A positive sign that the economy is moving again is if it’s literally moving via the transportation sector. For example, the Direxion Daily Transportation Bull 3X Shares (NYSEArca: TPOR) has been on the rise as of late, which could portend to the economy returning to normal following the Covid-19 pandemic.

TPOR seeks daily investment results equal to 300 percent of the daily performance of the Dow Jones Transportation Average. The index measures the performance of large, well-known companies within the transportation industry.

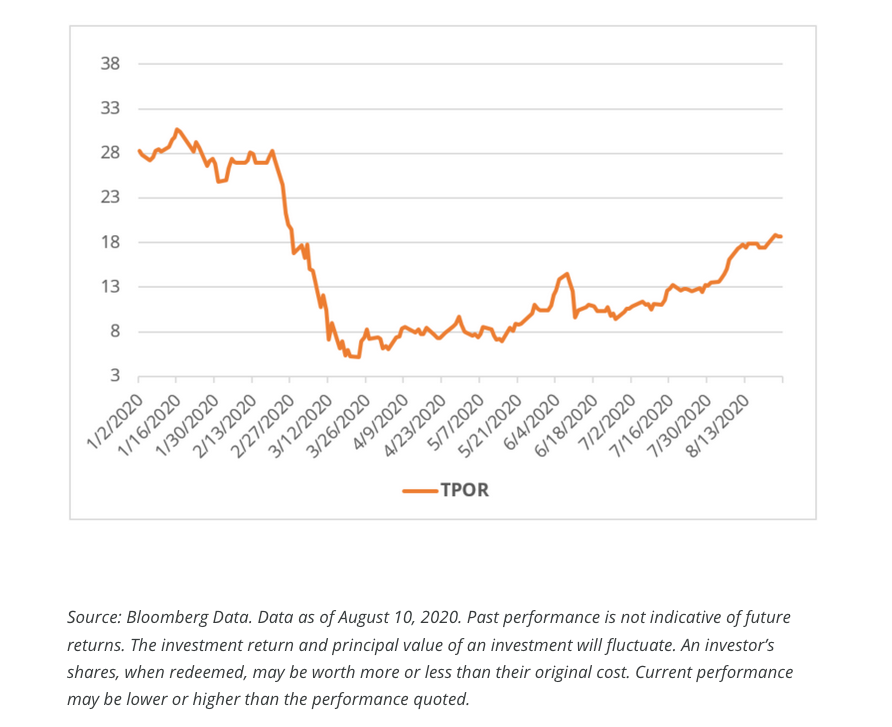

“In a surprising show of resilience in the face of hardship, the transportation sector managed to squeeze up substantially through July on the back of signs of hope in the financial results of many of its components,” a Direxion Investments “The Xchange” article noted. “As shown in the chart for the Direxion Daily Transportation Bull 3X Shares (TPOR) — which tracks 300% the daily returns of the Dow Jones Transportation Average— the broad sector is pushing a new six-month high on the back of a string of encouraging reports from the index’s biggest players.”

“July earnings deliveries from freight and logistics companies led off the recent rally,” the article noted further. “JB Hunt Transportation Services Inc. (JBHT) led off the segment by topping analyst estimates and surging to a new all-time high. Although revenue was down from Q2 2019, analysts saw long-term growth potential thanks to the company’s ability to maintain solid operating margins.”

Non-leveraged transportation ETFs to watch:

- iShares Transportation Average ETF (NYSEArca: IYT): seeks to track the investment results of the Dow Jones Transportation Average Index composed of U.S. equities in the transportation sector. The underlying index measures the performance of large, well-known companies within the transportation sector of the U.S. equity market.

- SPDR S&P Transportation ETF (NYSEArca: XTN): seeks to provide investment results that correspond generally to the total return performance of an index derived from the transportation segment of a U.S. total market composite index. The index represents the transportation segment of the S&P Total Market Index (“S&P TMI”).

- US Global Jets ETF (NYSEArca: JETS): seeks to track the performance of the U.S. Global Jets Index, which is composed of the exchange-listed common stock (or depository receipts) of U.S. and international passenger airlines, aircraft manufacturers, airports, and terminal services companies across the globe.

“While transportation is not typically a resilient sector during a recession, their role as essential services and their adoption of advanced logistics services have proven critical during this time of uncertainty and may again should the remainder of 2020 turn out like the first half,” the Direxion article said.

For more real estate trends, visit ETFTrends.com.