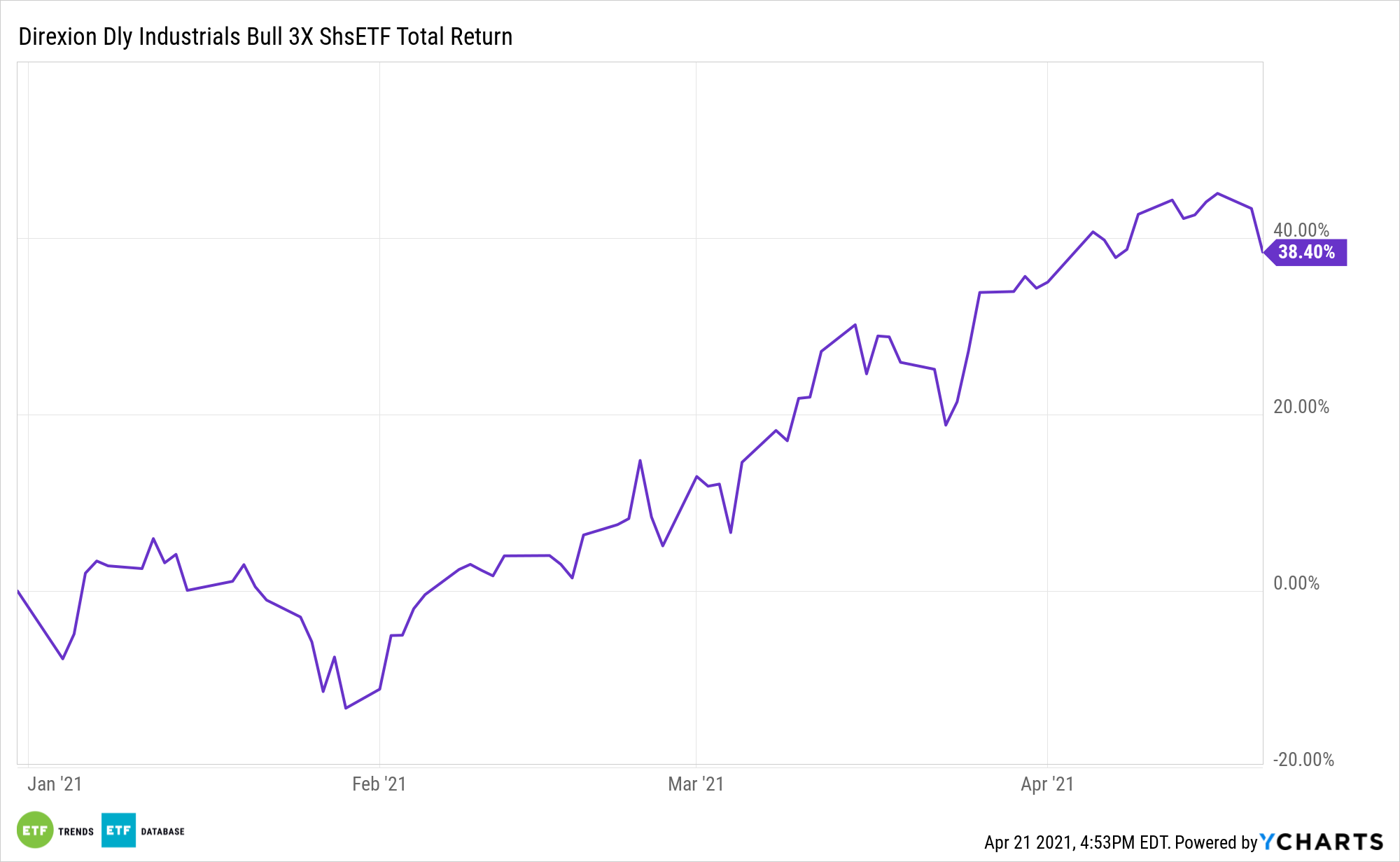

Since U.S. president Joe Biden debuted his infrastructure plan, the industrials sector has helped the Direxion Daily Industrials Bull 3X Shares (DUSL) climb to a year-to-date gain of almost 43%.

With a focus on improving America’s roads, bridges, and other infrastructure initiatives, traders are seeing a foreseeable rise in the demand for industrial materials. Traders can play that strength with an added dose of leverage with ETFs like DUSL.

DUSL seeks daily investment results of 300% of the daily performance of the Industrials Select Sector Index. The fund, under normal circumstances, invests at least 80% of its net assets in financial instruments, such as swap agreements, securities of the index, and ETFs that track the index and other financial instruments that provide daily leveraged exposure to the index or ETFs that track the index.

“President Joe Biden’s proposed $2 trillion infrastructure plan will result in another shot in the arm for companies across the industrials sector if Democrats are able to garner enough support for once-in-a-generation spending on roads, bridges and broadband access,” a CNBC report noted. “Industrials stocks, which have handily outperformed the broader S&P 500 over the last three months, could be set for even more gains, according to top industry analyst Nick Heymann.”

