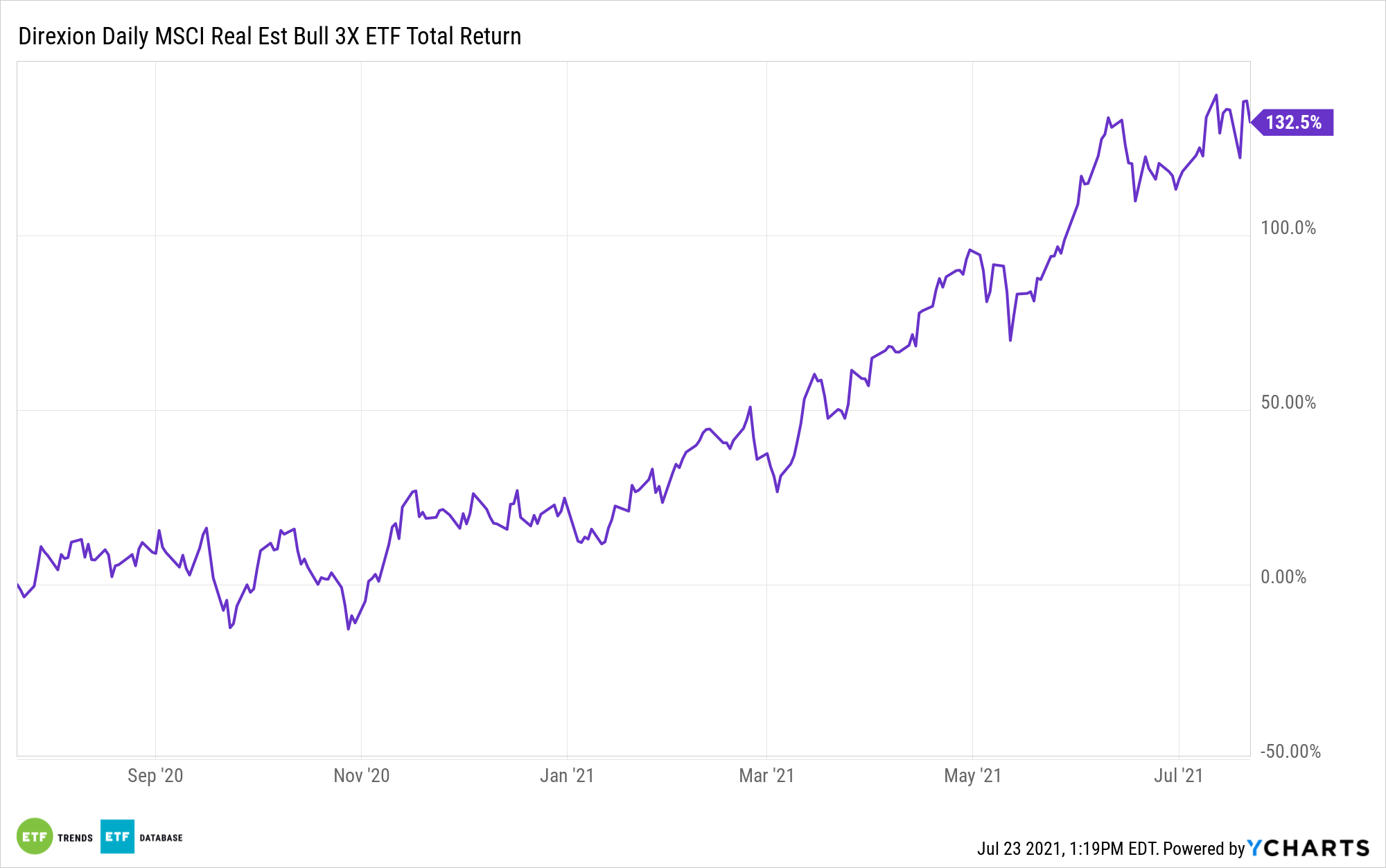

Home prices reached a zenith during the month of June, which should open up opportunities for traders using the Direxion Daily MSCI Real Estate Bull 3X ETF (DRN).

In the meantime, summer typically marks a spike in real estate activity. In this case, it was with prices.

“Continued strong demand pushed the median U.S. home price to a record high in June, though the national house-buying frenzy cooled slightly as supply ticked higher,” a Wall Street Journal report noted. “Existing-home sales rose 1.4% in June from the prior month to a seasonally adjusted annual rate of 5.86 million, the National Association of Realtors said Thursday. June sales rose 22.9% from a year earlier.”

As for DRN, the fund seeks daily investment results equal to 300% of the daily performance of the MSCI US IMI Real Estate 25/50 Index. The index is designed to measure the performance of the large-, mid- and small-capitalization segments of the U.S. equity universe that are classified in the real estate sector as per the GICS.

A True Seller’s Market

For prospective home buyers, competition is still fierce.

As the Wall Street Journal report noted, “as more homes come on the market, they are quickly snapped up by buyers, said Robert Frick, corporate economist at Navy Federal Credit Union.”

“Demand is trumping everything,” Frick said. “Higher inventory isn’t going to take the brakes off price increases.”

The Bearish Case

Of course, what goes up must eventually come down. In that case, cooler home prices could feed the other side of the trade through the Direxion Daily MSCI Real Est Bear 3X ETF (DRV).

DRV seeks daily investment results equal to 300% of the inverse of the daily performance of the MSCI US REIT Index, which is a free float-adjusted market capitalization weighted index that is comprised of equity REITs that are included in the MSCI US Investable Market 2500 Index. DRV invests in swap agreements, futures contracts, short positions, or other financial instruments that, in combination, provide inverse or short leveraged exposure to the index.

“I don’t believe you’ll see the kinds of [price]increases you’ve seen in the last 12 months,” said Sheryl Palmer, chief executive of home builder Taylor Morrison Home Corp. “That’s not sustainable.”

For more news and information, visit the Leveraged & Inverse Channel.