Even under the shadow of a vague China trade deal this week, markets took on a positive mood, as the focus moved away from headlines and macro events, toward earnings.

Reports from major banks were solid, small-caps have shown relative strength and some recently battered sectors like biotechnology and retail have ticked up. On Monday, the S&P 500 moved steadily higher during the day, albeit on lower volume, and Tuesday was relatively flat. But a large number of Q3 earnings reports continue for the next several weeks. The lion’s share of the S&P 500 will report in the next two weeks.

Of the companies that have already announced earnings through Friday (10/18/19), 81% posted earnings that beat analyst expectations. Should the trend continue, some traders think the index could test its all-time high.

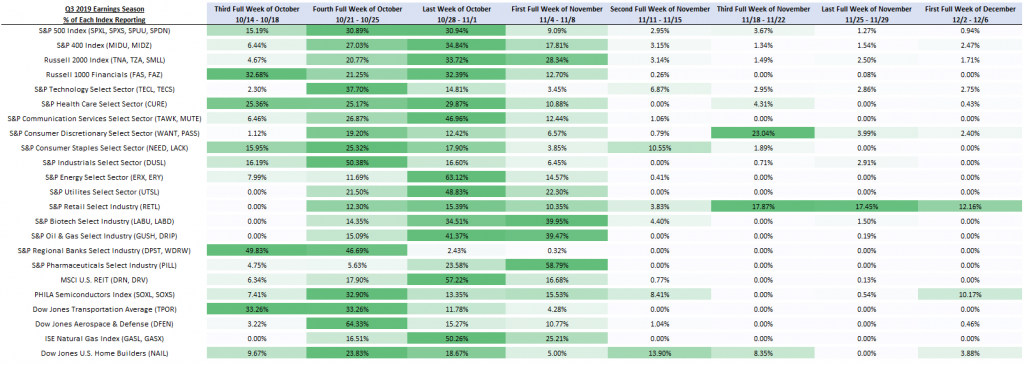

Below is a table identifying the percentage of names in each index reporting, arranged by trading week. Following that table is a list of Top Ten Holdings for key indexes, along with their earnings announcement dates, and corresponding bold trades using Direxion Leveraged ETFs.

Source: Bloomberg. Data as of 10/9/2019.

Q3 Quarterly Earnings Calendar

(All index data as of 9/30/2019)

| S&P 500 Index (SPXT) | S&P 400 Index (MID) | |||||||

| Top 10 Names | Ticker | Weight in the index | Expected Earnings Release | Top 10 Names | Ticker | Weight in the index | Expected Earnings Release | |

| Microsoft Corp | MSFT | 4.34% | 10/23/2019 | STERIS PLC | STE | 0.71% | 11/14/2019 | |

| Apple Inc | AAPL | 3.97% | 10/30/2019 | Teledyne Technologies Inc | TDY | 0.69% | 10/23/2019 | |

| Amazon.com Inc | AMZN | 2.95% | 10/24/2019 | Alleghany Corp | Y | 0.66% | 11/5/2019 | |

| Facebook Inc | FB | 1.78% | 10/30/2019 | Camden Property Trust | CPT | 0.65% | 10/31/2019 | |

| Berkshire Hathaway Inc | BRK/B | 1.66% | 11/4/2019 | Old Dominion Freight Line Inc | ODFL | 0.63% | 10/24/2019 | |

| Alphabet Inc | GOOG | 1.50% | 10/28/2019 | Zebra Technologies Corp | ZBRA | 0.63% | 10/29/2019 | |

| JPMorgan Chase & Co | JPM | 1.49% | 10/15/2019 | Domino’s Pizza Inc | DPZ | 0.62% | 2/20/2020 | |

| Alphabet Inc | GOOGL | 1.49% | 10/28/2019 | West Pharmaceutical Services Inc | WST | 0.62% | 10/24/2019 | |

| Johnson & Johnson | JNJ | 1.42% | 10/15/2019 | WR Berkley Corp | WRB | 0.62% | 10/22/2019 | |

| Procter & Gamble Co/The | PG | 1.26% | 10/22/2019 | Tyler Technologies Inc | TYL | 0.61% | 10/24/2019 | |

| Related Funds: | Related Funds: | |||||||

| Russell 2000® Index (RU20INTR) | Russell 1000 Financial Services Index (RGUSFLA) | |||||||

