The Q1 2019 earnings season is upon us.

Overall, the expectation is that earnings will decline slightly compared to Q4 2018. This could be the first earnings decline since the second quarter of 2016. Last year saw a tailwind provided by federal tax cut legislation, after steady growth in 2017.

Aggregate earnings for the S&P 500 are projected to be -3.9% lower than the same period last year on 4% higher revenues. Traders may recall that earnings growth in Q4 2018 was 13.4 percent.

Below is some food for thought as outlined by FactSet.

Earnings Growth: For Q1 2019, the estimated earnings decline for the S&P 500 is -3.9%. If -3.9% is the actual decline for the quarter, it will mark the first year-over-year decline in earnings for the index since Q2 2016.

Earnings Revisions: On December 31, the estimated earnings growth rate for Q1 2019 was 2.9%. All eleven sectors have lower growth rates today (compared to December 31) due to downward revisions to EPS estimates.

Earnings Guidance: For Q1 2019, 79 S&P 500 companies have issued negative EPS guidance and 28 S&P 500 companies have issued positive EPS guidance.

Valuation: The forward 12-month P/E ratio for the S&P 500 is 16.3. This P/E ratio is below the 5-year average (16.4) but above the 10-year average (14.7).

Earnings Scorecard: For Q1 2019 (with 20 companies in the S&P 500 reporting actual results for the quarter), 17 S&P 500 companies have reported a positive EPS surprise and 11 have reported a positive revenue surprise.

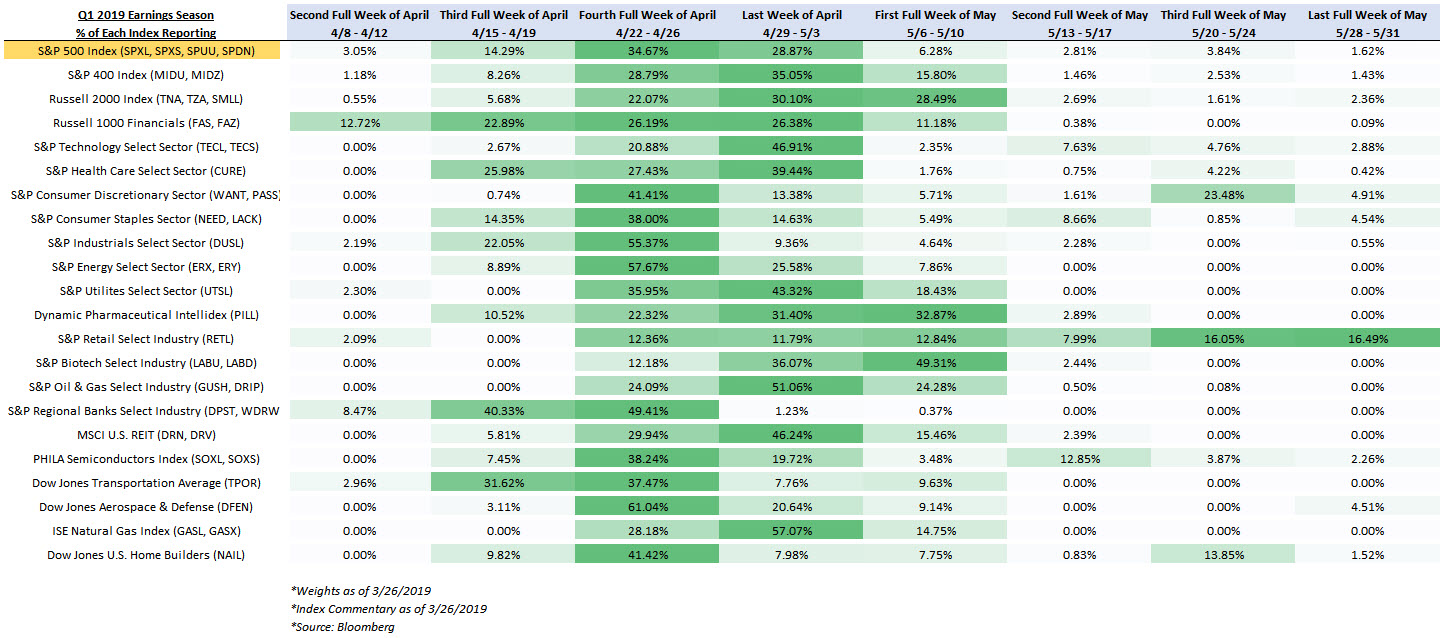

Below is a table identifying the percentage of names in each index that is reporting, arranged by trading week. Following that table is a list of Top Ten Holdings for key indexes, along with their earnings announcement dates, and corresponding bold trades using Direxion Leveraged ETFs.

