Cryptocurrencies might be dominating the 24-hour news cycle, but exchange traded funds (ETFs) have been the unsung heroes in the capital markets as inflows continue, putting the spotlight on potential trades like the Direxion Daily S&P 500® Bull 3X Shares ETF (SPXL).

In the meantime, retail traders keep on piling into ETFs. Per a Financial Times article, the appetite for ETFs is causing “a record-breaking pace of inflows into exchange traded funds this year, suggesting that beyond their eye-catching forays into quirky individual stocks, they are also playing a role in cushioning broader declines in indices.”

Per the article, ETFs took in $249 billion during a pandemic-ridden 2020. There was no drop-off this year as ETFs have already taken in $305 billion based on numbers from research firm CFRA.

“Investors are not panicking when a sell-off takes place and most of the new money being deployed is for broad market ETFs that are building blocks for portfolios,” said Todd Rosenbluth, CFRA’s head of ETF and mutual fund research.

Trading the S&P 500 is one potential play retail traders can take one, but with the triple leverage of SPXL, only seasoned investors should use them. The fund seeks 300% of the performance of the S&P 500, and as such, it’s up about 41% on the year.

Momentum continues to be on SPXL’s side. The 50-day moving average continues to stay above the 200-day moving average, while the relative strength index (RSI) is still below overbought levels.

Buying the Dips

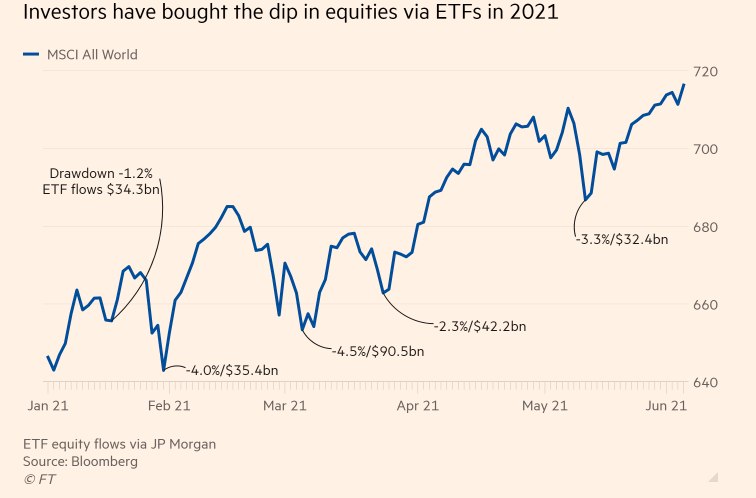

In terms of retail trading tendencies, it seems that ETF investors are keen to buying the dips. Per the Financial Time article, Bank of America noted that “the past 15 months have not brought a single 10 per cent correction to the S&P 500 index, usually an event that crops up at least once a year.”

In essence, retail trading has been able to provide the major indices with the support it needs to prevent extreme drawdowns like those witnessed during the pandemic sell-offs in early 2020. In effect, retail traders are at the ready when the markets fall, playing the dips and profiting at the peaks.

“Whenever there is an immediate drawdown in equities, retail comes in immediately to buy the dip,” said Eric Liu, an analyst at Vanda Research. “People default to ETFs as a way to buy the dip. And recently retail has been buying more ETFs than any other segment of the equity population.”

For more news and information, visit the Leveraged & Inverse Channel.