| Top 10 Names | Ticker | Weight in the index | Expected Earnings Release | Top 10 Names | Ticker | Weight in the index | Expected Earnings Release | |

| Haemonetics Corp | HAE | 0.34% | 11/1/2019 | Berkshire Hathaway Inc | BRK/B | 7.17% | 11/4/2019 | |

| Novocure Ltd | NVCR | 0.34% | 10/31/2019 | JPMorgan Chase & Co | JPM | 6.41% | 10/15/2019 | |

| Trex Co Inc | TREX | 0.28% | 10/28/2019 | Visa Inc | V | 5.44% | 10/24/2019 | |

| Portland General Electric Co | POR | 0.27% | 11/1/2019 | Mastercard Inc | MA | 4.36% | 10/29/2019 | |

| Generac Holdings Inc | GNRC | 0.27% | 10/30/2019 | Bank of America Corp | BAC | 4.20% | 10/16/2019 | |

| First Industrial Realty Trust Inc | FR | 0.27% | 10/23/2019 | Wells Fargo & Co | WFC | 3.43% | 10/15/2019 | |

| Science Applications International Corp | SAIC | 0.26% | 12/9/2019 | Citigroup Inc | C | 2.71% | 10/15/2019 | |

| ONE Gas Inc | OGS | 0.26% | 10/28/2019 | PayPal Holdings Inc | PYPL | 2.10% | 10/23/2019 | |

| Rexford Industrial Realty Inc | REXR | 0.26% | 10/30/2019 | American Tower Corp | AMT | 1.77% | 10/31/2019 | |

| Southwest Gas Holdings Inc | SWX | 0.26% | 11/5/2019 | Fidelity National Information Services Inc | FIS | 1.42% | 10/29/2019 | |

Related Funds:

|

Related Funds: | |||||||

| Technology Select Sector Index (IXTTR) | Health Care Select Sector Index (IXVTR) | |||||||

| Top 10 Names | Ticker | Weight in the index | Expected Earnings Release | Top 10 Names | Ticker | Weight in the index | Expected Earnings Release | |

| Microsoft Corp | MSFT | 19.59% | 10/23/2019 | Johnson & Johnson | JNJ | 10.36% | 10/15/2019 | |

| Visa Inc | V | 5.63% | 10/24/2019 | Merck & Co Inc | MRK | 6.48% | 10/29/2019 | |

| Mastercard Inc | MA | 4.53% | 10/29/2019 | UnitedHealth Group Inc | UNH | 6.34% | 10/15/2019 | |

| Intel Corp | INTC | 4.17% | 10/24/2019 | Pfizer Inc | PFE | 5.96% | 10/29/2019 | |

| Cisco Systems Inc | CSCO | 3.72% | 11/13/2019 | Medtronic PLC | MDT | 4.31% | 11/19/2019 | |

| Adobe Inc | ADBE | 2.47% | 12/12/2019 | Abbott Laboratories | ABT | 4.22% | 10/16/2019 | |

| salesforce.com Inc | CRM | 2.41% | 11/27/2019 | Amgen Inc | AMGN | 3.56% | 10/29/2019 | |

| International Business Machines Corp | IBM | 2.30% | 10/16/2019 | Thermo Fisher Scientific Inc | TMO | 3.34% | 10/23/2019 | |

| Oracle Corp | ORCL | 2.23% | 12/17/2019 | Eli Lilly & Co | LLY | 2.74% | 10/23/2019 | |

| Texas Instruments Inc | TXN | 2.21% | 10/22/2019 | Danaher Corp | DHR | 2.64% | 10/17/2019 | |

| Related Funds: | Related Funds: | |||||||

| S&P Consumer Discretionary Index (IXYTR) | S&P Consumer Staples Index (IXRTR) | |||||||

| Top 10 Names | Ticker | Weight in the index | Expected Earnings Release | Top 10 Names | Ticker | Weight in the index | Expected Earnings Release | |

| Home Depot Inc/The | HD | 11.06% | 11/19/2019 | Procter & Gamble Co/The | PG | 16.45% | 10/22/2019 | |

| McDonald’s Corp | MCD | 7.18% | 10/22/2019 | Coca-Cola Co/The | KO | 11.17% | 10/18/2019 | |

| NIKE Inc | NKE | 5.14% | 12/20/2019 | PepsiCo Inc | PEP | 10.34% | 2/14/2020 | |

