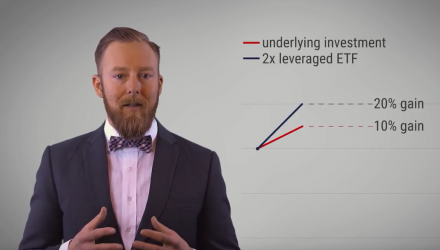

As defined by Investopedia, a leveraged ETF is “a fund that uses financial derivatives and debt to amplify the returns of an underlying index. Leveraged ETFs are available for most indexes, such as the Nasdaq 100 and the Dow Jones Industrial Average. These funds aim to keep a constant amount of leverage during the investment time frame, such as a 2:1 or 3:1 ratio.”

To learn more about leveraged ETFs and their risks, click on the link below:

For more investment strategies, visit the Leveraged Inverse Channel.