Big oil has been in pole position in the energy sector since the dawn of time, but the sector is evolving. Energy could soon be headed by renewable energy sources, which will continue to feed into sector strength and funds like the Direxion Daily Energy Bull 3X Shares (NYSEArca: ERX) .

A Wall Street Journal article captured this sentiment perfectly:

“In June, Goldman Sachs shared their expectation that spending for renewable power projects will become the largest area of energy spending in 2021, surpassing upstream oil and gas for the first time in history. The multinational investment bank and financial services company also expects the clean energy sector to reach a $16 trillion investment volume through 2030, eclipsing fossil fuels.”

ERX seeks daily investment results equal to 300% of the daily performance of the Energy Select Sector Index. The index is provided by S&P Dow Jones Indices and includes domestic companies from the energy sector which includes the following industries: oil, gas and consumable fuels; and energy equipment and services.

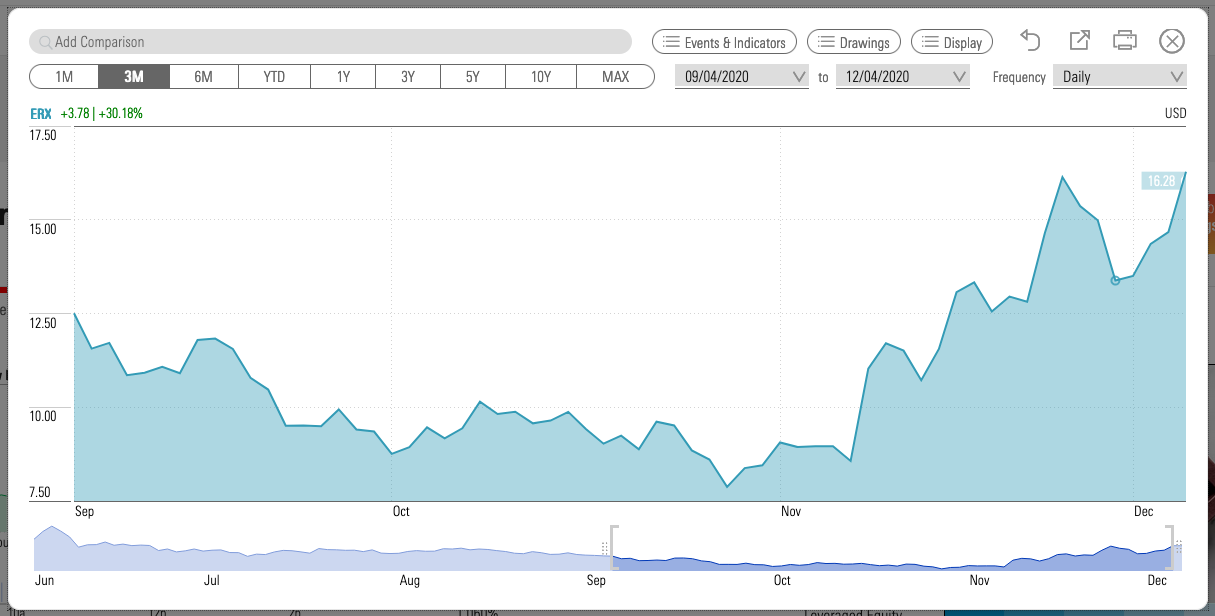

The fund has risen by about 30% over the past three months:

Is Renewable Energy The Next Frontier?

While oil is still a prime mover for the energy sector, there could be a changing of the guard. Renewable energy could become a sector leader, particularly when assisted by a Joe Biden presidency that focuses on clean energy initiatives.

Per a Forbes article, “climate change is set to be a top priority for the incoming administration, second only to the Covid-19 recovery. As discussed in my recent article, the president-elect has laid out an ambitious roadmap for decarbonizing the US economy, which includes a carbon-free power sector by 2035 and net-zero carbon emissions for the country by 2050. This will require unprecedented investments in green energy technologies: from traditional solar, wind, and storage to frontier tech like hydrogen fuel cells and small modular reactors (SMRs).”

Of course, there’s the other side of the trade, which errs on the side of bearishness. Traders can play weakness in the energy sector via the Direxion Daily Energy Bear 3X Shares (ERY).

On the opposite end of the spectrum, ERY seeks daily investment results that equate to 300% of the inverse of the daily performance of the Energy Select Sector Index. Like ERX, the index is provided by S&P Dow Jones Indices and includes domestic companies from the energy sector which includes the following industries: oil, gas and consumable fuels; and energy equipment and services.

For more news and information, visit the Leveraged & Inverse Channel.