| Starbucks Corp | SBUX | 4.56% | 10/30/2019 | Walmart Inc | WMT | 9.10% | 11/14/2019 | |

| Booking Holdings Inc | BKNG | 3.65% | 11/7/2019 | Philip Morris International Inc | PM | 4.77% | 10/17/2019 | |

| Lowe’s Cos Inc | LOW | 3.63% | 11/20/2019 | Mondelez International Inc | MDLZ | 4.69% | 10/23/2019 | |

| TJX Cos Inc/The | TJX | 3.00% | 11/19/2019 | Altria Group Inc | MO | 4.69% | 10/31/2019 | |

| Target Corp | TGT | 2.53% | 11/20/2019 | Costco Wholesale Corp | COST | 4.58% | 12/12/2019 | |

| General Motors Co | GM | 1.91% | 10/29/2019 | Colgate-Palmolive Co | CL | 3.58% | 11/1/2019 | |

| Dollar General Corp | DG | 1.84% | 11/27/2019 | Kimberly-Clark Corp | KMB | 2.80% | 10/22/2019 | |

| Related Funds: | Related Funds: | |||||||

| S&P Industrials Select Sector Index (IXITR) | S&P Energy Select Sector Index (IXETR) | |||||||

| Top 10 Names | Ticker | Weight in the index | Expected Earnings Release | Top 10 Names | Ticker | Weight in the index | Expected Earnings Release | |

| Boeing Co/The | BA | 9.01% | 10/23/2019 | Exxon Mobil Corp | XOM | 22.84% | 11/1/2019 | |

| Honeywell International Inc | HON | 5.17% | 10/17/2019 | Chevron Corp | CVX | 21.22% | 11/1/2019 | |

| Union Pacific Corp | UNP | 4.91% | 10/17/2019 | Phillips 66 | PSX | 4.71% | 10/25/2019 | |

| United Technologies Corp | UTX | 4.82% | 10/22/2019 | ConocoPhillips | COP | 4.62% | 10/29/2019 | |

| Lockheed Martin Corp | LMT | 4.31% | 10/22/2019 | EOG Resources Inc | EOG | 4.11% | 11/7/2019 | |

| 3M Co | MMM | 3.93% | 10/24/2019 | Marathon Petroleum Corp | MPC | 4.08% | 10/31/2019 | |

| United Parcel Service Inc | UPS | 3.58% | 10/22/2019 | Kinder Morgan Inc/DE | KMI | 4.01% | 10/16/2019 | |

| General Electric Co | GE | 3.27% | 10/30/2019 | Schlumberger Ltd | SLB | 3.98% | 10/18/2019 | |

| Caterpillar Inc | CAT | 3.02% | 10/23/2019 | Occidental Petroleum Corp | OXY | 3.75% | 11/6/2019 | |

| Northrop Grumman Corp | NOC | 2.63% | 10/24/2019 | Valero Energy Corp | VLO | 3.62% | 10/24/2019 | |

| Related Funds: | Related Funds: | |||||||

| S&P Utilities Select Sector Index (IXUTR) | S&P Communication Services Select Sector Index (IXUTR) | |||||||

| Top 10 Names | Ticker | Weight in the index | Expected Earnings Release | Top 10 Names | Ticker | Weight in the index | Expected Earnings Release | |

| NextEra Energy Inc | NEE | 12.90% | 10/22/2019 | Facebook Inc | FB | 18.37% | 10/30/2019 | |

| Duke Energy Corp | DUK | 7.97% | 11/8/2019 | Alphabet Inc | GOOG | 11.72% | 10/28/2019 | |

| Dominion Energy Inc | D | 7.60% | 11/1/2019 | Alphabet Inc | GOOGL | 11.63% | 10/28/2019 | |

| Southern Co/The | SO | 7.34% | 10/30/2019 | Charter Communications Inc | CHTR | 4.76% | 10/25/2019 | |

| Exelon Corp | EXC | 5.28% | 10/31/2019 | Verizon Communications Inc | VZ | 4.65% | 10/25/2019 | |

| Sempra Energy | SRE | 4.59% | 11/8/2019 | AT&T Inc | T | 4.61% | 10/23/2019 | |

| Xcel Energy Inc | XEL | 3.81% | 10/24/2019 | Comcast Corp | CMCSA | 4.46% | 10/24/2019 | |

