Oil prices have been giving traders sea sickness as of late with rising COVID-19 cases and hurricanes, which opens up opportunities for bullish as well as bearish plays.

“Both hurricanes and the virus are factors influencing oil production in the United States,” Direxion Investments Xchange blog post noted. “As the Delta variant of the COVID-19 virus threatens to dampen reopening efforts in the U.S., the 2021 Atlantic hurricane season is just picking up. These variables may impact both the demand and supply sides of the market. Consider the possible impact and increased volatility in the energy and oil sector.”

Politicians and health officials are currently debating lockdowns and vaccine mandates in response to an uptick in COVID-19 cases. If a wave of new lockdowns were to take effect, we could see major aftershocks in the price of oil. Since the U.S. is the number one consumer worldwide, slowing demand may cause prices to drop and oil refiners to adjust accordingly.

Of course, with price movements comes opportunities for traders. This is especially the case if traders want to lever up on their positions inherently in one ETF.

“With factors impacting both demand and supply sides, it looks like U.S. oil producers may be in for a volatile few months. Savvy traders may see this volatility and look to take advantage of it in the short term,” the same Direxion Investments Xchange post said.

Two ETFs to Play The Moves

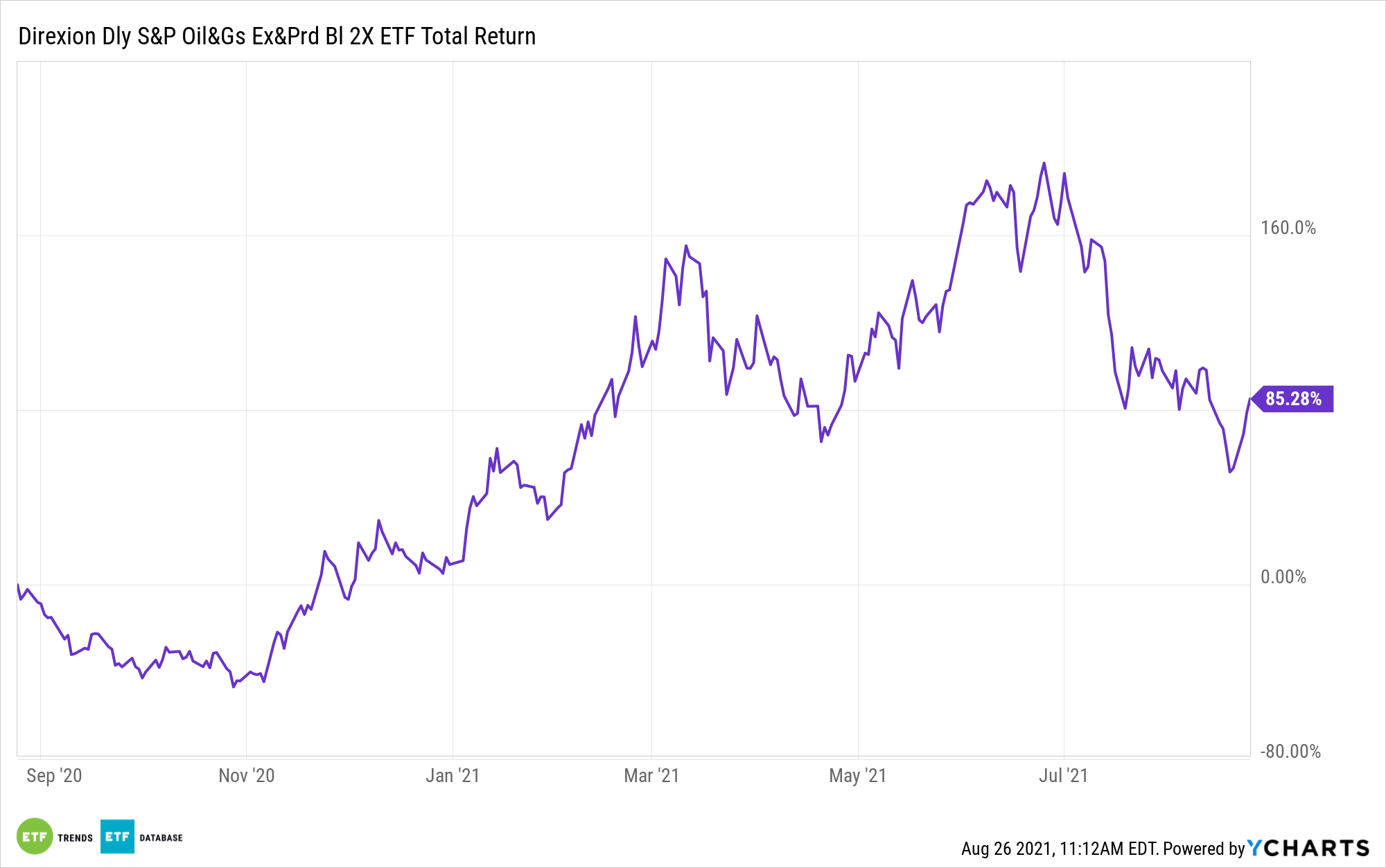

Whether you’re feeling bullish or bearish vibes, Direxion Investments has a fund that suits your sentiment. For the bulls, there’s the Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2X Shares (GUSH).