Source: Bloomberg.

Q1 Quarterly Earnings Calendar

(All index data as of 3/31/2019)

| S&P 500 Index (SPXT) | S&P 400 Index (MID) | |||||||

| Top 10 Weights | Ticker | Weight in the index | Expected Earnings Release | Top 10 Weights | Ticker | Weight in the index | Expected Earnings Release | |

| MICROSOFT CORP | MSFT UW | 3.85% | 5/1/2019 | IDEX CORP | IEX UN | 0.69% | 4/29/2019 | |

| APPLE INC | AAPL UW | 3.56% | 4/30/2019 | ZEBRA TECHNOLOGIES CORP-CL A | ZBRA UW | 0.68% | 5/7/2019 | |

| AMAZON.COM INC | AMZN UW | 3.13% | 4/25/2019 | STERIS PLC | STE UN | 0.63% | 5/8/2019 | |

| FACEBOOK INC-CLASS A | FB UW | 1.70% | 4/24/2019 | ULTIMATE SOFTWARE GROUP INC | ULTI UW | 0.63% | 4/30/2019 | |

| BERKSHIRE HATHAWAY INC-CL B | BRK/B UN | 1.66% | 5/6/2019 | TRIMBLE INC | TRMB UW | 0.61% | 5/6/2019 | |

| JOHNSON & JOHNSON | JNJ UN | 1.57% | 4/16/2019 | DOMINO’S PIZZA INC | DPZ UN | 0.61% | 4/25/2019 | |

| ALPHABET INC-CL C | GOOG UW | 1.55% | 4/29/2019 | PTC INC | PTC UW | 0.60% | 4/17/2019 | |

| ALPHABET INC-CL A | GOOGL UW | 1.52% | 4/29/2019 | CAMDEN PROPERTY TRUST | CPT UN | 0.59% | 5/5/2019 | |

| EXXON MOBIL CORP | XOM UN | 1.46% | 4/26/2019 | UGI CORP | UGI UN | 0.59% | 5/1/2019 | |

| JPMORGAN CHASE & CO | JPM UN | 1.39% | 4/12/2019 | NVR INC | NVR UN | 0.58% | 4/18/2019 | |

| Related Funds: | Related Funds: | |||||||

| Russell 2000® Index (RU20INTR) | Russell 1000 Financial Services Index (RGUSFLA) | |||||||

| Top 10 Weights | Ticker | Weight in the index | Expected Earnings Release | Top 10 Weights | Ticker | Weight in the index | Expected Earnings Release | |

| ETSY INC | ETSY UW | 0.40% | 5/7/2019 | BERKSHIRE HATHAWAY INC-CL B | BRK/B UN | 7.38% | 5/6/2019 | |

| FIVE BELOW | FIVE UW | 0.32% | 3/27/2019 | JPMORGAN CHASE & CO | JPM UN | 6.28% | 4/12/2019 | |

| INTEGRATED DEVICE TECH INC | IDTI UW | 0.32% | 4/29/2019 | VISA INC-CLASS A SHARES | V UN | 5.20% | 4/24/2019 | |

| TRADE DESK INC/THE -CLASS A | TTD UQ | 0.31% | 5/9/2019 | BANK OF AMERICA CORP | BAC UN | 4.66% | 4/16/2019 | |

| HUBSPOT INC | HUBS UN | 0.31% | 5/9/2019 | MASTERCARD INC – A | MA UN | 4.03% | 5/1/2019 | |

| PLANET FITNESS INC – CL A | PLNT UN | 0.29% | 5/7/2019 | WELLS FARGO & CO | WFC UN | 3.84% | 4/12/2019 | |

| CREE INC | CREE UW | 0.29% | 5/1/2019 | CITIGROUP INC | C UN | 2.76% | 4/15/2019 | |

| CIENA CORP | CIEN UN | 0.27% | 5/30/2019 | PAYPAL HOLDINGS INC | PYPL UW | 2.30% | 4/24/2019 | |

| PRIMERICA INC | PRI UN | 0.26% | 5/7/2019 | AMERICAN TOWER CORP | AMT UN | 1.62% | 5/1/2019 | |

| COUPA SOFTWARE INC | COUP UW | 0.25% | 6/3/2019 | AMERICAN EXPRESS CO | AXP UN | 1.45% | 4/18/2019 | |

| Related Funds: | Related Funds: | |||||||

| Technology Select Sector Index (IXTTR) | Health Care Select Sector Index (IXVTR) | |||||||

