Leverage-hungry traders can position themselves between large cap stability and small cap momentum with the Direxion Daily Mid Cap Bull 3X Shares (MIDU).

MIDU seeks daily investment results, before fees and expenses, of 300% of the daily performance of the S&P MidCap 400 Index. The fund, under normal circumstances, invests at least 80% of its net assets (plus borrowing for investment purposes) in financial instruments, such as swap agreements, and securities of the index, ETFs that track the index, and other financial instruments that provide daily leveraged exposure to the index or ETFs that track the index.

The index measures the performance of 400 mid-sized companies in the United States. With the extra leverage, MIDU has been doling out big gains, up 63% year-to-date.

Even without the leverage, the mid cap-focused S&P 400 index is up 19%. Both domestic and international investors could be wise to take note.

“Foreign investors actively participate in U.S. equity markets, but like their American counterparts, the international investors tend to be partial to large caps,” a Nasdaq article said. “That means they’re missing out on opportunities with smaller stocks, including mid caps.”

“As investors look over their equity market exposure, they may find that large cap stock positions are too big for rapid growth and small caps too susceptible to volatile short-term moves,” the article added further. “Middle-capitalization stocks, sometimes referred to as the market’s sweet spot, can help investors achieve improved risk-adjusted returns.”

As for Large- and Small-Cap Options…

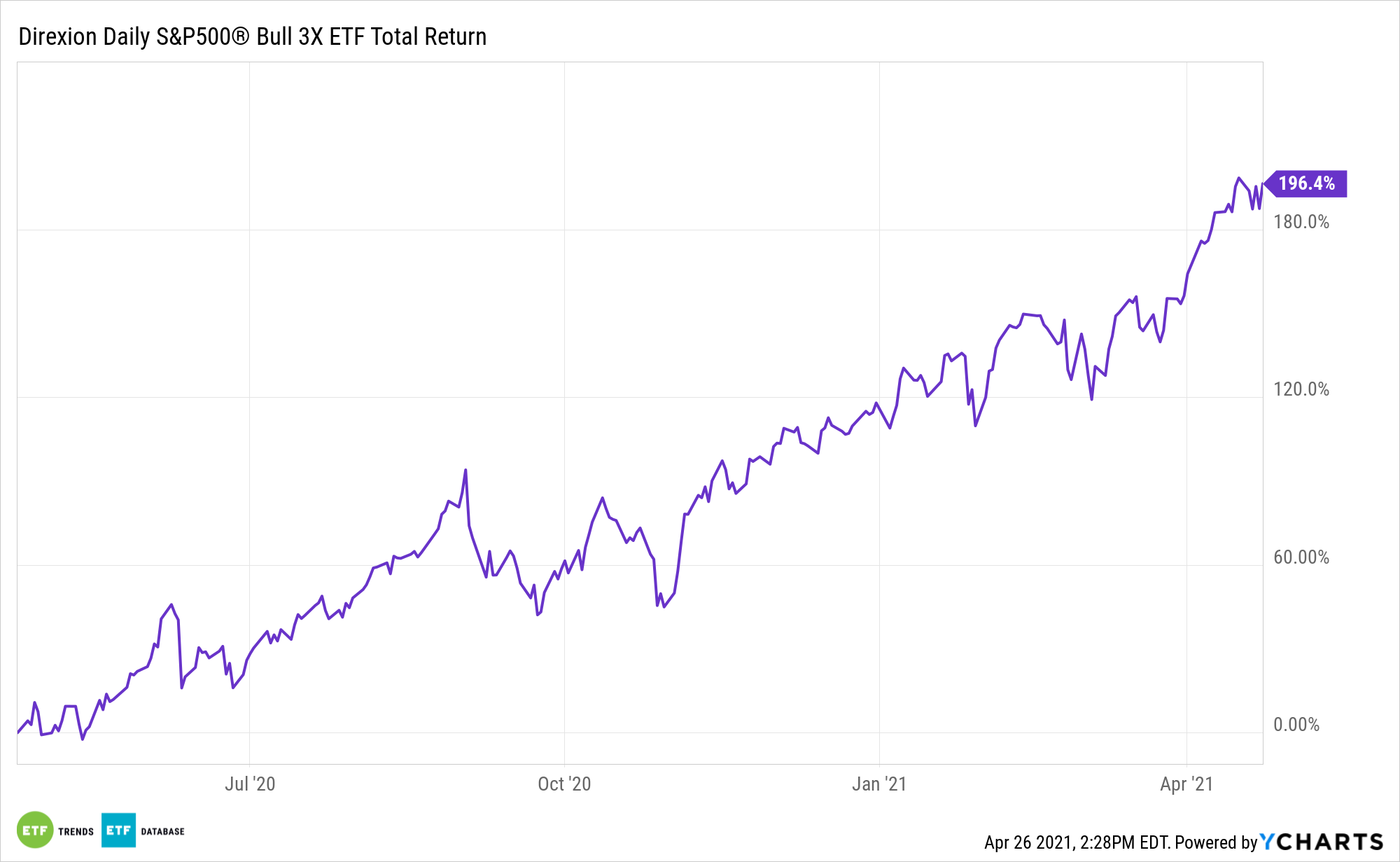

Direxion also offers large- and small-cap leveraged options for traders to consider. For those seeking exposure to large caps, there’s the Direxion Daily S&P 500® Bull 3X Shares ETF (SPXL).