GUSH seeks daily investment results of 200% of the daily performance of the S&P Oil & Gas Exploration & Production Select Industry Index. The fund, under normal circumstances, invests at least 80% of its net assets (plus borrowing for investment purposes) in financial instruments and securities of the index, ETFs that track the index, and other financial instruments that provide daily leveraged exposure to the index or ETFs that track the index.

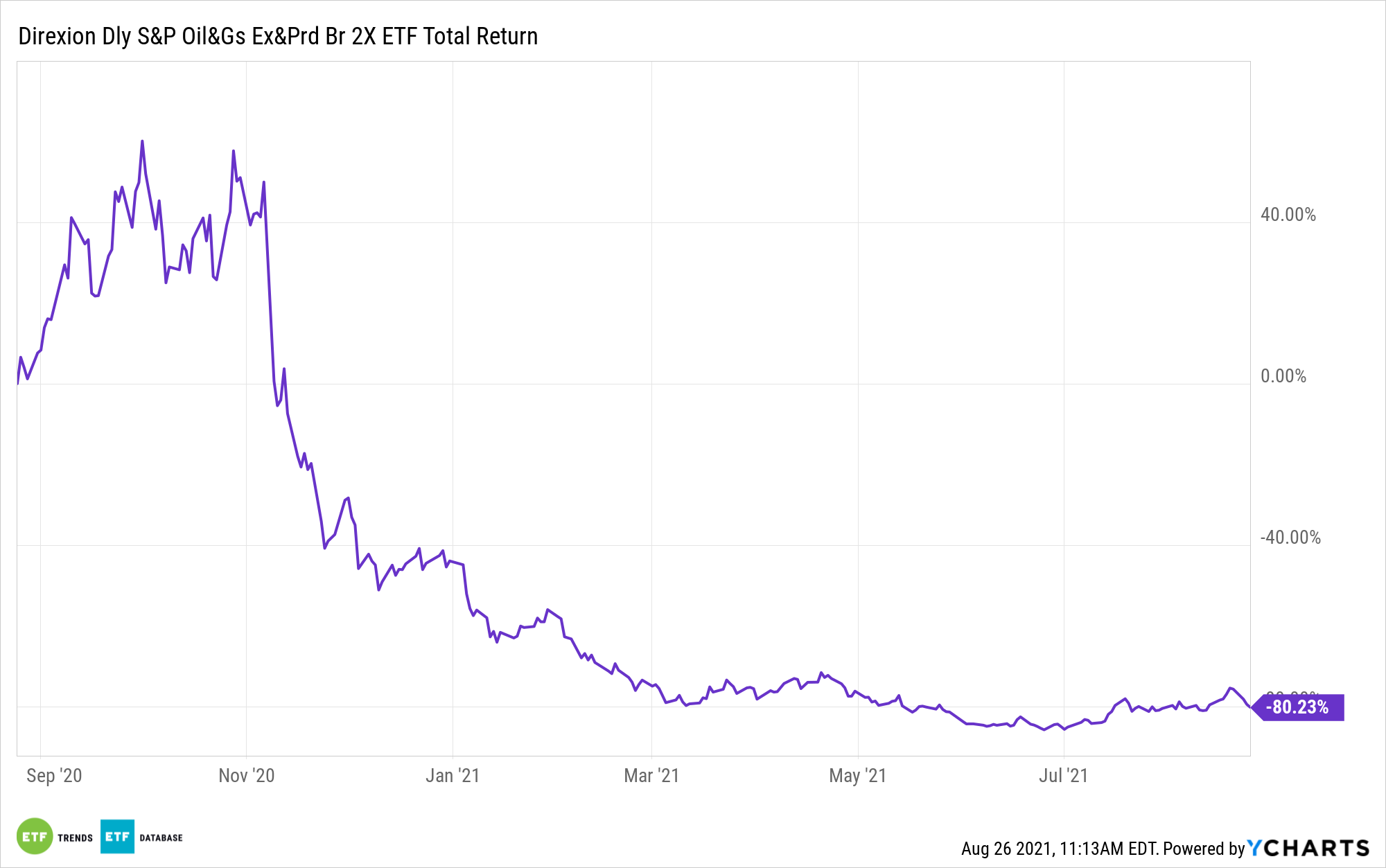

On the bearish side, there’s the Direxion Daily S&P Oil & Gas Exploration & Production Br 3X ETF (DRIP). Inversely to GUSH, DRIP seeks daily investment results that equal 200% of the inverse of the daily performance of the S&P Oil & Gas Exploration & Production Select Industry Index, which is designed to measure the performance of a sub-industry or group of sub-industries determined based on the Global Industry Classification Standards (GICS).

For more news and information, visit the Leveraged & Inverse Channel.