| Top 10 Weights | Ticker | Weight in the index | Expected Earnings Release | Top 10 Weights | Ticker | Weight in the index | Expected Earnings Release | |

| MICROSOFT CORP | MSFT UW | 18.22% | 5/1/2019 | JOHNSON & JOHNSON | JNJ UN | 10.79% | 4/16/2019 | |

| APPLE INC | AAPL UW | 16.85% | 4/30/2019 | PFIZER INC | PFE UN | 6.89% | 4/30/2019 | |

| VISA INC-CLASS A SHARES | V UN | 5.47% | 4/24/2019 | UNITEDHEALTH GROUP INC | UNH UN | 6.83% | 4/16/2019 | |

| INTEL CORP | INTC UW | 4.84% | 4/25/2019 | MERCK & CO. INC. | MRK UN | 6.26% | 4/30/2019 | |

| CISCO SYSTEMS INC | CSCO UW | 4.72% | 5/15/2019 | ABBOTT LABORATORIES | ABT UN | 4.06% | 4/17/2019 | |

| MASTERCARD INC – A | MA UN | 4.24% | 5/1/2019 | MEDTRONIC PLC | MDT UN | 3.57% | 5/23/2019 | |

| ORACLE CORP | ORCL UN | 2.73% | 6/18/2019 | ABBVIE INC | ABBV UN | 3.48% | 5/2/2019 | |

| ADOBE INC | ADBE UW | 2.61% | 6/18/2019 | AMGEN INC | AMGN UW | 3.43% | 4/23/2019 | |

| INTL BUSINESS MACHINES CORP | IBM UN | 2.51% | 4/16/2019 | ELI LILLY & CO | LLY UN | 3.31% | 4/30/2019 | |

| SALESFORCE.COM INC | CRM UN | 2.46% | 5/28/2019 | THERMO FISHER SCIENTIFIC INC | TMO UN | 3.19% | 4/24/2019 | |

| Related Funds: | Related Funds: | |||||||

| S&P Consumer Discretionary Index (IXYTR) | S&P Consumer Staples Index (IXRTR) | |||||||

| Top 10 Weights | Ticker | Weight in the index | Expected Earnings Release | Top 10 Weights | Ticker | Weight in the index | Expected Earnings Release | |

| AMAZON.COM INC | AMZN UW | 24.27% | 4/25/2019 | PROCTER & GAMBLE CO/THE | PG UN | 14.98% | 4/23/2019 | |

| HOME DEPOT INC | HD UN | 9.87% | 5/21/2019 | COCA-COLA CO/THE | KO UN | 10.43% | 4/23/2019 | |

| MCDONALD’S CORP | MCD UN | 6.62% | 4/30/2019 | PEPSICO INC | PEP UW | 9.96% | 4/17/2019 | |

| NIKE INC -CL B | NKE UN | 4.84% | 6/27/2019 | WALMART INC | WMT UN | 8.14% | 5/16/2019 | |

| STARBUCKS CORP | SBUX UW | 4.19% | 4/25/2019 | MONDELEZ INTERNATIONAL INC-A | MDLZ UW | 4.63% | 4/30/2019 | |

| LOWE’S COS INC | LOW UN | 3.92% | 5/22/2019 | COSTCO WHOLESALE CORP | COST UW | 4.54% | 5/30/2019 | |

| BOOKING HOLDINGS INC | BKNG UW | 3.67% | 5/8/2019 | ALTRIA GROUP INC | MO UN | 4.46% | 4/25/2019 | |

| TJX COMPANIES INC | TJX UN | 3.02% | 5/21/2019 | PHILIP MORRIS INTERNATIONAL | PM UN | 4.39% | 4/18/2019 | |

| GENERAL MOTORS CO | GM UN | 2.23% | 4/30/2019 | COLGATE-PALMOLIVE CO | CL UN | 4.05% | 4/26/2019 | |

| TARGET CORP | TGT UN | 1.92% | 5/22/2019 | WALGREENS BOOTS ALLIANCE INC | WBA UW | 3.48% | 4/2/2019 | |

| Related Funds: | Related Funds: | |||||||

| S&P Industrials Select Sector Index (IXITR) | S&P Energy Select Sector Index (IXETR) | |||||||