| Public Service Enterprise Group Inc | PEG | 3.54% | 10/30/2019 | Walt Disney Co/The | DIS | 4.40% | 11/7/2019 | |

| Consolidated Edison Inc | ED | 3.53% | 10/31/2019 | Netflix Inc | NFLX | 4.27% | 10/16/2019 | |

| WEC Energy Group Inc | WEC | 3.40% | 10/30/2019 | Twitter Inc | TWTR | 4.09% | 10/25/2019 | |

| Related Funds: | Related Funds: | |||||||

| S&P Retail Select Industry Index (SPSIRETR) | S&P Pharmaceuticals Select Industry Index (SPSIPHTR) | |||||||

| Top 10 Names | Ticker | Weight in the index | Expected Earnings Release | Top 10 Names | Ticker | Weight in the index | Expected Earnings Release | |

| Hibbett Sports Inc | HIBB | 1.67% | 11/22/2019 | Zoetis Inc | ZTS | 5.00% | 11/7/2019 | |

| GameStop Corp | GME | 1.60% | 12/5/2019 | Bristol-Myers Squibb Co | BMY | 4.92% | 10/31/2019 | |

| Rite Aid Corp | RAD | 1.50% | 12/26/2019 | Merck & Co Inc | MRK | 4.89% | 10/29/2019 | |

| Ulta Beauty Inc | ULTA | 1.44% | 12/5/2019 | Horizon Therapeutics Plc | HZNP | 4.87% | 11/6/2019 | |

| Target Corp | TGT | 1.42% | 11/20/2019 | Johnson & Johnson | JNJ | 4.75% | 10/15/2019 | |

| Foot Locker Inc | FL | 1.42% | 11/22/2019 | Eli Lilly & Co | LLY | 4.65% | 10/23/2019 | |

| Dollar General Corp | DG | 1.41% | 11/27/2019 | Pfizer Inc | PFE | 4.65% | 10/29/2019 | |

| Costco Wholesale Corp | COST | 1.40% | 12/12/2019 | Catalent Inc | CTLT | 4.51% | 11/5/2019 | |

| Sally Beauty Holdings Inc | SBH | 1.40% | 11/7/2019 | Elanco Animal Health Inc | ELAN | 4.51% | 11/6/2019 | |

| Dillard’s Inc | DDS | 1.40% | 11/15/2019 | Perrigo Co PLC | PRGO | 4.45% | 11/7/2019 | |

| Related Funds: | Related Funds: | |||||||

| S&P Oil & Gas Exploration and Production Index (SPSIOP) | S&P Biotechnology Select Industry Index (SPSIBITR) | |||||||

| Top 10 Names | Ticker | Weight in the index | Expected Earnings Release | Top 10 Names | Ticker | Weight in the index | Expected Earnings Release | |

| Marathon Petroleum Corp | MPC | 2.91% | 10/31/2019 | Seattle Genetics Inc | SGEN | 2.02% | 10/29/2019 | |

| PBF Energy Inc | PBF | 2.66% | 10/31/2019 | Medicines Co/The | MDCO | 1.88% | 10/30/2019 | |

| HollyFrontier Corp | HFC | 2.63% | 10/31/2019 | Arrowhead Pharmaceuticals Inc | ARWR | 1.87% | 12/10/2019 | |

| Hess Corp | HES | 2.59% | 10/30/2019 | Ligand Pharmaceuticals Inc | LGND | 1.80% | 11/4/2019 | |

| Phillips 66 | PSX | 2.55% | 10/25/2019 | Regeneron Pharmaceuticals Inc | REGN | 1.79% | 10/31/2019 | |

| Valero Energy Corp | VLO | 2.55% | 10/24/2019 | Celgene Corp | CELG | 1.77% | 10/24/2019 | |

| Delek US Holdings Inc | DK | 2.45% | 11/4/2019 | Amgen Inc | AMGN | 1.76% | 10/29/2019 | |

| ConocoPhillips | COP | 2.45% | 10/29/2019 | United Therapeutics Corp | UTHR | 1.73% | 10/30/2019 | |

| Murphy Oil Corp | MUR | 2.40% | 10/31/2019 | Incyte Corp | INCY | 1.71% | 10/29/2019 | |

