The volatility as a result of the COVID-19 pandemic has brought uncertainty to an all-time high. But there are areas where traders have found begun to pool optimism over recent weeks.

Traders looking to find some alpha in this high-volatility environment might be able to pick up some indication of the market sentiment by following the action in several daily leveraged ETFs issued by Direxion, each of which saw more than 50% growth in the final stretch of a tumultuous March.

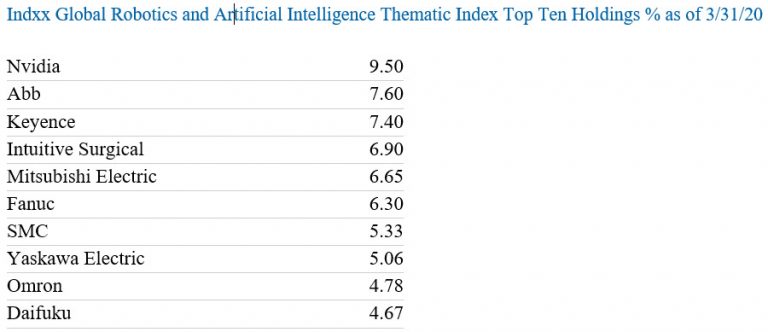

Direxion Robotics, Artificial Intelligence & Automation Index Bull 3X Shares

Up by a little more than 53% between March 23-27, the Direxion Robotics, Artificial Intelligence & Automation Index Bull 3X Shares ETF (UBOT) is among the most resilient of the bullish ETFs the issuer has on offer.

Part of this turnaround can be attributed to a bounce in robotics stocks like ABB, Ltd. and Intuitive Surgical, Inc. following the announcement and eventual passage of a $2 trillion stimulus package in the U.S. The sector was also buoyed thanks to solid earnings numbers from Micron Technology, Inc. which spurred buying throughout much of the semiconductor space, including industry leader Nvidia Corporation.

Although all of these stocks remain well off their previous highs, they’ve each managed to cut their losses substantially in just a few days. Whether they hold these levels is yet to be seen, but traders are obviously bullish on their eventual comeback.

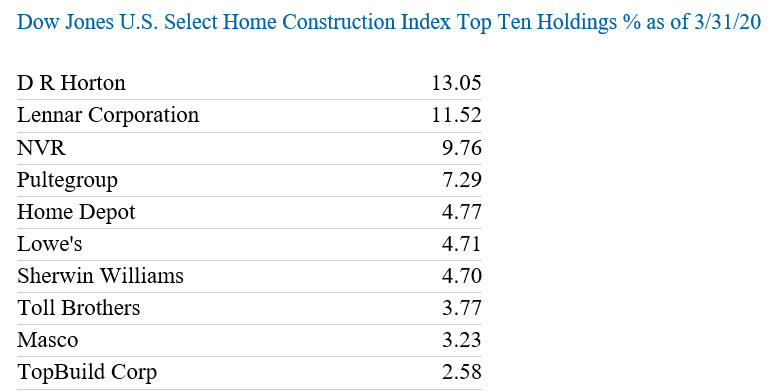

Direxion Daily Homebuilders & Supplies Bull 3X Shares

Homebuilders also saw a massive rebound over the final full week of March, with the Direxion Daily Homebuilders & Supplies Bull 3X Shares ETF (NAIL) surging about 55% over that period.

Admittedly, the sector saw some of the highest selling of any other, as housing demand plummeted with the rapid spread of COVID-19 throughout the U.S. A sharp drop in mortgage and refinancing applications that led to volatility in the rate market also contributed to the bearish conditions.

Intervention from the Federal Reserve helped staunch the losses, and returned interest rates to historical lows following a brief spike in lending rates. These measures helped provide support for homebuilding stocks like Lowe’s Companies, Inc., higher by about 31% during the week, and KB Home, up 48% in that span.

Direxion Daily Aerospace & Defense Bull 3X Shares

Surging 66% in the week in question, the Direxion Daily Aerospace & Defense Bull 3X Shares ETF (DFEN) staged possibly the biggest rebound of any of the other leveraged funds offered by the provider.

It’s fair to pin the cause of this surge squarely on the shoulders of the coronavirus relief package passed by Congress, which included a $60B bailout of the fledgling airline industry. This helped push shares of major component Boeing Co. higher by 70% and bolstered other contractors like Lockheed Martin Corporation and United Technologies Corporation.

At the moment, traders are keen to profit from this record-breaking injection of cash into the economy. However, with literally trillions of dollars now part of the government’s balance sheet, the defense sector may be in for a lofty hangover once it comes time to cover those costs.

As always, if you’re trading Direxion Leveraged ETFs, especially during highly volatile periods, stay close to your keyboard, and monitor your positions every day.

Related Leveraged ETFs:

Direxion Robotics, Artificial Intelligence & Automation Index Bull 3X Shares ETF (UBOT)

Direxion Daily Homebuilders & Supplies Bull 3X Shares ETF (NAIL)

Direxion Daily Aerospace & Defense Bull 3X Shares ETF (DFEN)

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

For the funds’ standardized and most recent month end performance click here (www.direxion.com/etfs)

These leveraged ETFs seek investment results that are 300% of the return of its benchmark index for a single day. Investing in a Direxion Shares ETF may be more volatile than investing in broadly diversified funds. The use of leverage by an ETF increases the risk to the ETF. The Direxion Shares ETFs are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk, consequences of seeking daily leveraged investment results and intend to actively monitor and manage their investment.

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 866-301-9214 or visit our website at direxioninvestments.com. A Fund’s prospectus and summary prospectus should be read carefully before investing.

Shares of the Direxion Shares are bought and sold at market price (not NAV) and are not individually redeemed from a Fund. Market Price returns are based upon the midpoint of the bid/ask spread at 4:00 pm EST (when NAV is normally calculated) and do not represent the returns you would receive if you traded shares at other times. Brokerage commissions will reduce returns. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Some performance results reflect expense reimbursements or recoupments and fee waivers in effect during certain periods shown. Absent these reimbursements or recoupments and fee waivers, results would have been less favorable.

Direxion Shares Risks – An investment in the ETFs involves risk, including the possible loss of principal. The ETFs are non-diversified and include risks associated with concentration that results from an ETF’s investments in a particular industry or sector which can increase volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. The ETFs do not attempt to, and should not be expected to, provide returns which are a multiple of the return of their respective index for periods other than a single day. For other risks including leverage, correlation, daily compounding, market volatility and risks specific to an industry or sector, please read the prospectus.

Distributor for Direxion Shares: Foreside Fund Services, LLC.

Direxion © 2010 – 2020