| Top 10 Weights | Ticker | Weight in the index | Expected Earnings Release | Top 10 Weights | Ticker | Weight in the index | Expected Earnings Release | |

| BOEING CO/THE | BA UN | 8.86% | 4/24/2019 | EXXON MOBIL CORP | XOM UN | 22.48% | 4/26/2019 | |

| 3M CO | MMM UN | 5.43% | 4/23/2019 | CHEVRON CORP | CVX UN | 19.35% | 4/26/2019 | |

| UNION PACIFIC CORP | UNP UN | 5.32% | 4/18/2019 | CONOCOPHILLIPS | COP UN | 6.38% | 4/26/2019 | |

| HONEYWELL INTERNATIONAL INC | HON UN | 5.23% | 4/18/2019 | EOG RESOURCES INC | EOG UN | 4.55% | 5/2/2019 | |

| UNITED TECHNOLOGIES CORP | UTX UN | 4.65% | 4/23/2019 | SCHLUMBERGER LTD | SLB UN | 4.48% | 4/18/2019 | |

| GENERAL ELECTRIC CO | GE UN | 4.00% | 4/18/2019 | OCCIDENTAL PETROLEUM CORP | OXY UN | 4.16% | 5/7/2019 | |

| CATERPILLAR INC | CAT UN | 3.45% | 4/24/2019 | MARATHON PETROLEUM CORP | MPC UN | 3.46% | 4/29/2019 | |

| UNITED PARCEL SERVICE-CL B | UPS UN | 3.43% | 4/25/2019 | PHILLIPS 66 | PSX UN | 3.40% | 4/30/2019 | |

| LOCKHEED MARTIN CORP | LMT UN | 3.30% | 4/23/2019 | KINDER MORGAN INC | KMI UN | 3.24% | 4/17/2019 | |

| CSX CORP | CSX UW | 2.58% | 4/16/2019 | VALERO ENERGY CORP | VLO UN | 3.01% | 4/25/2019 | |

| Related Funds: | Related Funds: | |||||||

| S&P Utilities Select Sector Index (IXUTR) | Dynamic Pharmaceutical Intellidex Index (DZRTR) | |||||||

| Top 10 Weights | Ticker | Weight in the index | Expected Earnings Release | Top 10 Weights | Ticker | Weight in the index | Expected Earnings Release | |

| NEXTERA ENERGY INC | NEE UN | 11.70% | 4/23/2019 | ELI LILLY & CO | LLY US | 5.41% | 4/30/2019 | |

| DUKE ENERGY CORP | DUK UN | 8.35% | 5/9/2019 | ABBOTT LABORATORIES | ABT US | 5.33% | 4/17/2019 | |

| DOMINION ENERGY INC | D UN | 7.71% | 4/26/2019 | MERCK & CO. INC. | MRK US | 5.27% | 4/30/2019 | |

| SOUTHERN CO/THE | SO UN | 6.82% | 5/1/2019 | JOHNSON & JOHNSON | JNJ US | 5.19% | 4/16/2019 | |

| EXELON CORP | EXC UN | 6.17% | 5/1/2019 | AMGEN INC | AMGN US | 5.15% | 4/23/2019 | |

| AMERICAN ELECTRIC POWER | AEP UN | 5.32% | 4/25/2019 | PFIZER INC | PFE US | 5.11% | 4/30/2019 | |

| SEMPRA ENERGY | SRE UN | 4.31% | 5/6/2019 | BRISTOL-MYERS SQUIBB CO | BMY US | 4.89% | 4/25/2019 | |

| PUBLIC SERVICE ENTERPRISE GP | PEG UN | 3.80% | 4/29/2019 | BIOGEN INC | BIIB US | 3.68% | 4/24/2019 | |

| XCEL ENERGY INC | XEL UW | 3.70% | 4/25/2019 | HORIZON PHARMA PLC | HZNP US | 3.47% | 5/8/2019 | |

| CONSOLIDATED EDISON INC | ED UN | 3.45% | 5/2/2019 | ALLERGAN PLC | AGN US | 3.03% | 4/26/2019 | |

| Related Funds: | Related Funds: | |||||||

| S&P Retail Select Industry Index (SPSIRETR) | S&P Biotechnology Select Industry Index (SPSIBITR) | |||||||