SPXL, under normal circumstances, invests at least 80% of its net assets (plus borrowing for investment purposes) in financial instruments, such as swap agreements, and securities of the index, ETFs) that track the index, and other financial instruments that provide daily leveraged exposure to the index or ETFs that track the index.

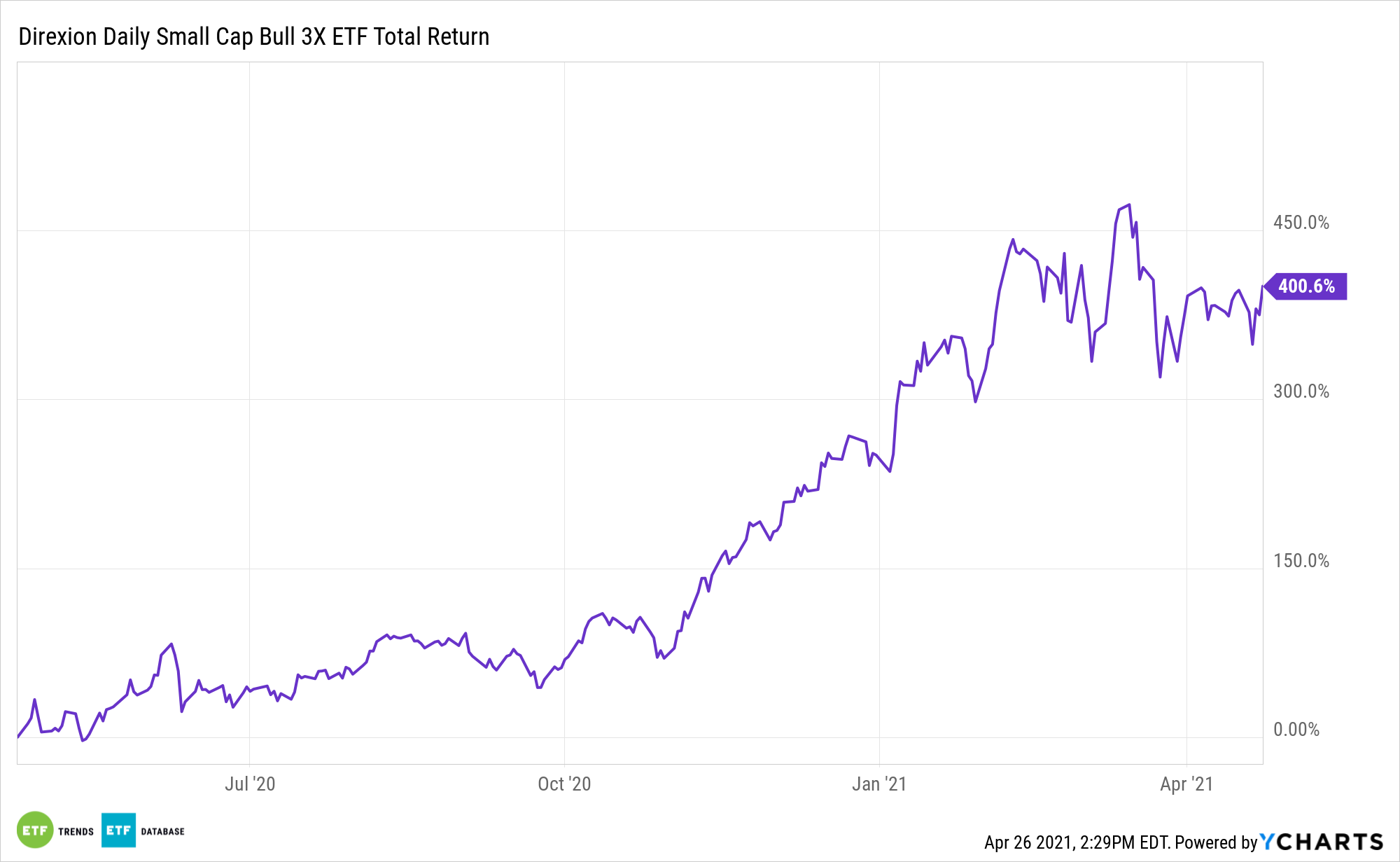

Traders basking in market volatility can opt for the high beta movements of small caps. The Direxion Daily Small Cap Bull 3X Shares (TNA) tracks the Russell 2000 Index and seeks daily investment results equal to 300% of the daily performance of the index.

For more news and information, visit the Leveraged & Inverse Channel.