The Aerospace and Defense Sectors

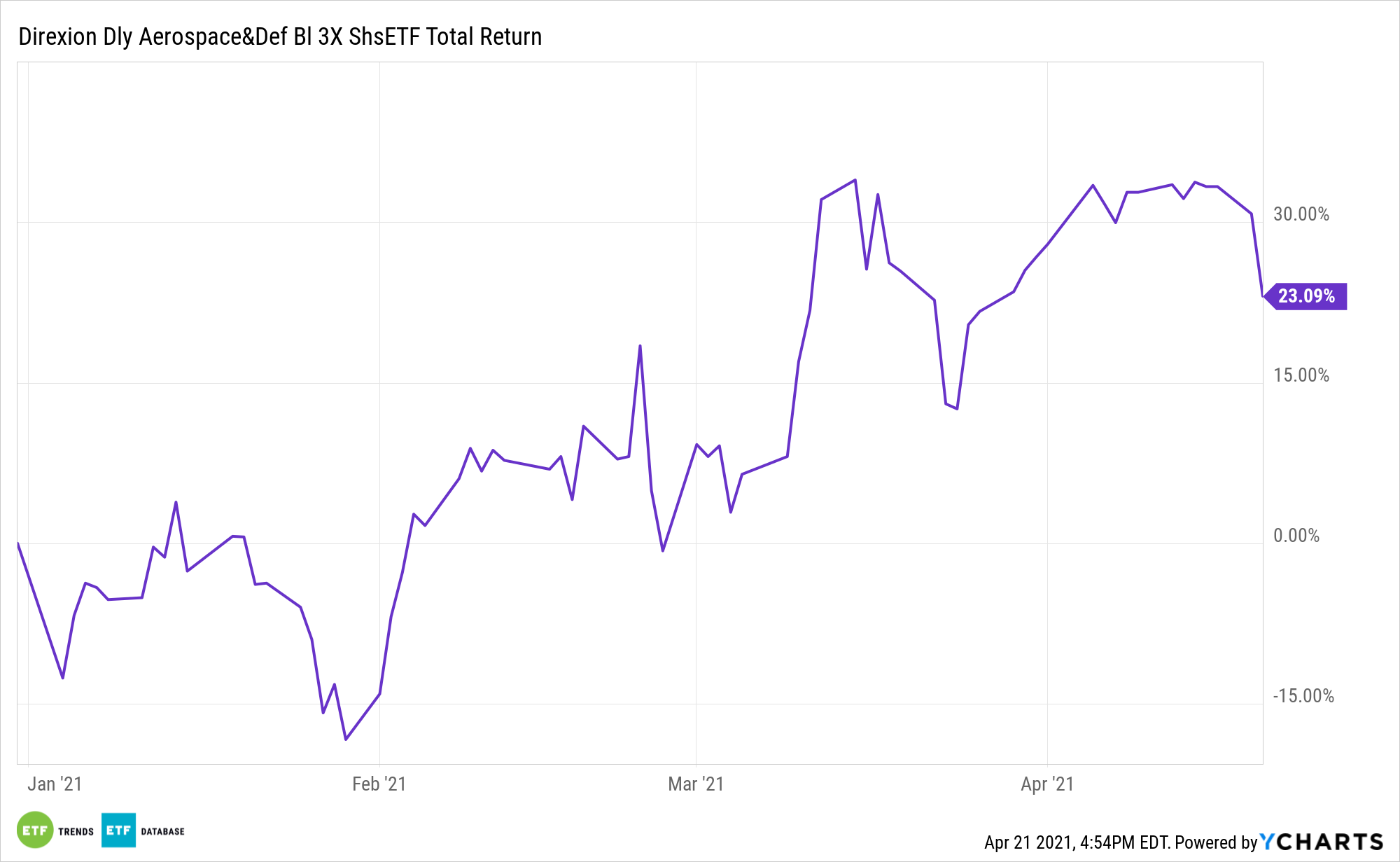

The infrastructure plan is also putting aerospace and defense into play.

“Aerospace and defense, capital goods, industrial technology and building products subsectors could all be due for another wave of buying if the American Jobs Plan is passed, Heymann told clients in a note earlier this week,” the CNBC report said further. “Heymann, the co-head of William Blair’s Global Industrial Infrastructure research, narrowed down a list of equities the firm believes could see the most additional upside thanks to big infrastructure spending in the months ahead.”

“Industrial companies are now at the forefront of investors’ focus as the industrial sector of the economy, which was severely impacted in 2020, is now leading the U.S. economy’s resurgence,” he wrote.

In similar fashion, short-term traders can turn to the Direxion Daily Aerospace & Defense 3X Shares ETF (DFEN). DFEN seeks daily investment results equal to 300% of the daily performance of the Dow Jones U.S. Select Aerospace & Defense Index, which attempts to measure the performance of the aerospace and defense industry of the U.S. equity market.

For more news and information, visit the Leveraged & Inverse Channel.