| Top 10 Weights | Ticker | Weight in the index | Expected Earnings Release | Top 10 Weights | Ticker | Weight in the index | Expected Earnings Release | |

| CARVANA CO | CVNA UN | 1.36% | 5/8/2019 | LIGAND PHARMACEUTICALS | LGND UQ | 1.75% | 5/7/2019 | |

| ULTA BEAUTY INC | ULTA UW | 1.30% | 5/30/2019 | MIRATI THERAPEUTICS INC | MRTX UW | 1.72% | 5/7/2019 | |

| ADVANCE AUTO PARTS INC | AAP UN | 1.29% | 5/23/2019 | IONIS PHARMACEUTICALS INC | IONS UW | 1.72% | 5/3/2019 | |

| AMAZON.COM INC | AMZN UW | 1.28% | 4/25/2019 | NEUROCRINE BIOSCIENCES INC | NBIX UW | 1.71% | 4/29/2019 | |

| TIFFANY & CO | TIF UN | 1.27% | 6/4/2019 | IMMUNOMEDICS INC | IMMU UQ | 1.67% | 5/9/2019 | |

| OFFICE DEPOT INC | ODP UW | 1.26% | 5/8/2019 | INTERCEPT PHARMACEUTICALS IN | ICPT UW | 1.66% | 5/7/2019 | |

| L BRANDS INC | LB UN | 1.25% | 5/22/2019 | BLUEBIRD BIO INC | BLUE UW | 1.66% | 5/1/2019 | |

| BJ’S WHOLESALE CLUB HOLDINGS | BJ UN | 1.25% | 6/15/2019 | SEATTLE GENETICS INC | SGEN UW | 1.64% | 4/25/2019 | |

| CARMAX INC | KMX UN | 1.25% | 3/29/2019 | SAGE THERAPEUTICS INC | SAGE UQ | 1.64% | 5/2/2019 | |

| STITCH FIX INC-CLASS A | SFIX UW | 1.25% | 6/10/2019 | ARRAY BIOPHARMA INC | ARRY UQ | 1.63% | 5/7/2019 | |

| Related Funds: | Related Funds: | |||||||

| S&P Oil & Gas Exploration and Production Index (SPSIOP) | S&P Regional Banks Select Industry Index (SPSIRBKT) | |||||||

| Top 10 Weights | Ticker | Weight in the index | Expected Earnings Release | Top 10 Weights | Ticker | Weight in the index | Expected Earnings Release | |