| Cabot Oil & Gas Corp | COG | 2.40% | 10/24/2019 | Vertex Pharmaceuticals Inc | VRTX | 1.70% | 10/23/2019 | |

| Related Funds: | Related Funds: | |||||||

| S&P Regional Banks Select Industry Index (SPSIRBKT) | MSCI US REIT Index (RMS G) | |||||||

| Top 10 Names | Ticker | Weight in the index | Expected Earnings Release | Top 10 Names | Ticker | Weight in the index | Expected Earnings Release | |

| PNC Financial Services Group Inc/The | PNC | 2.89% | 10/16/2019 | Prologis Inc | PLD | 5.40% | 10/15/2019 | |

| First Republic Bank/CA | FRC | 2.85% | 10/15/2019 | Equinix Inc | EQIX | 4.82% | 10/30/2019 | |

| BB&T Corp | BBT | 2.82% | 10/17/2019 | Simon Property Group Inc | SPG | 4.51% | 10/27/2019 | |

| M&T Bank Corp | MTB | 2.82% | 10/17/2019 | Public Storage | PSA | 3.89% | 10/30/2019 | |

| SunTrust Banks Inc | STI | 2.82% | 10/17/2019 | Welltower Inc | WELL | 3.72% | 10/28/2019 | |

| Comerica Inc | CMA | 2.79% | 10/16/2019 | Equity Residential | EQR | 3.25% | 10/22/2019 | |

| Zions Bancorp NA | ZION | 2.77% | 10/21/2019 | AvalonBay Communities Inc | AVB | 3.04% | 10/28/2019 | |

| KeyCorp | KEY | 2.71% | 10/17/2019 | Digital Realty Trust Inc | DLR | 2.71% | 10/29/2019 | |

| Huntington Bancshares Inc/OH | HBAN | 2.70% | 10/24/2019 | Ventas Inc | VTR | 2.65% | 10/25/2019 | |

| Regions Financial Corp | RF | 2.67% | 10/22/2019 | Realty Income Corp | O | 2.48% | 10/31/2019 | |

| Related Funds: | Related Funds: | |||||||

| Dow Jones Transportation Average (DJTTR) | PHLX Semiconductor Sector Index (XSOX) | |||||||

| Top 10 Names | Ticker | Weight in the index | Expected Earnings Release | Top 10 Names | Ticker | Weight in the index | Expected Earnings Release | |

| Norfolk Southern Corp | NSC | 10.37% | 10/23/2019 | NVIDIA Corp | NVDA | 8.41% | 11/14/2019 | |

| Union Pacific Corp | UNP | 9.45% | 10/17/2019 | Intel Corp | INTC | 8.32% | 10/24/2019 | |

| FedEx Corp | FDX | 8.50% | 12/17/2019 | Texas Instruments Inc | TXN | 8.03% | 10/22/2019 | |

| Kansas City Southern | KSU | 7.86% | 10/18/2019 | Broadcom Inc | AVGO | 7.57% | 12/5/2019 | |

| United Parcel Service Inc | UPS | 6.95% | 10/22/2019 | QUALCOMM Inc | QCOM | 7.51% | 11/6/2019 | |

| Landstar System Inc | LSTR | 6.75% | 10/23/2019 | Taiwan Semiconductor Manufacturing Co | TSM | 4.43% | 10/17/2019 | |

| JB Hunt Transport Services Inc | JBHT | 6.56% | 10/15/2019 | Lam Research Corp | LRCX | 4.34% | 10/23/2019 | |

| United Airlines Holdings Inc | UAL | 5.33% | 10/15/2019 | KLA Corp | KLAC | 4.18% | 10/28/2019 | |

| CH Robinson Worldwide Inc | CHRW | 5.07% | 10/29/2019 | NXP Semiconductors NV | NXPI | 4.06% | 10/28/2019 | |

| Kirby Corp | KEX | 4.85% | 10/25/2019 | Micron Technology Inc | MU | 3.73% | 12/17/2019 | |

| Related Funds: | Related Funds: | |||||||

| ISE Natural Gas Index (FUMTR) | Dow Jones U.S. Select Aerospace & Defense Index (DJSASDT) | |||||||

| Top 10 Names | Ticker | Weight in the index | Expected Earnings Release | Top 10 Names | Ticker | Weight in the index | Expected Earnings Release | |

