of Silicon Valley Bank and other banks that have happened since Beer’s fund walkthrough on March 8. Overwhelmingly, however, the concern for advisors looking to managed futures is uncertainty on how such a strategy will perform as markets begin to level out to more “normal” conditions in the next five years.

“Given that our cash today is yielding more than four percent, and through our ability to cut out fees and expenses, I’d hope that we would be able to deliver high single-digit returns just by capitalizing on normal gyrations of the market,” Beer said. “In a sense riding waves that might not be tsunamis like last year, but should hopefully be large enough to create opportunities to make money.”

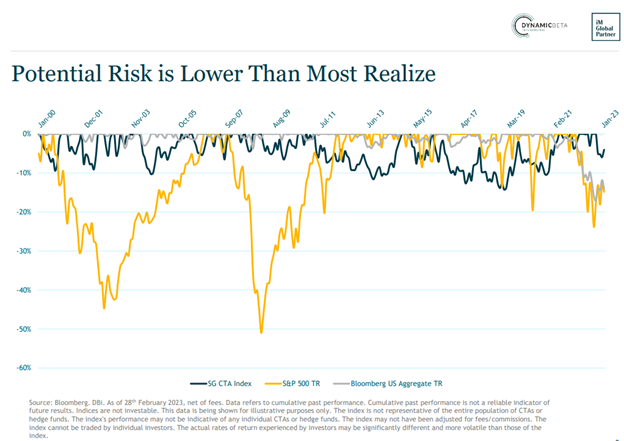

For advisors concerned about the risk of futures exposure, Beer is quick to point out that the S&P 500 has two significant periods of drawdowns greater than 40% over the last two decades and that bonds, while steady for most of that, plummeted 17% last year, relinquishing five years’ worth of returns in the process.

Image source: Dynamic Beta investments

“Managed futures goes through periodic drawdowns in the 10% range but never has had a drawdown more than 14%,” Beer said. “That’s quite incredible; it’s a drawdown less than a third of equities twice now, and now less than bonds.”

The iMGP DBi Managed Futures Strategy ETF (DBMF) allows for the diversification of portfolios across asset classes uncorrelated to traditional equities or bonds. It is an actively managed fund that uses long and short positions within the futures market on several asset classes: domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary).

The fund’s position within domestically managed futures and forward contracts is determined by the Dynamic Beta Engine, which analyzes the trailing 60-day performance of CTA hedge funds and then determines a portfolio of liquid contracts that would mimic the hedge funds’ averaged performance (not the positions).

DBMF takes long positions in derivatives with exposures to asset classes, sectors, or markets that are anticipated to grow in value and takes short positions in derivatives with exposures expected to fall in value.

DBMF has management fees of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.