| CALIFORNIA RESOURCES CORP | CRC UN | 2.43% | 5/2/2019 | FIRST REPUBLIC BANK/CA | FRC UN | 1.84% | 4/12/2019 | |

| OASIS PETROLEUM INC | OAS UN | 2.27% | 5/6/2019 | CIT GROUP INC | CIT UN | 1.80% | 4/23/2019 | |

| DEVON ENERGY CORP | DVN UN | 2.26% | 5/1/2019 | PNC FINANCIAL SERVICES GROUP | PNC UN | 1.78% | 4/12/2019 | |

| NOBLE ENERGY INC | NBL UN | 2.23% | 4/30/2019 | SIGNATURE BANK | SBNY UW | 1.78% | 4/18/2019 | |

| CHESAPEAKE ENERGY CORP | CHK UN | 2.23% | 5/1/2019 | STERLING BANCORP/DE | STL UN | 1.78% | 4/23/2019 | |

| WHITING PETROLEUM CORP | WLL UN | 2.19% | 4/30/2019 | PEOPLE’S UNITED FINANCIAL | PBCT UW | 1.77% | 4/18/2019 | |

| RANGE RESOURCES CORP | RRC UN | 2.16% | 4/25/2019 | CULLEN/FROST BANKERS INC | CFR UN | 1.76% | 4/25/2019 | |

| SM ENERGY CO | SM UN | 2.15% | 5/2/2019 | PACWEST BANCORP | PACW UW | 1.76% | 4/16/2019 | |

| WPX ENERGY INC | WPX UN | 2.15% | 5/1/2019 | FIFTH THIRD BANCORP | FITB UW | 1.74% | 4/23/2019 | |

| APACHE CORP | APA UN | 2.13% | 5/1/2019 | FIRST HORIZON NATIONAL CORP | FHN UN | 1.74% | 4/12/2019 | |

| Related Funds: | Related Funds: | |||||||

| MSCI US REIT Index (RMSG) | PHLX Semiconductor Sector Index (XSOX) | |||||||

| Top 10 Weights | Ticker | Weight in the index | Expected Earnings Release | Top 10 Weights | Ticker | Weight in the index | Expected Earnings Release | |

| SIMON PROPERTY GROUP INC | SPG UN | 6.14% | 4/25/2019 | NVIDIA CORP | NVDA UW | 8.85% | 5/15/2019 | |

| PROLOGIS INC | PLD UN | 4.97% | 4/16/2019 | QUALCOMM INC | QCOM UW | 8.39% | 5/1/2019 | |

| EQUINIX INC | EQIX UW | 3.94% | 5/1/2019 | BROADCOM INC | AVGO UW | 8.33% | 6/6/2019 | |

| PUBLIC STORAGE | PSA UN | 3.78% | 4/25/2019 | TEXAS INSTRUMENTS INC | TXN UW | 7.91% | 4/23/2019 | |

| WELLTOWER INC | WELL UN | 3.24% | 4/28/2019 | INTEL CORP | INTC UW | 7.79% | 4/25/2019 | |

| AVALONBAY COMMUNITIES INC | AVB UN | 3.04% | 4/25/2019 | ADVANCED MICRO DEVICES | AMD UW | 4.22% | 4/24/2019 | |

| EQUITY RESIDENTIAL | EQR UN | 3.03% | 4/30/2019 | TAIWAN SEMICONDUCTOR-SP ADR | TSM UN | 3.99% | 4/18/2019 | |

| DIGITAL REALTY TRUST INC | DLR UN | 2.68% | 4/28/2019 | APPLIED MATERIALS INC | AMAT UW | 3.99% | 5/16/2019 | |

| VENTAS INC | VTR UN | 2.54% | 4/25/2019 | LAM RESEARCH CORP | LRCX UW | 3.95% | 4/24/2019 | |

| REALTY INCOME CORP | O UN | 2.39% | 5/8/2019 | XILINX INC | XLNX UW | 3.90% | 4/24/2019 | |

| Related Funds: | Related Funds: | |||||||

| Dow Jones Transportation Average (DJTTR) | Dow Jones U.S. Select Aerospace & Defense Index (DJSASDT) | |||||||

| Top 10 Weights | Ticker | Weight in the index | Expected Earnings Release | Top 10 Weights | Ticker | Weight in the index | Expected Earnings Release | |