| Murphy Oil Corp | MUR | 5.06% | 10/31/2019 | Boeing Co/The | BA | 22.56% | 10/23/2019 | |

| Cimarex Energy Co | XEC | 4.92% | 11/4/2019 | United Technologies Corp | UTX | 15.68% | 10/22/2019 | |

| Cabot Oil & Gas Corp | COG | 4.91% | 10/24/2019 | Lockheed Martin Corp | LMT | 6.98% | 10/22/2019 | |

| Vermilion Energy Inc | VET | 4.85% | 10/28/2019 | Northrop Grumman Corp | NOC | 4.76% | 10/24/2019 | |

| Enerplus Corp | ERF | 4.73% | 11/8/2019 | TransDigm Group Inc | TDG | 4.68% | 11/5/2019 | |

| Devon Energy Corp | DVN | 4.57% | 11/5/2019 | Raytheon Co | RTN | 4.64% | 10/24/2019 | |

| Matador Resources Co | MTDR | 4.56% | 10/30/2019 | L3Harris Technologies Inc | LHX | 4.63% | 10/30/2019 | |

| Encana Corp | ECA | 4.52% | 11/1/2019 | General Dynamics Corp | GD | 4.35% | 10/23/2019 | |

| EQT Corp | EQT | 4.45% | 10/24/2019 | Teledyne Technologies Inc | TDY | 3.42% | 10/23/2019 | |

| Range Resources Corp | RRC | 4.34% | 10/28/2019 | Textron Inc | TXT | 3.22% | 10/17/2019 | |

| Related Funds: | Related Funds: | |||||||

| Dow Jones U.S. Select Home Builders Index (DJSHMBT) | ||||||||

| Top 10 Names | Ticker | Weight in the index | Expected Earnings Release | |||||

| DR Horton Inc | DHI | 13.56% | 11/12/2019 | |||||

| Lennar Corp | LEN | 12.89% | 1/8/2020 | |||||

| NVR Inc | NVR | 9.67% | 10/18/2019 | |||||

| PulteGroup Inc | PHM | 7.23% | 10/22/2019 | |||||

| Sherwin-Williams Co/The | SHW | 4.56% | 10/22/2019 | |||||

| Home Depot Inc/The | HD | 4.27% | 11/19/2019 | |||||

| Lowe’s Cos Inc | LOW | 4.08% | 11/20/2019 | |||||

| Toll Brothers Inc | TOL | 3.88% | 12/3/2019 | |||||

| Masco Corp | MAS | 2.95% | 10/30/2019 | |||||

| TopBuild Corp | BLD | 2.54% | 10/31/2019 | |||||

| Related Funds: | ||||||||

ETFs are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk, consequences of seeking daily leveraged investment results and intend to actively monitor and manage their investments. Due to the daily nature of the leverage employed, there is no guarantee of amplified long-term returns. Past performance is not indicative of future results.

An investor should consider the investment objectives, risks, charges, and expenses of Direxion Shares carefully before investing. The prospectus and summary prospectus contain this and other information about Direxion Shares. Click here to obtain a prospectus or contact Direxion at (877) 437-9363. The prospectus or summary prospectus should be read carefully before investing.

Direxion Shares Risks – An investment in the ETFs involves risk, including the possible loss of principal. Each ETF is non-diversified and includes risks associated with the ETF concentrating its investments in a particular industry, sector, or geographic region which can result in increased volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. Each Fund does not attempt to, and should not be expected to, provide returns which are a multiple of the return of their underlying index for periods other than a single day. Risks of each Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Counterparty Risk, Intra-Day Investment Risk, for each Bull Fund, Daily Index Correlation/Tracking Risk and Other Investment Companies (including ETFs) Risk, for each Bear Fund, Daily Inverse Index Correlation/Tracking Risk and risks related to Shorting and Cash Transactions. In addition to these risks, there are risks associated with an ETF’s investment in a specific sector, industry, or stocks that comprise each Fund’s underlying index. Please see the summary and full prospectuses for a more complete description of these and other risks of each Fund.

The views in this material represent an assessment of the current market conditions and is not intended to be a forecast of future events. These views are intended to educated the reader and do not constitute investment advice regarding the funds or any security in particular. Past performance does not guarantee future results.

Distributor for Direxion Shares: Foreside Fund Services, LLC.

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 646-561-9116 or click here. A Fund’s prospectus and summary prospectus should be read carefully before investing.