The coronavirus pandemic may have pumped the brakes on the economy en route to a slow crawl back to pre-Covid 19 levels, but it could be small cap equities that could power the U.S. out of a virus-induced recession.

While in the long-term large cap outperformance versus call caps is apparent, particularly in the last few years, things change when the economy goes south. Since the pandemic sell-offs in March, small caps have rebounded to a greater degree compared to their large cap brethren.

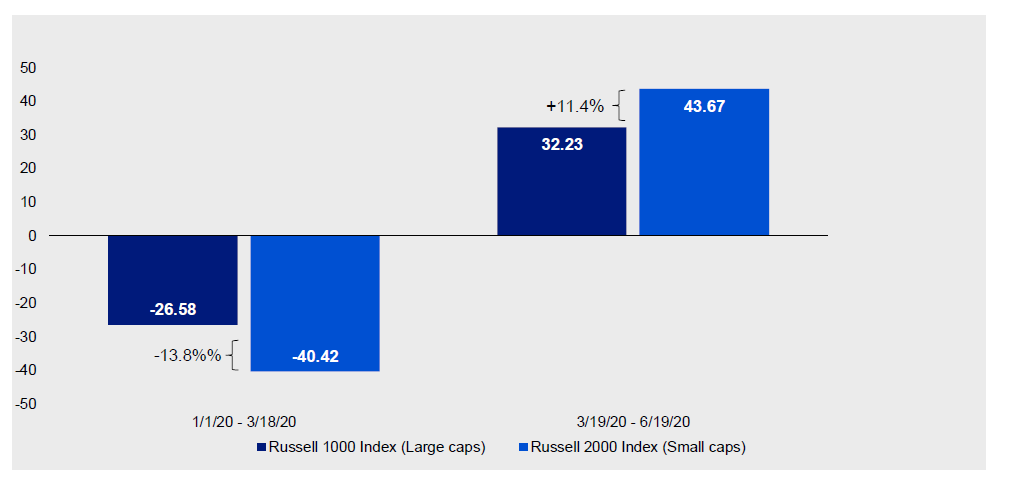

“Small-cap stocks have had a tough run versus the larger-cap cohort of the US equity market, having underperformed large caps three consecutive calendar years and four of the past five years (on the basis of the Russell 2000 Index representing small caps, and the Russell 1000 Index, large caps),” an Invesco blog noted. “After a tough start to 2020, things have improved for small caps as the initial COVID-19-related shock has begun to abate and signs of a recovery are noticeable. Since the March 18 trough, small caps have rebounded with a 43.7% gain, outpacing large caps by 11.4% (Figure 1, as of 6/19/20).”

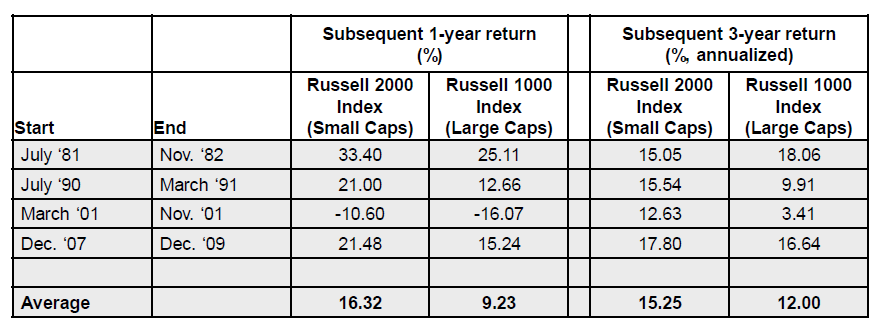

The blog also noted that while “the recovery from the economic impacts of the pandemic starts, small caps may have history on their side. As shown in Figure 2, small caps have outperformed large caps coming out of the past four recessions in all but one of the subsequent 1- and 3-year periods. Small caps outperformed, on average, by 7.09% for subsequent 1-year periods and 3.25% (annualized) for the ensuing 3-year periods.”

Leveraging Small Cap Strength

Given this, traders can utilize leveraged small cap exposure whether they feel small caps will continue to outperform as economies reopen or if they’ll digress and large caps run the show. In particular, traders can use the Direxion Daily Small Cap Bull (TNA) and Bear (TZA).

Both funds seek daily investment results, before fees and expenses, equal to 300%, or 300% of the inverse (or opposite), of the performance of the Russell 2000® Index. In general, whether you favor bullishness or bearishness, Direxion’s leveraged ETFs are powerful tools to help traders:

- Magnify short-term perspective with daily 3X leverage

- Capitalize on an opportunity with bull and bear funds for both sides of the trade

- Stay agile – with liquidity to trade through rapidly changing markets

For bullish traders who don’t want the 3x leverage, they can minimize their risk using the Daily Small Cap Bull 2X Shares (SMLL). SMLL seeks daily investment results, before fees and expenses, of 200% of the daily performance of the Russell 2000® Index.

The fund invests at least 80% of its net assets (plus borrowing for investment purposes) in financial instruments, such as swap agreements, and securities of the index, ETFs that track the index and other financial instruments that provide daily leveraged exposure to the index or ETFs that track the index. The index measures the performance of approximately 2,000 small-cap companies in the Russell 3000® Index, based on a combination of their market capitalization and current index membership.

For more market trends, visit ETF Trends.