| NORFOLK SOUTHERN CORP | NSC UN | 10.94% | 4/24/2019 | BOEING CO/THE | BA UN | 20.60% | 4/24/2019 | |

| FEDEX CORP | FDX UN | 10.56% | 6/25/2019 | UNITED TECHNOLOGIES CORP | UTX UN | 17.43% | 4/23/2019 | |

| UNION PACIFIC CORP | UNP UN | 9.76% | 4/18/2019 | LOCKHEED MARTIN CORP | LMT UN | 6.12% | 4/23/2019 | |

| KANSAS CITY SOUTHERN | KSU UN | 6.86% | 4/17/2019 | TRANSDIGM GROUP INC | TDG UN | 4.49% | 5/7/2019 | |

| UNITED PARCEL SERVICE-CL B | UPS UN | 6.54% | 4/25/2019 | GENERAL DYNAMICS CORP | GD UN | 4.31% | 4/24/2019 | |

| LANDSTAR SYSTEM INC | LSTR UW | 6.43% | 4/24/2019 | L3 TECHNOLOGIES INC | LLL UN | 4.30% | 5/1/2019 | |

| HUNT (JB) TRANSPRT SVCS INC | JBHT UW | 5.92% | 4/15/2019 | RAYTHEON COMPANY | RTN UN | 4.28% | 4/25/2019 | |

| C.H. ROBINSON WORLDWIDE INC | CHRW UW | 5.16% | 5/7/2019 | HARRIS CORP | HRS UN | 4.27% | 5/1/2019 | |

| UNITED CONTINENTAL HOLDINGS | UAL UW | 4.67% | 4/16/2019 | NORTHROP GRUMMAN CORP | NOC UN | 4.07% | 4/24/2019 | |

| KIRBY CORP | KEX UN | 4.59% | 4/24/2019 | TEXTRON INC | TXT UN | 3.11% | 4/17/2019 | |

| Related Funds: | Related Funds: | |||||||

| ISE Natural Gas Index (FUMTR) | Dow Jones U.S. Select Home Builders Index (DJSHMBT) | |||||||

| Top 10 Weights | Ticker | Weight in the index | Expected Earnings Release | Top 10 Weights | Ticker | Weight in the index | Expected Earnings Release | |

| NOBLE ENERGY INC | NBL UN | 4.94% | 4/30/2019 | DR HORTON INC | DHI UN | 14.03% | 4/25/2019 | |

| EQT CORP | EQT UN | 4.84% | 4/25/2019 | LENNAR CORP-A | LEN UN | 13.51% | 3/27/2019 | |

| CABOT OIL & GAS CORP | COG UN | 4.67% | 4/26/2019 | NVR INC | NVR UN | 9.54% | 4/18/2019 | |

| DEVON ENERGY CORP | DVN UN | 4.67% | 5/1/2019 | PULTEGROUP INC | PHM UN | 6.93% | 4/23/2019 | |

| RANGE RESOURCES CORP | RRC UN | 4.51% | 4/25/2019 | TOLL BROTHERS INC | TOL UN | 4.85% | 5/21/2019 | |

| MURPHY OIL CORP | MUR UN | 4.41% | 5/1/2019 | LOWE’S COS INC | LOW UN | 4.52% | 5/22/2019 | |

| ENCANA CORP | ECA UN | 4.34% | 5/1/2019 | HOME DEPOT INC | HD UN | 4.48% | 5/21/2019 | |

| NATIONAL FUEL GAS CO | NFG UN | 4.32% | 5/2/2019 | SHERWIN-WILLIAMS CO/THE | SHW UN | 3.29% | 4/23/2019 | |

| CONCHO RESOURCES INC | CXO UN | 4.30% | 5/5/2019 | MASCO CORP | MAS UN | 2.64% | 4/25/2019 | |

| ANTERO RESOURCES CORP | AR UN | 4.28% | 4/24/2019 | LENNOX INTERNATIONAL INC | LII UN | 2.35% | 4/22/2019 | |

| Related Funds: | Related Funds: | |||||||

ETFs are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk, consequences of seeking daily leveraged investment results and intend to actively monitor and manage their investments. Due to the daily nature of the leverage employed, there is no guarantee of amplified long-term returns. Past performance is not indicative of future results.

An investor should consider the investment objectives, risks, charges, and expenses of Direxion Shares carefully before investing. The prospectus and summary prospectus contain this and other information about Direxion Shares. Click here to obtain a prospectus or contact Direxion at (877) 437-9363. The prospectus or summary prospectus should be read carefully before investing.

Direxion Shares Risks – An investment in the ETFs involves risk, including the possible loss of principal. Each ETF is non-diversified and includes risks associated with the ETF concentrating its investments in a particular industry, sector, or geographic region which can result in increased volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. Each Fund does not attempt to, and should not be expected to, provide returns which are a multiple of the return of their underlying index for periods other than a single day. Risks of each Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Counterparty Risk, Intra-Day Investment Risk, for each Bull Fund, Daily Index Correlation/Tracking Risk and Other Investment Companies (including ETFs) Risk, for each Bear Fund, Daily Inverse Index Correlation/Tracking Risk and risks related to Shorting and Cash Transactions. In addition to these risks, there are risks associated with an ETF’s investment in a specific sector, industry, or stocks that comprise each Fund’s underlying index. Please see the summary and full prospectuses for a more complete description of these and other risks of each Fund.

The views in this material represent an assessment of the current market conditions and is not intended to be a forecast of future events. These views are intended to educated the reader and do not constitute investment advice regarding the funds or any security in particular. Past performance does not guarantee future results.