It’s no secret that gold has been a major beneficiary during the coronavirus pandemic as a viable safe haven asset amid all the uncertainty in the capital markets. But investors don’t actually have to get pure play gold exposure in order to reap the benefits of the precious metal—enter gold miners.

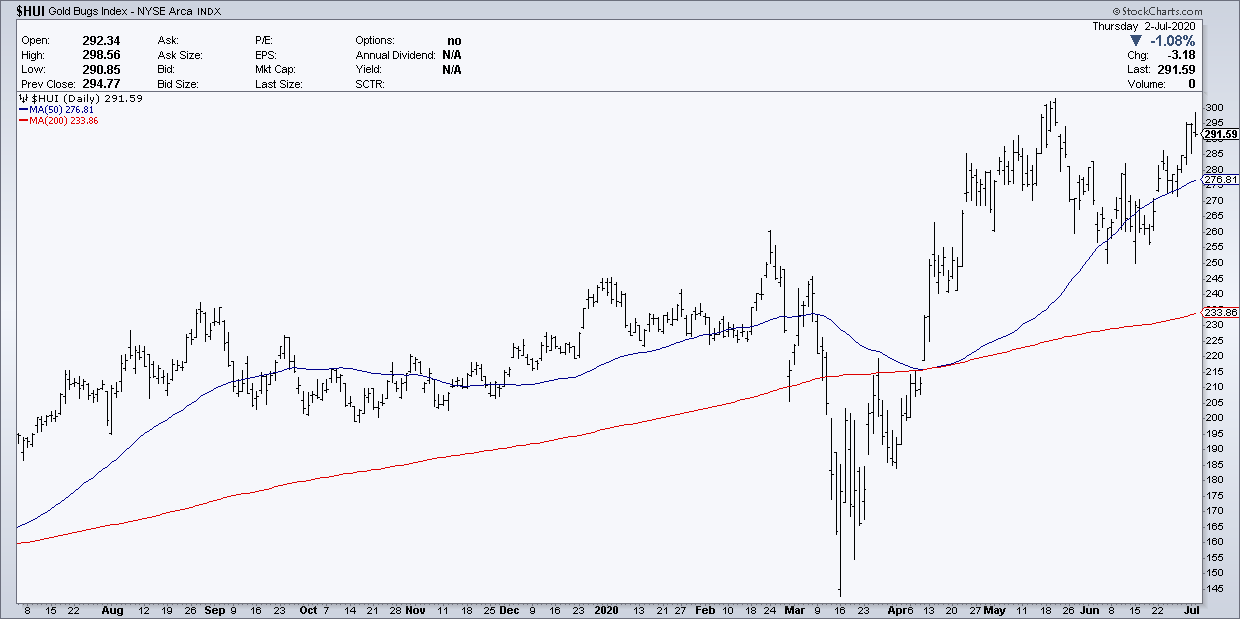

“The Gold Bugs Index (HUI) has recovered nicely since March, exhibiting a 2x gain from the March bottom. In addition, the index formed a bullish cup pattern over the month of June, which is indicating building momentum for another upside move,” Robert Kientz wrote in FX Empire.

“The iShares MSCI Global Gold Miners ETF (RING) has the same pattern as the previous two indexes, wouldn’t you know it,” added Kientz. “One would begin to think that these funds are all seeing the exact same investment pattern emerging.”

If this correlation persists, here are a few ways traders can get gold exposure via exchange-traded funds (ETFs) through miners:

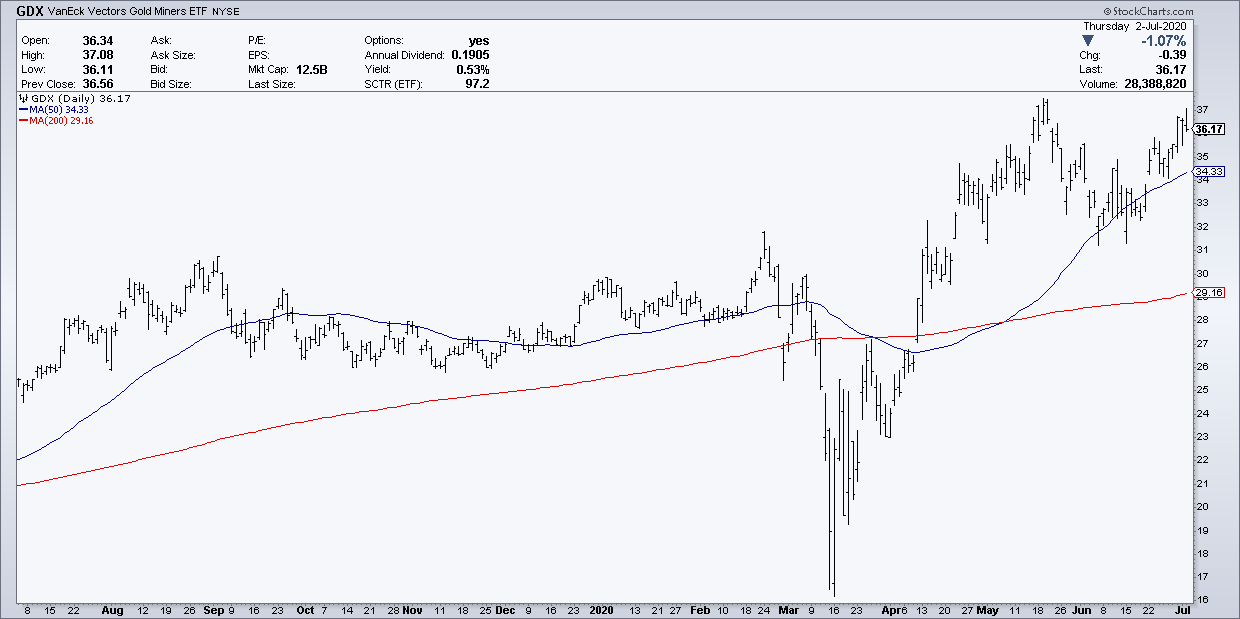

VanEck Vectors Gold Miners (NYSEArca: GDX): seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the NYSE® Arca Gold Miners Index®. The fund normally invests at least 80% of its total assets in common stocks and depositary receipts of companies involved in the gold mining industry. The index is a modified market-capitalization weighted index primarily comprised of publicly traded companies involved in the mining for gold and silver.

Direxion Daily Jr Gold Miners Bull 3X ETF (NYSEArca: JNUG): seeks daily investment results, before fees and expenses, of 200% of the daily performance of the MVIS Global Junior Gold Miners Index. The fund invests at least 80% of its net assets (plus borrowing for investment purposes) in financial instruments, such as swap agreements, and securities of the index, ETFs that track the index and other financial instruments that provide daily leveraged exposure to the index or ETFs that track the index. The index includes companies from markets that are freely investable to foreign investors, including “emerging markets,” as that term is defined by the index provider.

Direxion Daily Gold Miners Bull 3X ETF (NYSEArca: NUGT) : seeks daily investment results, before fees and expenses, of 200% of the daily performance of the NYSE Arca Gold Miners Index. The fund invests at least 80% of its net assets (plus borrowing for investment purposes) in financial instruments, such as swap agreements, and securities of the index, ETFs that track the index and other financial instruments that provide daily leveraged exposure to the index or ETFs that track the index. The index is a comprised of publicly traded companies that operate globally in both developed and emerging markets, and are involved primarily in mining for gold and, in mining for silver.

For more market trends, visit ETF Trends.